Kraft 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION FLANGST// 9-MAR-06 02:24 DISK126:[06CHI5.06CHI1135]DW1135A.;8

mrll.fmt Free: 445D*/540D Foot: 0D/ 0D VJ RSeq: 1 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DW1135A.;8

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

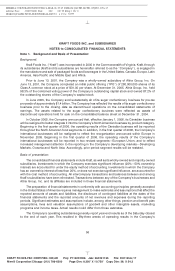

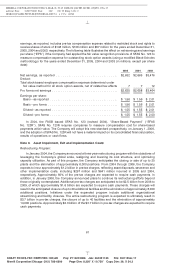

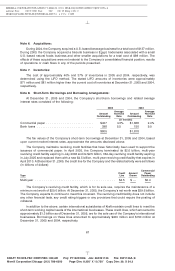

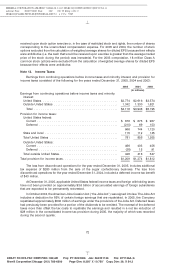

Summary results of operations for the sugar confectionery business were as follows:

For the Years Ended

December 31,

2005 2004 2003

(in millions)

Net revenues .............................................. $228 $477 $512

Earnings before income taxes .................................. $ 41 $103 $151

Impairment loss on assets of discontinued operations held for sale ....... (107)

Provision for income taxes ..................................... (16) (54)

Loss on sale of discontinued operations ........................... (297)

(Loss) earnings from discontinued operations, net of income taxes ........ $(272) $ (4) $ 97

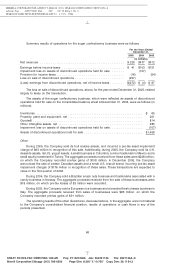

The loss on sale of discontinued operations, above, for the year ended December 31, 2005, related

largely to taxes on the transaction.

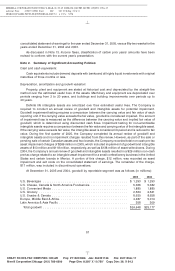

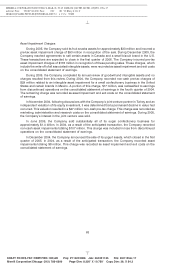

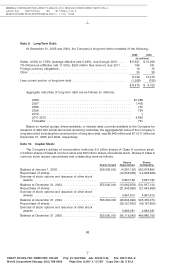

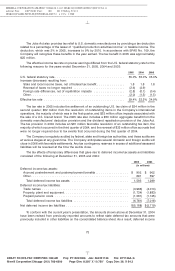

The assets of the sugar confectionery business, which were reflected as assets of discontinued

operations held for sale on the consolidated balance sheet at December 31, 2004, were as follows (in

millions):

Inventories .......................................................... $ 65

Property, plant and equipment, net ......................................... 201

Goodwill ............................................................ 814

Other intangible assets, net .............................................. 485

Impairment loss on assets of discontinued operations held for sale .................. (107)

Assets of discontinued operations held for sale ................................ $1,458

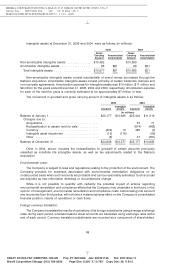

Other:

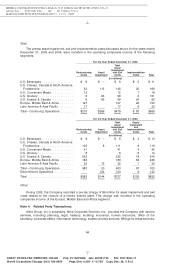

During 2005, the Company sold its fruit snacks assets, and incurred a pre-tax asset impairment

charge of $93 million in recognition of this sale. Additionally, during 2005, the Company sold its U.K.

desserts assets, its U.S. yogurt assets, a small business in Colombia, a minor trademark in Mexico and a

small equity investment in Turkey. The aggregate proceeds received from these sales were $238 million,

on which the Company recorded pre-tax gains of $108 million. In December 2005, the Company

announced the sale of certain Canadian assets and a small U.S. biscuit brand, incurring pre-tax asset

impairment charges of $176 million in recognition of these sales. These transactions are expected to

close in the first quarter of 2006.

During 2004, the Company sold a Brazilian snack nuts business and trademarks associated with a

candy business in Norway. The aggregate proceeds received from the sale of these businesses were

$18 million, on which pre-tax losses of $3 million were recorded.

During 2003, the Company sold a European rice business and a branded fresh cheese business in

Italy. The aggregate proceeds received from sales of businesses were $96 million, on which the

Company recorded pre-tax gains of $31 million.

The operating results of the other divestitures, discussed above, in the aggregate, were not material

to the Company’s consolidated financial position, results of operations or cash flows in any of the

periods presented.

66

6 C Cs: 2584