Kraft 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION MBLOUNT// 9-MAR-06 12:42 DISK126:[06CHI5.06CHI1135]DM1135A.;12

mrll.fmt Free: 60D*/240D Foot: 0D/ 0D VJ RSeq: 5 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DM1135A.;12

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

commitments for projected needs to be utilized in the normal course of business. Other purchase

obligations include commitments for marketing, advertising, capital expenditures, information

technology and professional services. Arrangements are considered purchase obligations if a

contract specifies all significant terms, including fixed or minimum quantities to be purchased, a

pricing structure and approximate timing of the transaction. Most arrangements are cancelable

without a significant penalty, and with short notice (usually 30 days). Any amounts reflected on the

consolidated balance sheet as accounts payable and accrued liabilities are excluded from the table

above.

(4) Other long-term liabilities primarily consist of certain specific severance and incentive

compensation arrangements. The following long-term liabilities included on the consolidated

balance sheet are excluded from the table above: accrued pension, postretirement health care and

postemployment costs, income taxes, minority interest, insurance accruals and other accruals. The

Company is unable to estimate the timing of the payments for these items. Currently, the Company

anticipates making U.S. pension contributions of approximately $140 million in 2006 and non-U.S.

pension contributions of approximately $106 million in 2006, based on current tax law (as discussed

in Note 15 to the consolidated financial statements).

The Company believes that its cash from operations and existing credit facility will provide sufficient

liquidity to meet its working capital needs (including the cash requirements of the restructuring

program), planned capital expenditures, future contractual obligations and payment of its anticipated

quarterly dividends.

Equity and Dividends

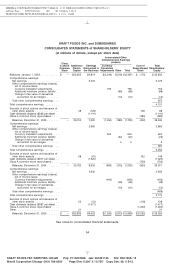

In December 2003, the Company’s Board of Directors approved the repurchase from time to time of

up to $700 million of the Company’s Class A common stock. In December 2004, the Company

completed the program, acquiring 21.7 million Class A shares at an average price of $32.23 per share. In

December 2004, the Company commenced repurchasing shares under a two-year $1.5 billion Class A

common stock repurchase program authorized by its Board of Directors. Through December 31, 2005,

repurchases under the $1.5 billion program were 40.6 million shares at a cost of $1.25 billion, or $30.81

per share. During 2005, the Company repurchased 39.2 million shares at a cost of $1.2 billion, and in

2004, the Company repurchased 21.5 million shares at a cost of $700 million.

In March 2006, the Company’s Board of Directors authorized a new share repurchase program to

repurchase from time to time up to $2.0 billion of the Company’s Class A common stock. This new

program, expected to run through 2008, will commence upon the completion of the existing two-year

$1.5 billion program, which is expected to be completed during the first quarter of 2006.

As discussed in Note 11 to the consolidated financial statements, during 2005 and 2004, the

Company granted approximately 4.2 million and 4.1 million restricted Class A shares, respectively, to

eligible U.S.-based employees, and during 2005 and 2004, also issued to eligible non-U.S. employees

rights to receive approximately 1.8 million and 1.9 million Class A equivalent shares, respectively. The

market value per restricted share or right was $33.32 and $32.23 on the dates of the 2005 and 2004

grants, respectively. Restrictions on most of the stock and rights granted in 2005 lapse in the first quarter

of 2008, while restrictions on grants in 2004 lapse in the first quarter of 2007.

In 2004, the FASB issued SFAS No. 123 (revised 2004), ‘‘Share-Based Payment’’ (‘‘SFAS

No. 123R’’). SFAS No. 123R requires companies to measure compensation cost for share-based

payments at fair value. The Company will adopt this new standard prospectively, on January 1, 2006,

and the adoption of SFAS No. 123R will not have a material impact on its consolidated financial position,

results of operations or cash flows. At December 31, 2005, the number of shares to be issued upon

46

6 C Cs: 31127