LG 2000 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

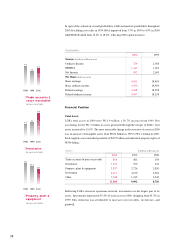

Gross profit in 2000 amounted to W3.0 trillion, 37.7% higher than W2.2 trillion in 1999.

Gross profit as a percentage of sales declined from 20.8% to 20.3%, reflecting an increase

in total sales costs.

Sales and administrative expenses amounted to W2.1 trillion in 2000, a 39.0% increase

from W1.5 trillion in 1999. Operating profit after expenses in 2000 totaled W921 billion

in comparison to W684 billion in 1999.

The greatest generator of profits in 2000 among all LGE companies was the Digital

Appliance Company, achieving W481 billion in operating profits and a 12.4% operating

margin. Supported by the in-house production of core parts and a successful "6 sigma"

campaign, profitability also improved in 2000. The Digital Display Company, the Digital

Media Company, and the Information & Communications Company (full year) recorded

operating margins of 7.4%, 5.8% and 7.0%, respectively.

As a result, the average operating margin in 2000 was 6.2%, a decrease from W6.5% in

1999. Excluding the performance of the Information & Communications Company, which

was included in LGE operations since its merger with LG Information and

Communications in September 2000, operating profit as a percent of sales came to 7.2%

in 2000. Therefore, LGE expects substantial improvements in profitability in 2001 when

restructuring is completed.

Non-operating Income

LGE's non-operating income included interest and dividend income earned from financial

instruments held by LGE; foreign exchange gains resulting from trade in currencies other

than the Korean won and from currency conversion; gains on the disposal of investments,

property, plants, and other fixed assets; and earnings from LGE affiliates when

calculating the equity method (Please refer to page 51 of “Notes to Financial Statements”

for an explanation of the equity method). Non-operating income in 2000 was W1,042

billion, 67.7% lower than W3,224 billion in 1999. The difference was caused by

transactions in 1999 with Philips Electronics and Hyundai Electronics. In 1999, LGE sold

its LG. Philips LCD securities with warrant to Philips for a gain of W1,180 billion. In

addition, LGE transferred an LCD-related patent to LG Philips LCD for gain of W281

billion in 1999. In May 1999, LGE also sold its shares in LG Semiconductor to Hyundai

Electronics. As a result of the sale, LGE had gain on sale of investment securities

equivalent to W1,102 billion in 1999.

1999

115

228

2,694

-

187

3,224

2000

67

186

257

287

244

1,042

Non-operating Income

Interest & dividends

Foreign exchange gains

Gain on disposal of noncurrent assets

Equity in earnings of affiliates

Other

1998

159

966

98

-

274

1,496

In billions of Korean won

8.0%

4.8%

2.9%

Interest Expenses

1998 1999 2000

As a percent of sales

36

Special Gains in 1999

In 1999, LGE sold its LG

Philips LCD securities with

warrant to Philips for a gain of

W1,180 billion. In May 1999,

LGE sold its shares in LG

Semiconductor to Hyundai

Electronics. As a result of the

sale, LGE had gain on sale of

investment securities

equivalent to W1,102 billion in

1 9 9 9 .