Kraft 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION FLANGST// 9-MAR-06 02:25 DISK126:[06CHI5.06CHI1135]EA1135A.;8

mrll.fmt Free: 235D*/300D Foot: 0D/ 0D VJ RSeq: 5 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

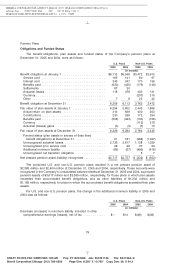

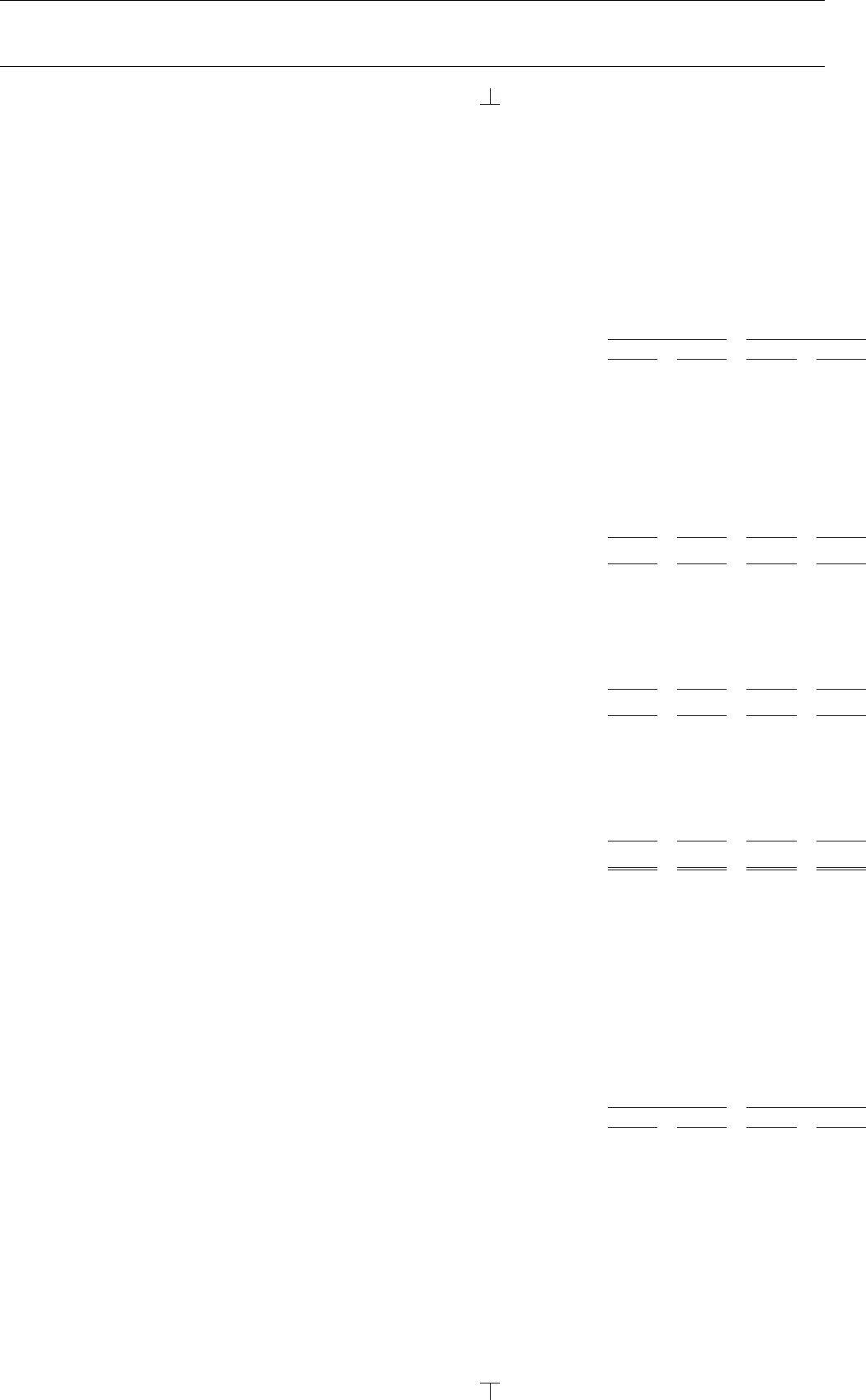

Pension Plans

Obligations and Funded Status

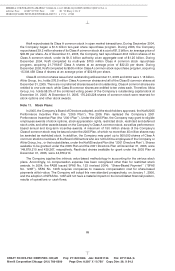

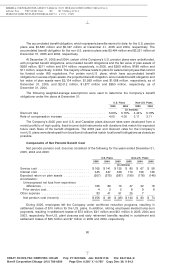

The benefit obligations, plan assets and funded status of the Company’s pension plans at

December 31, 2005 and 2004, were as follows:

U.S. Plans Non-U.S. Plans

2005 2004 2005 2004

(in millions)

Benefit obligation at January 1 ........................ $6,113 $5,546 $3,472 $2,910

Service cost ................................... 165 141 80 67

Interest cost ................................... 345 347 170 156

Benefits paid ................................... (530) (435) (179) (149)

Settlements .................................... 87 30

Actuarial losses ................................. 118 478 403 131

Currency ...................................... (207) 315

Other ........................................ 7 6 23 42

Benefit obligation at December 31 ..................... 6,305 6,113 3,762 3,472

Fair value of plan assets at January 1 .................. 6,294 5,802 2,445 1,866

Actual return on plan assets ........................ 313 639 400 203

Contributions ................................... 230 299 172 254

Benefits paid ................................... (508) (443) (133) (106)

Currency ...................................... (113) 218

Actuarial (losses) gains ........................... (3) (3) (7) 10

Fair value of plan assets at December 31 ................ 6,326 6,294 2,764 2,445

Funded status (plan assets in excess of (less than)

benefit obligations) at December 31 ................. 21 181 (998) (1,027)

Unrecognized actuarial losses ...................... 2,736 2,617 1,108 1,029

Unrecognized prior service cost ..................... 29 26 47 54

Additional minimum liability ........................ (69) (67) (495) (416)

Unrecognized net transition obligation ................. 6 7

Net prepaid pension asset (liability) recognized ............ $2,717 $2,757 $ (332) $ (353)

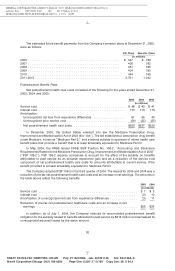

The combined U.S. and non-U.S. pension plans resulted in a net prepaid pension asset of

$2,385 million and $2,404 million at December 31, 2005 and 2004, respectively. These amounts were

recognized in the Company’s consolidated balance sheets at December 31, 2005 and 2004, as prepaid

pension assets of $3,617 million and $3,569 million, respectively, for those plans in which plan assets

exceeded their accumulated benefit obligations, and as other liabilities of $1,232 million and

$1,165 million, respectively, for plans in which the accumulated benefit obligations exceeded their plan

assets.

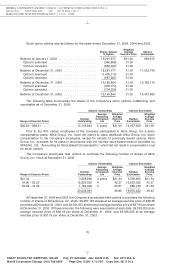

For U.S. and non-U.S. pension plans, the change in the additional minimum liability in 2005 and

2004 was as follows:

U.S. Plans Non-U.S. Plans

2005 2004 2005 2004

(in millions)

Decrease (increase) in minimum liability included in other

comprehensive earnings (losses), net of tax ............ $— $14 $(48) $(36)

79

6 C Cs: 55655