Kraft 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION MBLOUNT// 9-MAR-06 11:15 DISK126:[06CHI5.06CHI1135]DS1135A.;13

mrll.fmt Free: 105D*/0D Foot: 0D/ 0D VJ RSeq: 1 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DS1135A.;13

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

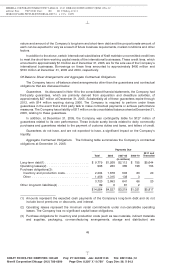

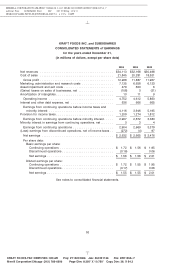

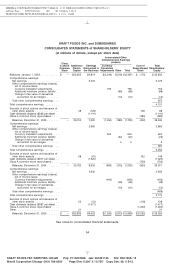

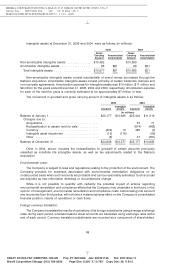

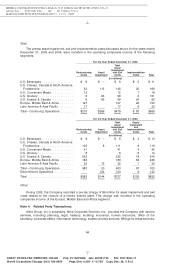

KRAFT FOODS INC. and SUBSIDIARIES

CONSOLIDATED STATEMENTS of SHAREHOLDERS’ EQUITY

(in millions of dollars, except per share data)

Accumulated Other

Comprehensive Earnings

(Losses)

Class

A and B Additional Earnings Currency Cost of Total

Common Paid-In Reinvested in Translation Repurchased Shareholders’

Stock Capital the Business Adjustments Other Total Stock Equity

Balances, January 1, 2003 ........... $ — $23,655 $4,814 $(2,249) $(218) $(2,467) $ (170) $ 25,832

Comprehensive earnings:

Net earnings .................. 3,476 3,476

Other comprehensive earnings (losses),

net of income taxes:

Currency translation adjustments .... 755 755 755

Additional minimum pension liability . (68) (68) (68)

Change in fair value of derivatives

accounted for as hedges ....... (12) (12) (12)

Total other comprehensive earnings . . . 675

Total comprehensive earnings ........ 4,151

Exercise of stock options and issuance of

other stock awards .............. 49 (129) 148 68

Cash dividends declared ($0.66 per share) . . (1,141) (1,141)

Class A common stock repurchased .... (380) (380)

Balances, December 31, 2003 ....... — 23,704 7,020 (1,494) (298) (1,792) (402) 28,530

Comprehensive earnings:

Net earnings .................. 2,665 2,665

Other comprehensive earnings (losses),

net of income taxes:

Currency translation adjustments .... 604 604 604

Additional minimum pension liability . (22) (22) (22)

Change in fair value of derivatives

accounted for as hedges ....... 5 5 5

Total other comprehensive earnings . . . 587

Total comprehensive earnings ........ 3,252

Exercise of stock options and issuance of

other stock awards .............. 58 (61) 152 149

Cash dividends declared ($0.77 per share) . . (1,320) (1,320)

Class A common stock repurchased .... (700) (700)

Balances, December 31, 2004 ....... — 23,762 8,304 (890) (315) (1,205) (950) 29,911

Comprehensive earnings:

Net earnings .................. 2,632 2,632

Other comprehensive earnings (losses),

net of income taxes:

Currency translation adjustments .... (400) (400) (400)

Additional minimum pension liability . (48) (48) (48)

Change in fair value of derivatives

accounted for as hedges ....... (10) (10) (10)

Total other comprehensive earnings . . . (458)

Total comprehensive earnings ........ 2,174

Exercise of stock options and issuance of

other stock awards .............. 52 (12) (118) 158

Cash dividends declared ($0.87 per share) . . (1,471) (1,471)

Class A common stock repurchased .... (1,200) (1,200)

Other ......................... 21 21

Balances, December 31, 2005 ....... $ — $23,835 $9,453 $(1,290) $(373) $(1,663) $(2,032) $ 29,593

See notes to consolidated financial statements.

54

6 C Cs: 28482