Kraft 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DY1135A.;6

mrll.fmt Free: 200D*/300D Foot: 0D/ 0D VJ RSeq: 4 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DY1135A.;6

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

received upon stock option exercise or, in the case of restricted stock and rights, the number of shares

corresponding to the unamortized compensation expense. For 2005 and 2004, the number of stock

options excluded from the calculation of weighted average shares for diluted EPS because their effects

were antidilutive (i.e. the cash that would be received upon exercise is greater than the average market

price of the stock during the period) was immaterial. For the 2003 computation, 18 million Class A

common stock options were excluded from the calculation of weighted average shares for diluted EPS

because their effects were antidilutive.

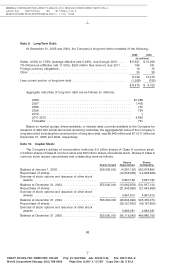

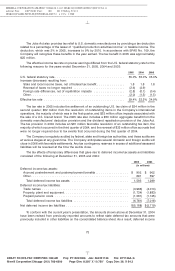

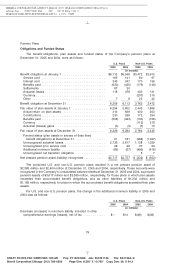

Note 13. Income Taxes:

Earnings from continuing operations before income taxes and minority interest, and provision for

income taxes consisted of the following for the years ended December 31, 2005, 2004 and 2003:

2005 2004 2003

(in millions)

Earnings from continuing operations before income taxes and minority

interest:

United States ......................................... $2,774 $2,616 $3,574

Outside United States ................................... 1,342 1,330 1,621

Total .............................................. $4,116 $3,946 $5,195

Provision for income taxes:

United States federal:

Current ............................................ $ 876 $ 675 $ 967

Deferred ........................................... (210) 69 153

666 744 1,120

State and local ........................................ 115 112 145

Total United States ..................................... 781 856 1,265

Outside United States:

Current ............................................ 466 403 456

Deferred ........................................... (38) 15 91

Total outside United States ................................ 428 418 547

Total provision for income taxes .............................. $1,209 $1,274 $1,812

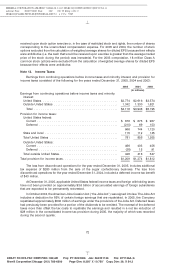

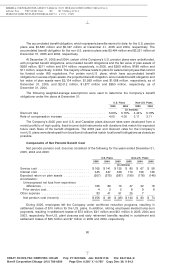

The loss from discontinued operations for the year ended December 31, 2005, includes additional

tax expense of $280 million from the sale of the sugar confectionery business. The loss from

discontinued operations for the year ended December 31, 2004, included a deferred income tax benefit

of $43 million.

At December 31, 2005, applicable United States federal income taxes and foreign withholding taxes

have not been provided on approximately $3.6 billion of accumulated earnings of foreign subsidiaries

that are expected to be permanently reinvested.

In October 2004, the American Jobs Creation Act (‘‘the Jobs Act’’) was signed into law. The Jobs Act

includes a deduction for 85% of certain foreign earnings that are repatriated. In 2005, the Company

repatriated approximately $500 million of earnings under the provisions of the Jobs Act. Deferred taxes

had previously been provided for a portion of the dividends to be remitted. The reversal of the deferred

taxes more than offset the tax costs to repatriate the earnings and resulted in a net tax reduction of

$28 million in the consolidated income tax provision during 2005, the majority of which was recorded

during the second quarter.

72

6 C Cs: 5587