Kraft 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DI1135A.;10

mrll.fmt Free: 1010DM/0D Foot: 0D/ 0D VJ RSeq: 1 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

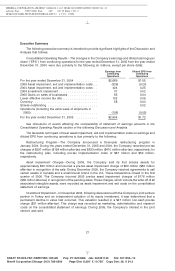

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operation.

Description of the Company

Kraft Foods Inc. (‘‘Kraft’’), together with its subsidiaries (collectively referred to as the ‘‘Company’’),

manufactures and markets packaged food products, consisting principally of beverages, cheese,

snacks, convenient meals and various packaged grocery products. Kraft manages and reports

operating results through two units, Kraft North America Commercial and Kraft International

Commercial. Reportable segments for Kraft North America Commercial are organized and managed

principally by product category. Kraft International Commercial’s operations are organized and

managed by geographic location. At December 31, 2005, Altria Group, Inc. held 98.3% of the combined

voting power of Kraft’s outstanding capital stock and owned 87.2% of the outstanding shares of Kraft’s

capital stock.

Kraft North America Commercial’s segments are U.S. Beverages; U.S. Cheese, Canada & North

America Foodservice; U.S. Convenient Meals; U.S. Grocery; and U.S. Snacks & Cereals. Kraft

International Commercial’s segments are Europe, Middle East & Africa; and Latin America & Asia Pacific.

In October 2005, the Company announced that, effective January 1, 2006, its Canadian business will be

realigned to better integrate it into the Company’s North American business by product category.

Beginning in the first quarter of 2006, the operating results of the Canadian business will be reported

throughout the North American food segments. In addition, in the first quarter of 2006, the Company’s

international businesses will be realigned to reflect the reorganization announced within Europe in

November 2005. Beginning in the first quarter of 2006, the operating results of the Company’s

international businesses will be reported in two revised segments—European Union; and Developing

Markets, Oceania and North Asia, the latter to reflect the Company’s increased management focus on

developing markets. Accordingly, prior period segment results will be restated.

In June 2005, the Company sold substantially all of its sugar confectionery business for pre-tax

proceeds of approximately $1.4 billion. The Company has reflected the results of its sugar confectionery

business prior to the closing date as discontinued operations on the consolidated statements of

earnings for all years presented. The assets related to the sugar confectionery business were reflected

as assets of discontinued operations held for sale on the consolidated balance sheet at December 31,

2004. The Company recorded a loss on sale of discontinued operations of $297 million in the second

quarter of 2005, related largely to taxes on the transaction.

The Company’s operating subsidiaries generally report year-end results as of the Saturday closest

to the end of each year. This resulted in fifty-three weeks of operating results in the Company’s

consolidated statement of earnings for the year ended December 31, 2005, versus fifty-two weeks for the

years ended December 31, 2004 and 2003.

As previously communicated, for significant business reasons, the Altria Group, Inc. Board of

Directors is looking at a number of restructuring alternatives, including the possibility of separating Kraft

from the balance of Altria Group, Inc. Altria Group, Inc. has indicated that continuing improvements in its

litigation environment are a prerequisite to such action by its Board of Directors, and the timing and

chronology of events are uncertain.

20

6 C Cs: 25278