Kraft 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION MBLOUNT// 9-MAR-06 14:03 DISK126:[06CHI5.06CHI1135]DE1135A.;25

mrll.fmt Free: 530D*/540D Foot: 0D/ 0D VJ RSeq: 14 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DE1135A.;25

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

prevailing during a reporting period. During times of a strengthening U.S. dollar, the Company’s reported

net revenues and operating income will be reduced because the local currency will translate into fewer

U.S. dollars. Additionally, international sales are subject to risks related to imposition of tariffs, quotas,

trade barriers and other similar restrictions. All of these risks could result in increased costs or decreased

revenues, either of which could adversely affect the Company’s profitability.

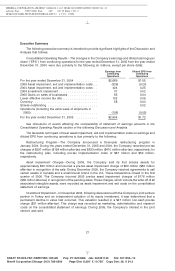

The Company may not be able to successfully implement its restructuring program.

The Company’s future success and earnings growth depend in part on its ability to make products

efficiently. In January 2004, the Company announced a three-year global restructuring program

designed to improve its cost structure and utilization of assets. In January 2006, the Company

announced plans to expand its restructuring efforts beyond those originally contemplated. Initiatives in

the expanded program include further organizational streamlining and facility closures. If the Company

is unable to successfully implement the restructuring program, it may not be able to fully recognize the

estimated cost benefits. Conversely, if the implementation of the program has a negative impact on the

Company’s relationships with employees, major customers or vendors, the Company’s profitability

could be adversely affected.

The Company may not be able to successfully consummate proposed acquisitions or

divestitures or integrate acquired businesses.

From time to time, the Company evaluates acquiring other businesses that would strategically fit

within the Company. If the Company is unable to consummate, successfully integrate and grow these

acquisitions and to realize contemplated revenue synergies and cost savings, its financial results could

be adversely affected. In addition, the Company may, from time to time, divest businesses that are less of

a strategic fit within its portfolio or do not meet its growth or profitability targets, and the Company’s

profitability may be impacted by either gains or losses on the sales, or lost operating income from, those

businesses. The Company may also not be able to divest businesses that are not core businesses or

may not be able to do so on terms that are favorable to the Company. In addition, the Company may be

required to incur asset impairment charges related to acquired or divested businesses which may

reduce the Company’s profitability. These potential acquisitions or divestitures present financial,

managerial and operational challenges, including diversion of management attention from existing

businesses, difficulty with integrating or separating personnel and financial and other systems,

increased expenses, assumption of unknown liabilities, indemnities and potential disputes with the

buyers or sellers.

The Company may experience liabilities or negative effects on its reputation as a result of

product recalls, product injuries or other legal claims.

The Company sells products for human consumption, which involves a number of legal risks.

Product contamination, spoilage or other adulteration, product misbranding or product tampering could

require the Company to recall products. The Company may also be subject to liability if its products or

operations violate applicable laws or regulations or in the event its products cause injury, illness or

death. In addition, the Company advertises its products and could be the target of claims relating to false

or deceptive advertising under U.S. federal and state laws as well as foreign laws, including consumer

protection statutes of some states. A significant product liability or other legal judgment against the

Company or a widespread product recall may negatively impact the Company’s profitability. Even if a

product liability or consumer fraud claim is unsuccessful or is not merited or fully pursued, the negative

publicity surrounding such assertions regarding the Company’s products or processes could adversely

affect its reputation and brand image.

14

6 C Cs: 52564