LG 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Earnings from LGE affiliates shifted from a negative gain of W146 billion in 1999 to a

positive gain of W287 billion in 2000.

Non-operating expenses were W1,234 billion in 2000, 6.5% lower than W1,320 billion in

1 9 9 9 .

The major reason for such improvement was the significant decrease in interest expenses,

equaling W437 billion in 2000. The decrease reflects a consistently falling interest rate as

well as LGE's effort to reduce interest expenses through diverse fund-raising channels.

Interest expenses as a percentage of sales decreased from 4.8% in 1999 to 2.9% in 2000

while interest expenses as a proportion of operating profit significantly improved from

74.5% to 47.4%.

Affected by the abrupt depreciation of Korean won, loss of foreign currency translation

rose from W17 billion in 1999 to W133 billion in 2000. The direct causes of this loss

were increased foreign currency debts resulting from Usance equivalent to US$91 million

and Y250 million, and foreign currency floating rate notes amounting to US$221 million.

Furthermore, LGE underwent the write-off of LGIC's bad assets equaling W54 billion and

the loss on cancellation of LGIC shares totaling W56 billion. Another factor for non-

operating expenses was the W196 billion loss from transfer of trade accounts and notes

receivable. Of this loss, the negotiation of foreign currency receivables resulted in a W180

billion loss, and the issuance of asset (receivables)-backed securities led to W10 billion

l o s s .

EBITDA & Profitability

With consistency and adherence to 1998 and 1999 accounting principle amendments,

EBITDA (earnings before interest expenses, taxes, depreciation and amortization)

increased in all of the last four years. In 2000, EBITDA amounted to W1,445 billion.

Following depreciation and amortization, EBIT (earnings before interest expenses and

taxes) were W921 billion, a significant rise from W684 billion of 1999.

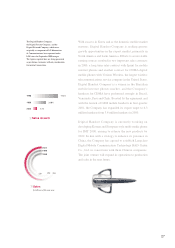

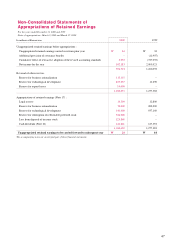

1999

509

261

106

97

146

201

1,320

2000

437

275

196

109

-

217

1,234

Non-operating Expenses

Interest expenses

Foreign exchange losses

Loss from transfer of trade

accounts & notes receivable

Loss from disposal of noncurrent

assets

Equity in losses of affiliates

Other

1998

793

827

-

25

26

42

1,713

In billions of Korean won

427 419

706

R&D Expenditure

1998 1999 2000

In billions of Korean won

37