Kraft 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DI1135A.;10

mrll.fmt Free: 30D*/120D Foot: 0D/ 0D VJ RSeq: 3 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

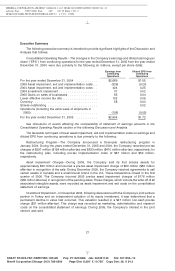

For further details on the restructuring program or asset impairment and implementation costs, see

Note 3 to the Consolidated Financial Statements and the Business Environment section of the following

Discussion and Analysis.

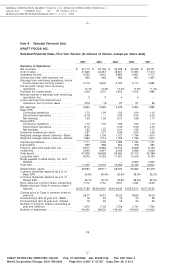

Gains on Sales of Businesses—The favorable impact on earnings and diluted EPS from continuing

operations is due primarily to the gain on sale of the U.K. desserts assets in 2005.

Lower Effective Income Tax Rate—The Company’s reported effective income tax rate decreased by

2.9 percentage points to 29.4%. The 2005 effective tax rate reflects several benefits, including the

settlement of an outstanding U.S. tax claim of $24 million; $82 million from the resolution of outstanding

items in the Company’s international operations; and $33 million in tax impacts associated with the sale

of a U.S. biscuit brand. The 2005 rate also includes a $53 million aggregate benefit from the domestic

manufacturers’ deduction provision and the dividend repatriation provision of the American Jobs

Creation Act. The tax provision in 2004 includes an $81 million favorable resolution of an outstanding tax

item and the reversal of $35 million of tax accruals that were no longer required due to tax events that

occurred during 2004.

Currency—The favorable currency impact on earnings and diluted EPS from continuing operations

is due primarily to the weakness of the U.S. dollar versus the euro, the Canadian dollar, the Brazilian real

and certain other currencies.

Operations—The decrease in results from operations was due primarily to the following:

• Lower income at Kraft North America Commercial, reflecting higher commodity and benefit costs,

and increased marketing spending, partially offset by higher pricing and favorable volume/mix

(including the benefit from the 53rd week).

• Lower income at Kraft International Commercial, reflecting higher commodity and developing

market infrastructure costs, partially offset by higher pricing and favorable volume/mix (including

the benefit from the 53rd week).

For further details, see the Consolidated Operating Results and Operating Results by Business

Segment sections of the following Discussion and Analysis.

2006 Forecasted Results—In January 2006, the Company announced that it expects 2006 full-year

diluted EPS in a range of $1.38 to $1.43. This forecast includes anticipated charges of approximately

$0.50 for costs related to its restructuring program and an effective income tax rate of approximately

33%. It does not reflect the potential impacts from the resolution of outstanding tax audits. The factors

described in the section entitled Risk Factors in Part 1, Item 1A of this Annual Report on Form 10-K

represent continuing risks to these forecasts.

Discussion and Analysis

Critical Accounting Policies and Estimates

Note 2 to the consolidated financial statements includes a summary of the significant accounting

policies and methods used in the preparation of the Company’s consolidated financial statements. In

most instances, the Company must use an accounting policy or method because it is the only policy or

method permitted under accounting principles generally accepted in the United States of America (‘‘U.S.

GAAP’’).

The preparation of all financial statements includes the use of estimates and assumptions that affect

a number of amounts included in the Company’s financial statements, including, among other things,

employee benefit costs and income taxes. The Company bases its estimates on historical experience

and other assumptions that it believes are reasonable. If actual amounts are ultimately different from

previous estimates, the revisions are included in the Company’s consolidated results of operations for

22

6 C Cs: 3224