Kraft 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DQ1135A.;7

mrll.fmt Free: 15D*/0D Foot: 0D/ 0D VJ RSeq: 1 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DQ1135A.;7

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

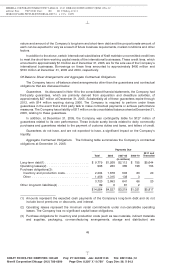

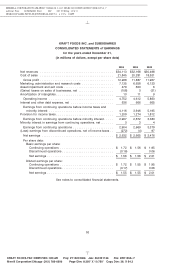

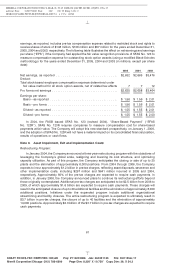

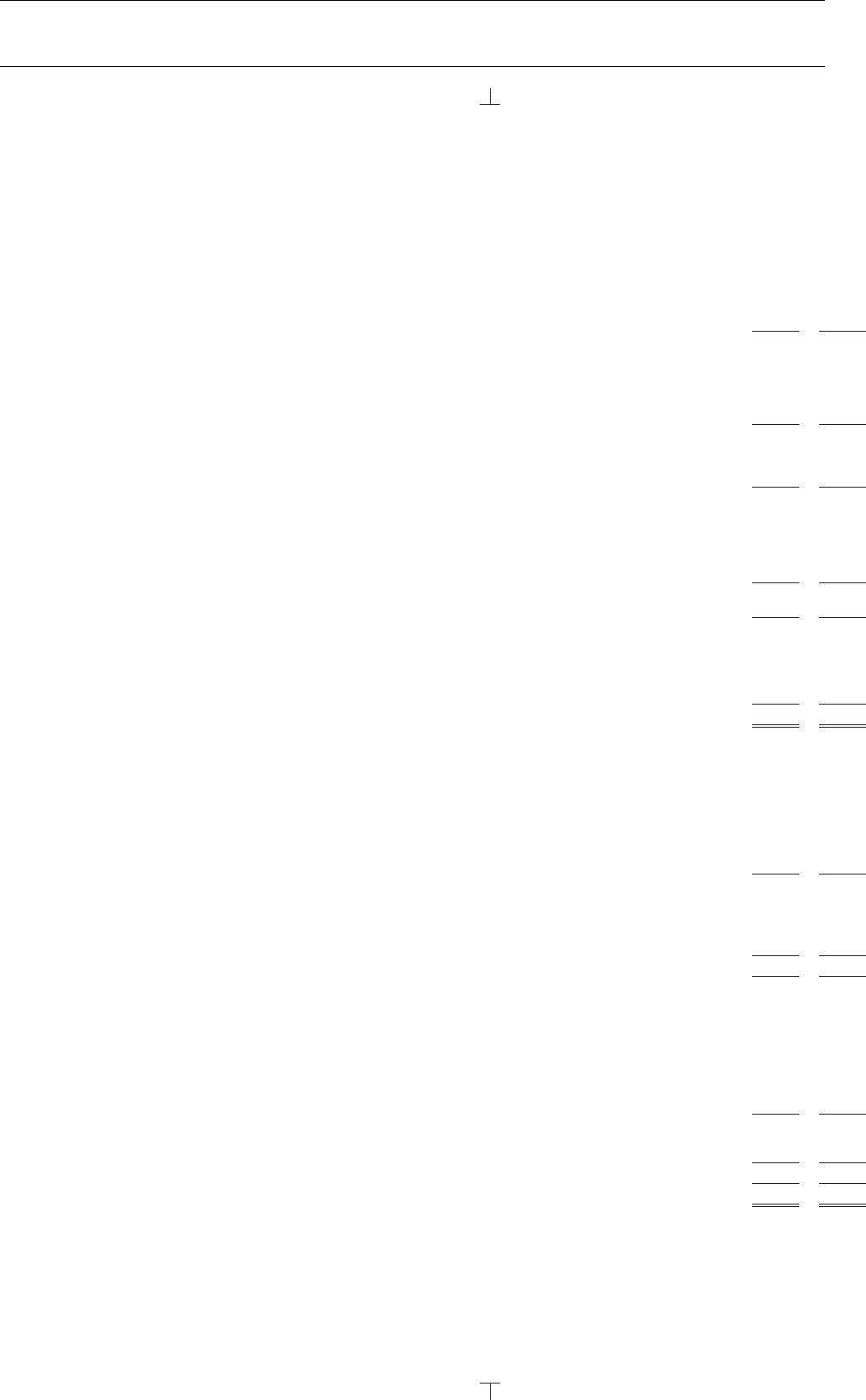

KRAFT FOODS INC. and SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS, at December 31,

(in millions of dollars)

2005 2004

ASSETS

Cash and cash equivalents ............................................... $ 316 $ 282

Receivables (less allowances of $92 in 2005 and $118 in 2004) ........................ 3,385 3,541

Inventories:

Raw materials ...................................................... 1,363 1,367

Finished product .................................................... 1,980 2,080

3,343 3,447

Deferred income taxes .................................................. 879 749

Assets of discontinued operations held for sale .................................. 1,458

Other current assets ................................................... 230 245

Total current assets ................................................... 8,153 9,722

Property, plant and equipment, at cost:

Land and land improvements ............................................ 388 400

Buildings and building equipment ......................................... 3,551 3,545

Machinery and equipment .............................................. 12,008 11,892

Construction in progress ............................................... 651 646

16,598 16,483

Less accumulated depreciation ........................................... 6,781 6,498

9,817 9,985

Goodwill ........................................................... 24,648 25,177

Other intangible assets, net ............................................... 10,516 10,634

Prepaid pension assets ................................................. 3,617 3,569

Other assets ........................................................ 877 841

TOTAL ASSETS ..................................................... $57,628 $59,928

LIABILITIES

Short-term borrowings .................................................. $ 805 $1,818

Current portion of long-term debt ........................................... 1,268 750

Due to Altria Group, Inc. and affiliates ........................................ 652 227

Accounts payable ..................................................... 2,270 2,207

Accrued liabilities:

Marketing ......................................................... 1,529 1,637

Employment costs ................................................... 625 732

Other ........................................................... 1,338 1,537

Income taxes ........................................................ 237 170

Total current liabilities ................................................. 8,724 9,078

Long-term debt ...................................................... 8,475 9,723

Deferred income taxes .................................................. 6,067 6,468

Accrued postretirement health care costs ...................................... 1,931 1,887

Other liabilities ....................................................... 2,838 2,861

Total liabilities ...................................................... 28,035 30,017

Contingencies (Note 18)

SHAREHOLDERS’ EQUITY

Class A common stock, no par value (555,000,000 shares issued in 2005 and 2004)

Class B common stock, no par value (1,180,000,000 shares issued and outstanding in 2005 and

2004)

Additional paid-in capital ................................................. 23,835 23,762

Earnings reinvested in the business .......................................... 9,453 8,304

Accumulated other comprehensive losses (including currency translation of $(1,290) in 2005 and

$(890) in 2004) ..................................................... (1,663) (1,205)

31,625 30,861

Less cost of repurchased stock (65,119,245 Class A shares in 2005 and 29,644,926 Class A shares

in 2004) .......................................................... (2,032) (950)

Total shareholders’ equity ............................................... 29,593 29,911

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY .............................. $57,628 $59,928

See notes to consolidated financial statements.

52

6 C Cs: 63214