Kraft 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION EYOUNG// 8-MAR-06 09:45 DISK126:[06CHI5.06CHI1135]DU1135A.;17

mrll.fmt Free: 435D*/1155D Foot: 0D/ 0D VJ RSeq: 2 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

consolidated statement of earnings for the year ended December 31, 2005, versus fifty-two weeks for the

years ended December 31, 2004 and 2003.

As discussed in Note 13. Income Taxes, classification of certain prior years’ amounts have been

revised to conform with the current year’s presentation.

Note 2. Summary of Significant Accounting Policies:

Cash and cash equivalents:

Cash equivalents include demand deposits with banks and all highly liquid investments with original

maturities of three months or less.

Depreciation, amortization and goodwill valuation:

Property, plant and equipment are stated at historical cost and depreciated by the straight-line

method over the estimated useful lives of the assets. Machinery and equipment are depreciated over

periods ranging from 3 to 20 years, and buildings and building improvements over periods up to

40 years.

Definite life intangible assets are amortized over their estimated useful lives. The Company is

required to conduct an annual review of goodwill and intangible assets for potential impairment.

Goodwill impairment testing requires a comparison between the carrying value and fair value of each

reporting unit. If the carrying value exceeds the fair value, goodwill is considered impaired. The amount

of impairment loss is measured as the difference between the carrying value and implied fair value of

goodwill, which is determined using discounted cash flows. Impairment testing for non-amortizable

intangible assets requires a comparison between the fair value and carrying value of the intangible asset.

If the carrying value exceeds fair value, the intangible asset is considered impaired and is reduced to fair

value. During the first quarter of 2005, the Company completed its annual review of goodwill and

intangible assets and no impairment charges resulted from this review. However, as part of the sale or

pending sale of certain Canadian assets and two brands, the Company recorded total non-cash pre-tax

asset impairment charges of $269 million in 2005, which included impairment of goodwill and intangible

assets of $13 million and $118 million, respectively, as well as $138 million of asset write-downs. During

2004, the Company’s annual review of goodwill and intangible assets resulted in a $29 million non-cash

pre-tax charge related to an intangible asset impairment for a small confectionery business in the United

States and certain brands in Mexico. A portion of this charge, $12 million, was recorded as asset

impairment and exit costs on the consolidated statement of earnings. The remainder of the charge,

$17 million, was included in discontinued operations.

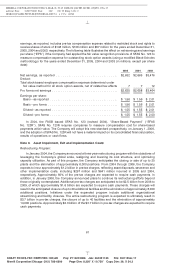

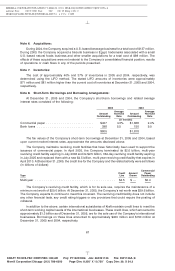

At December 31, 2005 and 2004, goodwill by reportable segment was as follows (in millions):

2005 2004

U.S. Beverages .............................................. $ 1,293 $ 1,293

U.S. Cheese, Canada & North America Foodservice .................... 5,366 5,382

U.S. Convenient Meals ......................................... 1,880 1,880

U.S. Grocery ................................................ 2,634 2,641

U.S. Snacks & Cereals ......................................... 8,630 8,658

Europe, Middle East & Africa ..................................... 4,487 5,014

Latin America & Asia Pacific ..................................... 358 309

Total goodwill .............................................. $24,648 $25,177

57

6 C Cs: 3278