Kraft 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DY1135A.;6

mrll.fmt Free: 1430D*/1975D Foot: 0D/ 0D VJ RSeq: 1 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DY1135A.;6

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

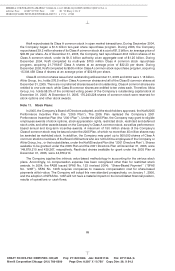

Kraft repurchases its Class A common stock in open market transactions. During December 2004,

the Company began a $1.5 billion two-year share repurchase program. During 2005, the Company

repurchased 39.2 million shares of its Class A common stock at a cost of $1.2 billion, an average price of

$30.65 per share. As of December 31, 2005, the Company had repurchased 40.6 million shares of its

Class A common stock, under its $1.5 billion authority, at an aggregate cost of $1.25 billion. During

December 2004, Kraft completed its multi-year $700 million Class A common stock repurchase

program, acquiring 21,718,847 Class A shares at an average price of $32.23 per share. During

December 2003, Kraft completed its $500 million Class A common stock repurchase program, acquiring

15,308,458 Class A shares at an average price of $32.66 per share.

Class B common shares issued and outstanding at December 31, 2005 and 2004 were 1.18 billion.

Altria Group, Inc. holds 276.5 million Class A common shares and all of the Class B common shares at

December 31, 2005. There are no preferred shares issued and outstanding. Class A common shares are

entitled to one vote each, while Class B common shares are entitled to ten votes each. Therefore, Altria

Group, Inc. holds 98.3% of the combined voting power of the Company’s outstanding capital stock at

December 31, 2005. At December 31, 2005, 170,243,228 shares of common stock were reserved for

stock options and other stock awards.

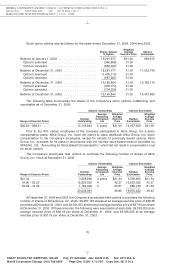

Note 11. Stock Plans:

In 2005, the Company’s Board of Directors adopted, and the stockholders approved, the Kraft 2005

Performance Incentive Plan (the ‘‘2005 Plan’’). The 2005 Plan replaced the Company’s 2001

Performance Incentive Plan (the ‘‘2001 Plan’’). Under the 2005 Plan, the Company may grant to eligible

employees awards of stock options, stock appreciation rights, restricted stock, restricted and deferred

stock units, and other awards based on the Company’s Class A common stock, as well as performance-

based annual and long-term incentive awards. A maximum of 150 million shares of the Company’s

Class A common stock may be issued under the 2005 Plan, of which no more than 45 million shares may

be awarded as restricted stock. In addition, the Company may grant up to 500,000 shares of Class A

common stock to members of the Board of Directors who are not full-time employees of the Company or

Altria Group, Inc., or their subsidiaries, under the Kraft Directors Plan (the ‘‘2001 Directors Plan’’). Shares

available to be granted under the 2005 Plan and the 2001 Directors Plan at December 31, 2005, were

149,879,210 and 439,367, respectively. Restricted shares available for grant under the 2005 Plan at

December 31, 2005, were 44,879,210.

The Company applies the intrinsic value-based methodology in accounting for the various stock

plans. Accordingly, no compensation expense has been recognized other than for restricted stock

awards. In 2004, the FASB issued SFAS No. 123 (revised 2004), ‘‘Share-Based Payment’’ (‘‘SFAS

No. 123R’’). SFAS No. 123R requires companies to measure compensation cost for share-based

payments at fair value. The Company will adopt this new standard prospectively, on January 1, 2006,

and the adoption of SFAS No. 123R will not have a material impact on its consolidated financial position,

results of operations or cash flows.

69

6 C Cs: 47163