Kraft 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION EYOUNG// 8-MAR-06 09:45 DISK126:[06CHI5.06CHI1135]DU1135A.;17

mrll.fmt Free: 2510D*/4810D Foot: 0D/ 0D VJ RSeq: 8 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

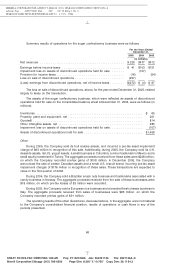

Asset Impairment Charges:

During 2005, the Company sold its fruit snacks assets for approximately $30 million and incurred a

pre-tax asset impairment charge of $93 million in recognition of the sale. During December 2005, the

Company reached agreements to sell certain assets in Canada and a small biscuit brand in the U.S.

These transactions are expected to close in the first quarter of 2006. The Company incurred pre-tax

asset impairment charges of $176 million in recognition of these pending sales. These charges, which

include the write-off of all associated intangible assets, were recorded as asset impairment and exit costs

on the consolidated statement of earnings.

During 2005, the Company completed its annual review of goodwill and intangible assets and no

charges resulted from this review. During 2004, the Company recorded non-cash pre-tax charges of

$29 million related to an intangible asset impairment for a small confectionery business in the United

States and certain brands in Mexico. A portion of this charge, $17 million, was reclassified to earnings

from discontinued operations on the consolidated statement of earnings in the fourth quarter of 2004.

The remaining charge was recorded as asset impairment and exit costs on the consolidated statement

of earnings.

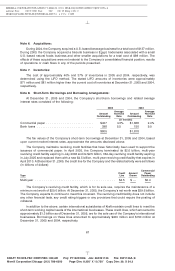

In November 2004, following discussions with the Company’s joint venture partner in Turkey and an

independent valuation of its equity investment, it was determined that a permanent decline in value had

occurred. This valuation resulted in a $47 million non-cash pre-tax charge. This charge was recorded as

marketing, administration and research costs on the consolidated statement of earnings. During 2005,

the Company’s interest in the joint venture was sold.

In June 2005, the Company sold substantially all of its sugar confectionery business for

approximately $1.4 billion. In 2004, as a result of the anticipated transaction, the Company recorded

non-cash asset impairments totaling $107 million. This charge was included in loss from discontinued

operations on the consolidated statement of earnings.

In December 2004, the Company announced the sale of its yogurt assets, which closed in the first

quarter of 2005. In 2004, as a result of the anticipated transaction, the Company recorded asset

impairments totaling $8 million. This charge was recorded as asset impairment and exit costs on the

consolidated statement of earnings.

63

6 C Cs: 39803