Kraft 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DI1135A.;10

mrll.fmt Free: 375D*/420D Foot: 0D/ 0D VJ RSeq: 2 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

Executive Summary

The following executive summary is intended to provide significant highlights of the Discussion and

Analysis that follows.

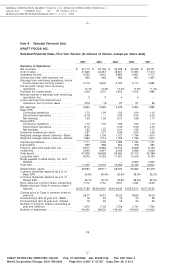

Consolidated Operating Results—The changes in the Company’s earnings and diluted earnings per

share (‘‘EPS’’) from continuing operations for the year ended December 31, 2005 from the year ended

December 31, 2004, were due primarily to the following (in millions, except per share data):

Earnings from Diluted EPS from

Continuing Continuing

Operations Operations

For the year ended December 31, 2004 ............ $2,669 $1.55

2005 Asset impairment, exit and implementation costs . . (339) (0.20)

2004 Asset impairment, exit and implementation costs . . 424 0.25

2004 Investment impairment ..................... 31 0.02

2005 Gains on sales of businesses ................ 65 0.04

Lower effective income tax rate ................... 102 0.06

Currency ................................... 58 0.03

Shares outstanding ........................... 0.02

Operations (including the extra week of shipments in

2005) .................................... (106) (0.05)

For the year ended December 31, 2005 ............ $2,904 $1.72

See discussion of events affecting the comparability of statement of earnings amounts in the

Consolidated Operating Results section of the following Discussion and Analysis.

The favorable net impact of lower asset impairment, exit and implementation costs on earnings and

diluted EPS from continuing operations is due primarily to the following:

Restructuring Program—The Company announced a three-year restructuring program in

January 2004. During the years ended December 31, 2005 and 2004, the Company recorded pre-tax

charges of $297 million ($199 million after-tax) and $633 million ($410 million after-tax), respectively, for

the restructuring plan, including pre-tax implementation costs of $87 million and $50 million,

respectively.

Asset Impairment Charges—During 2005, the Company sold its fruit snacks assets for

approximately $30 million and incurred a pre-tax asset impairment charge of $93 million ($60 million

after-tax) in recognition of the sale. During December 2005, the Company reached agreements to sell

certain assets in Canada and a small biscuit brand in the U.S. These transactions closed in the first

quarter of 2006. The Company incurred 2005 pre-tax asset impairment charges of $176 million

($80 million after-tax) in recognition of the pending sales. These charges, which include the write-off of all

associated intangible assets, were recorded as asset impairment and exit costs on the consolidated

statement of earnings.

Investment Impairment—In November 2004, following discussions with the Company’s joint venture

partner in Turkey and an independent valuation of its equity investment, it was determined that a

permanent decline in value had occurred. This valuation resulted in a $47 million non-cash pre-tax

charge ($31 million after-tax). This charge was recorded as marketing, administration and research

costs on the consolidated statement of earnings. During 2005, the Company’s interest in the joint

venture was sold.

21

6 C Cs: 21254