Kraft 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION EYOUNG// 8-MAR-06 09:45 DISK126:[06CHI5.06CHI1135]DU1135A.;17

mrll.fmt Free: 515D*/540D Foot: 0D/ 0D VJ RSeq: 6 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

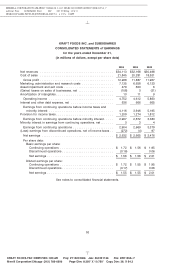

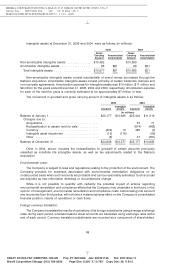

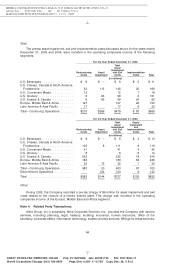

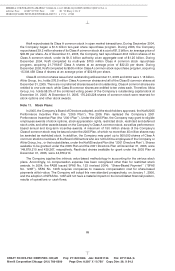

earnings, as reported, includes pre-tax compensation expense related to restricted stock and rights to

receive shares of stock of $148 million, $106 million and $57 million for the years ended December 31,

2005, 2004 and 2003, respectively. The following table illustrates the effect on net earnings and earnings

per share (‘‘EPS’’) if the Company had applied the fair value recognition provisions of SFAS No. 123 to

measure compensation expense for outstanding stock option awards (using a modified Black-Scholes

methodology) for the years ended December 31, 2005, 2004 and 2003 (in millions, except per share

data):

2005 2004 2003

Net earnings, as reported .................................. $2,632 $2,665 $3,476

Deduct:

Total stock-based employee compensation expense determined under

fair value method for all stock option awards, net of related tax effects 7 7 12

Pro forma net earnings .................................... $2,625 $2,658 $3,464

Earnings per share:

Basic—as reported ..................................... $ 1.56 $ 1.56 $ 2.01

Basic—pro forma ...................................... $ 1.56 $ 1.56 $ 2.01

Diluted—as reported .................................... $ 1.55 $ 1.55 $ 2.01

Diluted—pro forma ..................................... $ 1.55 $ 1.55 $ 2.00

In 2004, the FASB issued SFAS No. 123 (revised 2004), ‘‘Share-Based Payment’’ (‘‘SFAS

No. 123R’’). SFAS No. 123R requires companies to measure compensation cost for share-based

payments at fair value. The Company will adopt this new standard prospectively, on January 1, 2006,

and the adoption of SFAS No. 123R will not have a material impact on its consolidated financial position,

results of operations or cash flows.

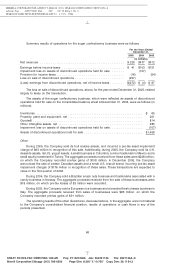

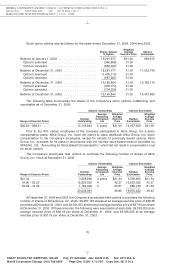

Note 3. Asset Impairment, Exit and Implementation Costs:

Restructuring Program:

In January 2004, the Company announced a three-year restructuring program with the objectives of

leveraging the Company’s global scale, realigning and lowering its cost structure, and optimizing

capacity utilization. As part of this program, the Company anticipates the closing or sale of up to 20

plants and the elimination of approximately 6,000 positions. From 2004 through 2006, the Company

expects to incur approximately $1.2 billion in pre-tax charges, reflecting asset disposals, severance and

other implementation costs, including $297 million and $641 million incurred in 2005 and 2004,

respectively. Approximately 60% of the pre-tax charges are expected to require cash payments. In

addition, in January 2006, the Company announced plans to continue its restructuring efforts beyond

those originally contemplated. Additional pre-tax charges are anticipated to be $2.5 billion from 2006 to

2009, of which approximately $1.6 billion are expected to require cash payments. These charges will

result in the anticipated closure of up to 20 additional facilities and the elimination of approximately 8,000

additional positions. Initiatives under the expanded program include additional organizational

streamlining and facility closures. The entire restructuring program is expected to ultimately result in

$3.7 billion in pre-tax charges, the closure of up to 40 facilities and the elimination of approximately

14,000 positions. Approximately $2.3 billion of the $3.7 billion in pre-tax charges are expected to require

cash payments.

61

6 C Cs: 48743