Kraft 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DK1135A.;21

mrll.fmt Free: 85D*/300D Foot: 0D/ 0D VJ RSeq: 5 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DK1135A.;21

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

The Company’s reported effective income tax rate decreased by 2.6 percentage points to 32.3%,

resulting from an $81 million favorable resolution of an outstanding tax item and the reversal of

$35 million of tax accruals that are no longer required due to tax events that occurred during 2004.

Earnings from continuing operations of $2,669 million decreased $710 million (21.0%), due

primarily to lower operating income, partially offset by a lower effective income tax rate. Diluted EPS from

continuing operations, which was $1.55, decreased by 20.5%.

Earnings from discontinued operations, net of income tax, decreased $101 million, resulting in a net

loss of $4 million in 2004. The decrease was due primarily to pre-tax non-cash asset impairment charges

in 2004 of $107 million ($69 million after-tax) and an intangible pre-tax asset impairment charge of

$17 million ($11 million after-tax).

Net earnings of $2,665 million decreased $811 million (23.3%). Diluted EPS from net earnings,

which was $1.55, decreased by 22.9%.

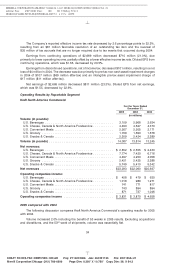

Operating Results by Reportable Segment

Kraft North America Commercial

For the Years Ended

December 31,

2005 2004 2003

(in millions)

Volume (in pounds):

U.S. Beverages ..................................... 3,109 2,968 2,634

U.S. Cheese, Canada & North America Foodservice ........... 4,493 4,527 4,373

U.S. Convenient Meals ................................ 2,267 2,205 2,171

U.S. Grocery ....................................... 1,709 1,690 1,678

U.S. Snacks & Cereals ................................ 2,509 2,424 2,389

Volume (in pounds) ................................... 14,087 13,814 13,245

Net revenues:

U.S. Beverages ..................................... $ 2,852 $ 2,555 $ 2,433

U.S. Cheese, Canada & North America Foodservice ........... 7,774 7,420 6,716

U.S. Convenient Meals ................................ 4,497 4,250 4,058

U.S. Grocery ....................................... 2,421 2,425 2,388

U.S. Snacks & Cereals ................................ 5,749 5,410 5,342

Net revenues ........................................ $23,293 $22,060 $20,937

Operating companies income:

U.S. Beverages ..................................... $ 458 $ 479 $ 630

U.S. Cheese, Canada & North America Foodservice ........... 1,018 989 1,271

U.S. Convenient Meals ................................ 741 771 817

U.S. Grocery ....................................... 743 894 894

U.S. Snacks & Cereals ................................ 871 737 1,046

Operating companies income ........................... $ 3,831 $ 3,870 $ 4,658

2005 compared with 2004

The following discussion compares Kraft North America Commercial’s operating results for 2005

with 2004.

Volume increased 2.0% including the benefit of 53 weeks in 2005 results. Excluding acquisitions

and divestitures, and the 53rd week of shipments, volume was essentially flat.

34

6 C Cs: 48970