Kraft 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION FLANGST// 9-MAR-06 02:24 DISK126:[06CHI5.06CHI1135]DW1135A.;8

mrll.fmt Free: 120D*/0D Foot: 0D/ 0D VJ RSeq: 3 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DW1135A.;8

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

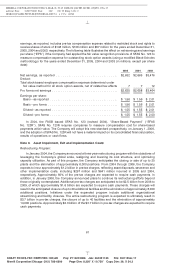

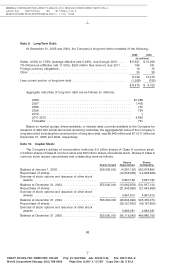

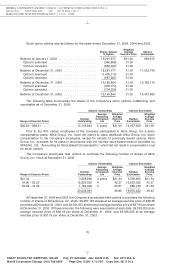

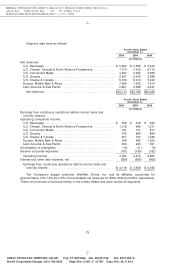

Note 9. Long-Term Debt:

At December 31, 2005 and 2004, the Company’s long-term debt consisted of the following:

2005 2004

(in millions)

Notes, 4.00% to 7.55% (average effective rate 5.49%), due through 2031 ..... $9,537 $ 10,259

7% Debenture (effective rate 11.32%), $200 million face amount, due 2011 . . . 165 161

Foreign currency obligations ..................................... 16 15

Other ..................................................... 25 38

9,743 10,473

Less current portion of long-term debt .............................. (1,268) (750)

$ 8,475 $ 9,723

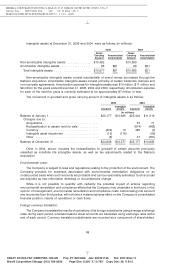

Aggregate maturities of long-term debt are as follows (in millions):

2006 .................................................. $1,268

2007 .................................................. 1,405

2008 .................................................. 707

2009 .................................................. 754

2010 .................................................. 1

2011-2015 .............................................. 4,893

Thereafter .............................................. 751

Based on market quotes, where available, or interest rates currently available to the Company for

issuance of debt with similar terms and remaining maturities, the aggregate fair value of the Company’s

long-term debt, including the current portion of long-term debt, was $9,945 million and $11,017 million at

December 31, 2005 and 2004, respectively.

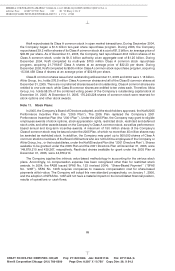

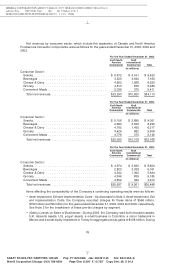

Note 10. Capital Stock:

The Company’s articles of incorporation authorize 3.0 billion shares of Class A common stock,

2.0 billion shares of Class B common stock and 500 million shares of preferred stock. Shares of Class A

common stock issued, repurchased and outstanding were as follows:

Shares Shares

Shares Issued Repurchased Outstanding

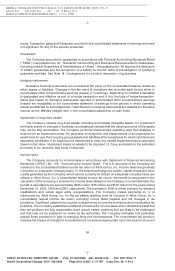

Balance at January 1, 2003 ..................... 555,000,000 (4,381,150) 550,618,850

Repurchase of shares ......................... (12,508,908) (12,508,908)

Exercise of stock options and issuance of other stock

awards .................................. 3,827,182 3,827,182

Balance at December 31, 2003 ................... 555,000,000 (13,062,876) 541,937,124

Repurchase of shares ......................... (21,543,660) (21,543,660)

Exercise of stock options and issuance of other stock

awards .................................. 4,961,610 4,961,610

Balance at December 31, 2004 ................... 555,000,000 (29,644,926) 525,355,074

Repurchase of shares ......................... (39,157,600) (39,157,600)

Exercise of stock options and issuance of other stock

awards .................................. 3,683,281 3,683,281

Balance at December 31, 2005 ................... 555,000,000 (65,119,245) 489,880,755

68

6 C Cs: 54142