Kraft 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION EYOUNG// 8-MAR-06 09:45 DISK126:[06CHI5.06CHI1135]DU1135A.;17

mrll.fmt Free: 110D*/120D Foot: 0D/ 0D VJ RSeq: 5 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

and future tax audits in various jurisdictions, significant income tax accrual reversals could continue to

occur, which could trigger reimbursements from Altria Group, Inc.

Inventories:

Inventories are stated at the lower of cost or market. The last-in, first-out (‘‘LIFO’’) method is used to

cost a majority of domestic inventories. The cost of other inventories is principally determined by the

average cost method.

In 2004, the FASB issued SFAS No. 151, ‘‘Inventory Costs.’’ SFAS No. 151 requires that abnormal

idle facility expense, spoilage, freight and handling costs be recognized as current-period charges. In

addition, SFAS No. 151 requires that allocation of fixed production overhead costs to inventories be

based on the normal capacity of the production facility. The Company is required to adopt the provisions

of SFAS No. 151 prospectively as of January 1, 2006, but the effect of adoption will not have a material

impact on its consolidated results of operations, financial position or cash flows.

Marketing costs:

The Company promotes its products with advertising, consumer incentives and trade promotions.

Such programs include, but are not limited to, discounts, coupons, rebates, in-store display incentives

and volume-based incentives. Advertising costs are expensed as incurred. Consumer incentive and

trade promotion activities are recorded as a reduction of revenues based on amounts estimated as

being due to customers and consumers at the end of a period, based principally on historical utilization

and redemption rates. For interim reporting purposes, advertising and consumer incentive expenses are

charged to operations as a percentage of volume, based on estimated volume and related expense for

the full year.

Revenue recognition:

The Company recognizes revenues, net of sales incentives and including shipping and handling

charges billed to customers, upon shipment or delivery of goods when title and risk of loss pass to

customers. Shipping and handling costs are classified as part of cost of sales.

Software costs:

The Company capitalizes certain computer software and software development costs incurred in

connection with developing or obtaining computer software for internal use. Capitalized software costs

are included in property, plant and equipment on the consolidated balance sheets and amortized on a

straight-line basis over the estimated useful lives of the software, which do not exceed five years.

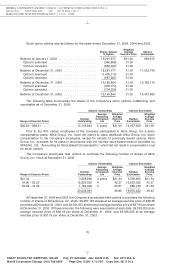

Stock-based compensation:

The Company accounts for employee stock compensation plans in accordance with the intrinsic

value-based method permitted by SFAS No. 123, ‘‘Accounting for Stock-Based Compensation,’’ which

has not resulted in compensation cost for stock options. The market value at date of grant of restricted

stock and rights to receive shares of stock is recorded as compensation expense over the period of

restriction (three years).

At December 31, 2005, the Company had stock-based employee compensation plans, which are

described more fully in Note 11. Stock Plans. The Company applies the recognition and measurement

principles of Accounting Principles Board Opinion No. 25, ‘‘Accounting for Stock Issued to Employees,’’

and related Interpretations in accounting for stock options within those plans. No compensation

expense for employee stock options is reflected in net earnings, as all stock options granted under those

plans had an exercise price equal to the market value of the common stock on the date of grant. Net

60

6 C Cs: 47208