LG 2000 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

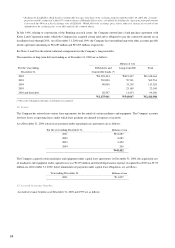

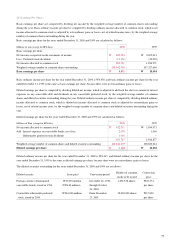

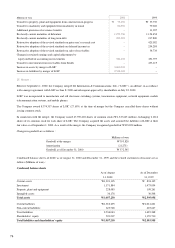

The Korean economy is currently experiencing additional difficulties, particularly in the areas of restructuring private enterprises

and reforming the banking industry. The Korean government continues to apply pressure to Korean companies to restructure into

more efficient and profitable firms. The banking industry is currently undergoing consolidations and significant uncertainty exists

with regard to the availability of short-term financing during the coming year. The Company may be either directly or indirectly

affected by the situation described above. In addition, the Company has investments in, and receivables from affiliates in Thailand,

Indonesia and other Asia Pacific countries. The Company also has outstanding guarantees on the debt obligations of these affiliates.

These affiliates have been affected, and may continue to be affected, by the unstable economic situation in the Asia Pacific region.

The accompanying financial statements reflect management’s current assessment of the impact to date of the economic situation on

the financial position of the Company. Actual results may differ materially from management’s current assessment.

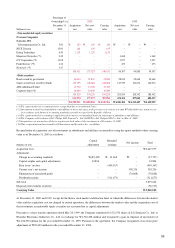

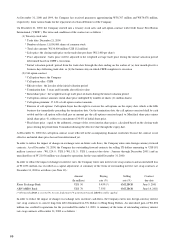

15. Capital Stock :

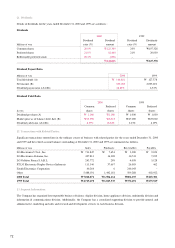

As of December 31, 2000 and 1999, capital stock is as follows :

2000 1999

Number of Millions of Number of Millions of

issuance (shares) Par value won issuance (shares) Par value won

Common stock 155,118,070 W 5,000 W 775,590 107,327,666 W 5,000 W 536,638

Preferred stock(*1) 19,095,547 5,000 95,478 19,095,547 5,000 95,478

Redeemable

preferred stock(*2) 32,000,000 5,000 160,000 – – –

206,213,617 W1,031,068 126,423,213 W 632,116

As of December 31, 2000 and 1999, the number of shares authorized is 500,000,000 shares.

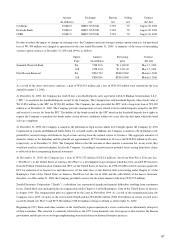

Summary of changes in capital and capital surplus in 2000 is as follows (In millions of won) :

Date of Issuance Type The number Par value Capital in excess Cash

of shares of par value(*) received(*)

September 1, 2000 Common stock issued 47,790,404 W238,952 W1,108,693 W1,347,645

in merger of LGIC

December 23, 2000 Redeemable preferred 32,000,000 160,000 382,952 542,952

stock issued

W398,952 W1,491,645 W1,890,597

(*) Paid-in capital in excess of par value and cash received are net of new stock issuance costs.

(*1) As of December 31, 2000 and 1999, 19,095,547 shares of non-voting preferred stock are issued and outstanding. The preferred shareholders

have no voting rights and are entitled to non-participating and non-cumulative preferred dividends at a rate of one percentage point over those

for common stock. This preferred dividend rate is not applicable to stock dividends.15. Capital Stock, Continued :

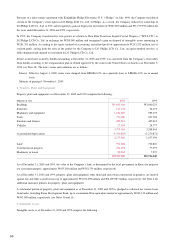

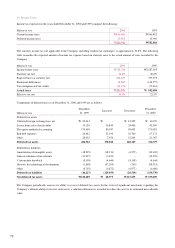

(*2) Pursuant to the resolution by the board of directors on December 12, 2000, the Company issued convertible redeemable preferred stock

(“RPS”) on December 23, 2000.

The terms and conditions of the RPS are as follows :

* Date of issuance: December 23, 2000

* Number of shares issued: 32,000,000 shares

* Per-share issue price: W17,000 per share (par value : W5,000)

* The shareholders of RPS are entitled to cumulative and non-participating preferred dividends subordinate to other preferred stocks at a

fixed dividend rate of 7.5% of the per-share issue price per annum, and are not entitled to stock dividends or stock rights.

* Redemption: The Company may redeem RPS during the period from the next date following the first annual shareholders’ meeting after the

issuance date through one month after the annual shareholders’ meeting for the fiscal year of 2003.

* The shareholders of the RPS have no voting rights, except for the period from the next shareholders’ meeting following the shareholders’

meeting in which dividends at a rate less than 7.5% of the per-share issue price are declared through the other shareholders’ meeting in

which dividends at 7.5% of the per-share issue price are declared.

* The RPS will be redeemable at the per-share issue price from retained earnings available for dividends.

* The shareholders of the RPSs shall have the right, at their discretion, to convert all or any portion of the RPSs into common shares of the

Company (par value W5,000) at any time after December 23, 2001. The conversion price is W17,000 per share at the issuance date and will

be adjusted to the relevant market price as of every 23rd of March, June, September, and December in case the market price is lower than

conversion price.

68