LG 2000 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

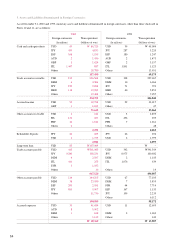

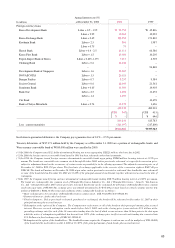

* Exchange by bondholder: Each bond is exchangeable for a pro rata share of the exchange property until November 30, 2007. The exchange

property initially comprised 1,880,397 common shares of Hyundai Electronics, calculated by dividing the aggregate principal amount

(converted into Won at a fixed exchange rate of US$1.00 : W888.30) by the exchange price, but is subject to change as a result of any

adjustment to the exchange price or an offer made for the common shares.

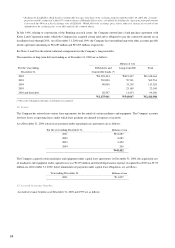

In July 1996, relating to construction of the Bundang research center, the Company entered into a land purchase agreement with

Korea Land Corporation under which the Company has acquired certain land and is obligated to pay the contracted amount on an

installment basis through 2001. As of December 31, 2000 and 1999, the Company has outstanding long-term other accounts payable

for the agreement amounting to W2,287 million and W5,205 million, respectively.

See Notes 3 and 8 for the related collateral arrangements for the Company’s long-term debt.

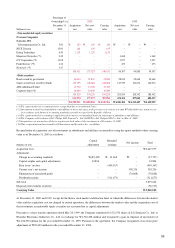

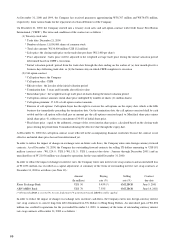

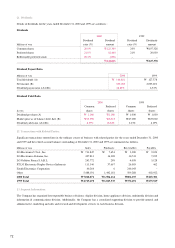

The maturities of long-term debt outstanding as of December 31, 2000 are as follows:

Millions of won

For the year ending Debentures and Long-term debt Total

December 31, Convertible bonds (*)

2002 W1,203,394 W415,267 W1,618,661

2003 510,000 59,761 569,761

2004 80,000 33,218 113,218

2005 – 23,168 23,168

2006 and thereafter 82,547 11,633 94,180

W1,875,941 W543,047 W2,418,988

(*) No early redemption of bonds or debentures is assumed.

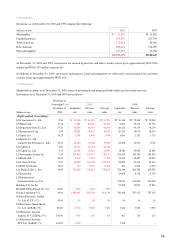

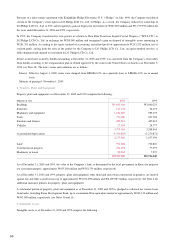

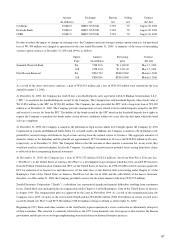

12. Leases:

The Company has entered into various lease agreements for the rental of certain machinery and equipment. The Company accounts

for these leases as operating leases under which lease payment are charged to expense as incurred.

As of December 31, 2000, future lease payments under operating lease agreements are as follows :

For the year ending December 31, Millions of won

2001 W31,687

2002 6,085

2003 2,450

2004 260

W40,482

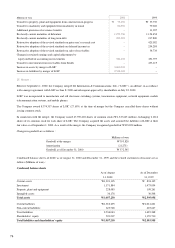

The Company acquired certain machinery and equipment under capital lease agreements. At December 31, 2000, the acquisition cost

of machinery and equipment under capital leases was W 695 million and related depreciation expense recognized in 2000 was W 69

million.As of December 31, 2000, future minimum lease payments under capital lease obligations, are as follows :

Year ending December 31, Millions of won

2001 W 1,857

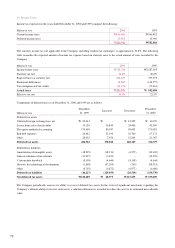

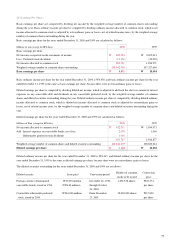

13. Accrued Severance Benefits:

Accrued severance benefits as of December 31, 2000 and 1999 are as follows:

64