LG 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

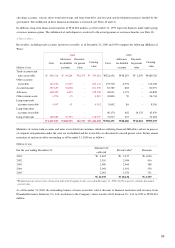

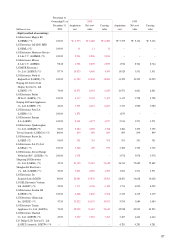

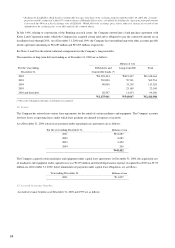

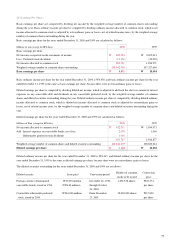

11. Long-Term Debt :

Long-term debt as of December 31, 2000 and 1999 comprises the following:

Annual interest rate (%)

In millions at December 31, 2000 2000 1999

Debentures

Public, guaranteed payable through 2001 22.0 - 25.0 W 55,500 W 787,100

Private, non-guaranteed payable through 2004 7.25 - 16.5 460,000 311,000

Public, non-guaranteed payable through 2003 7.0 - 12.0 2,410,000 1,320,000

Floating rate notes in foreign currency,

payable through 2002 (*1) LIBOR+1.2-1.4 278,394 83,350

(US$ 221) HK$ 550

US$ 2

3,203,894 2,501,450

Convertible Bonds

Foreign currency, issued in 1991 (*2) – –40

(US$ –) (US$ –)

Foreign currency, issued in 1996 (*3) 1.25 33,096 33,096

(US$ 40) (US$ 40)

Won currency, issued in 1998 1.00 –100,000

33,096 133,136

Exchangeable Bonds (*4)

Foreign currency, issued in 1997 0.25 66,623 66,623

(US$ 75) (US$ 75)

3,303,613 2,701,209

Less : treasury debentures (17,171) (117,171)

current maturities (1,410,500) (1,154,450)

discount on debentures (28,045) (38,170)

premium on debentures 306 7,589

1,848,203 1,399,007

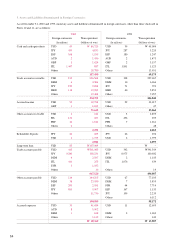

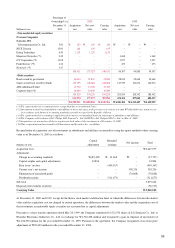

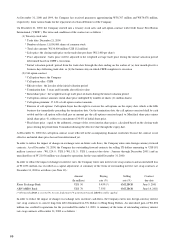

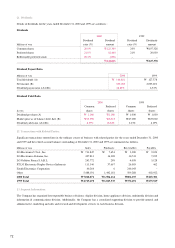

Annual interest rate (%)

In millions at December 31, 2000 2000 1999

Won currency loans

Kookmin Bank 5.0 – 10.0 94,728 4,439

Korea Development Bank 5.5 – 9.95 196,659 91,266

Housing and Commercial Bank 3.0 843 853

Hana Bank 5.5 – 8.0 2,694 920

Hanvit Bank 8.08 30,000 30,000

Korea Technology Banking Corporation 6.0 – 7.5 15,061 6,104

Korea Development Capital Corporation 7.0 1,280 –

Korea Network Research Association 7.0 467 –

W 341,732 W 133,582

62

[ ]