Kraft 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DI1135A.;10

mrll.fmt Free: 95D*/240D Foot: 0D/ 0D VJ RSeq: 4 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

the period in which the actual amounts become known. Historically, the aggregate differences, if any,

between the Company’s estimates and actual amounts in any year have not had a significant impact on

the Company’s consolidated financial statements.

The selection and disclosure of the Company’s critical accounting policies and estimates have been

discussed with the Company’s Audit Committee. The following is a review of the more significant

assumptions and estimates, as well as the accounting policies and methods used in the preparation of

the Company’s consolidated financial statements:

Employee Benefit Plans. As discussed in Note 15 to the consolidated financial statements, the

Company provides a range of benefits to its employees and retired employees, including pensions,

postretirement health care benefits and postemployment benefits (primarily severance). The Company

records amounts relating to these plans based on calculations specified by U.S. GAAP, which include

various actuarial assumptions, such as discount rates, assumed rates of return on plan assets,

compensation increases, turnover rates and health care cost trend rates. The Company reviews its

actuarial assumptions on an annual basis and makes modifications to the assumptions based on current

rates and trends when it is deemed appropriate to do so. As permitted by U.S. GAAP, any effect of the

modifications is generally amortized over future periods. The Company believes that the assumptions

utilized in recording its obligations under its plans, which are presented in Note 15 to the consolidated

financial statements, are reasonable based on its experience and advice from its actuaries.

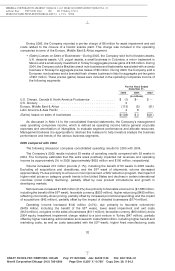

During the years ended December 31, 2005, 2004 and 2003, the Company recorded the following

amounts in the consolidated statements of earnings for employee benefit plans:

2005 2004 2003

(in millions)

U.S. pension plan cost (income) ................................. $256 $ 46 $(46)

Non-U.S. pension plan cost ..................................... 140 93 74

Postretirement health care cost .................................. 253 237 229

Postemployment benefit plan cost ................................ 139 167 6

Employee savings plan cost .................................... 94 92 84

Net expense for employee benefit plans .......................... $882 $635 $347

The 2005 net expense for employee benefit plans of $882 million increased by $247 million over the

2004 amount. The cost increase primarily relates to higher U.S. pension plan costs, including higher

amortization of the unrecognized net loss from experience differences, a lower expected return on plan

assets, a lower discount rate assumption and higher settlement losses as employees retired or left

during 2005. The 2004 net expense for employee benefit plans of $635 million increased by $288 million

over the 2003 amount. This cost increase primarily relates to increased postemployment benefit costs,

resulting from several workforce reduction programs during 2004 as part of the overall restructuring

program ($167 million), and a lowering of the Company’s discount rate assumption on its pension and

postretirement benefit plans, partially offset by the impact of the Medicare Prescription Drug,

Improvement and Modernization Act of 2003 discussed below.

In December 2003, the United States enacted into law the Medicare Prescription Drug,

Improvement and Modernization Act of 2003 (the ‘‘Act’’). The Act establishes a prescription drug benefit

under Medicare, known as ‘‘Medicare Part D,’’ and a federal subsidy to sponsors of retiree health care

benefit plans that provide a benefit that is at least actuarially equivalent to Medicare Part D.

In May 2004, the Financial Accounting Standards Board (‘‘FASB’’) issued FASB Staff Position

No. 106-2, ‘‘Accounting and Disclosure Requirements Related to the Medicare Prescription Drug,

Improvement and Modernization Act of 2003’’ (‘‘FSP 106-2’’). FSP 106-2 requires companies to account

for the effect of the subsidy on benefits attributable to past service as an actuarial experience gain and as

23

6 C Cs: 34797