Kraft 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION ABLIJDE// 7-MAR-06 14:42 DISK126:[06CHI5.06CHI1135]DY1135A.;6

mrll.fmt Free: 40D*/120D Foot: 0D/ 0D VJ RSeq: 3 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DY1135A.;6

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 38. X 54.3

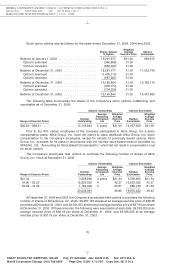

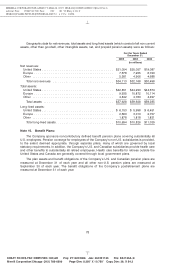

Had compensation cost for stock option awards under the Kraft plans and Altria Group, Inc. plans

been determined by using the fair value at the grant date, the Company’s net earnings and basic and

diluted EPS would have been $2,625 million, $1.56 and $1.55, respectively, for the year ended

December 31, 2005; $2,658 million, $1.56 and $1.55, respectively, for the year ended December 31,

2004; and $3,464 million, $2.01 and $2.00, respectively, for the year ended December 31, 2003. The

foregoing impact of compensation cost was determined using a modified Black-Scholes methodology

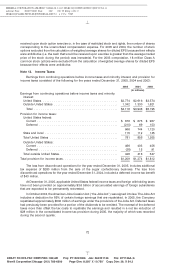

and the following assumptions:

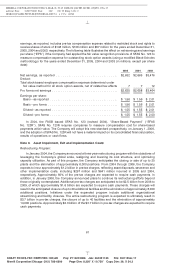

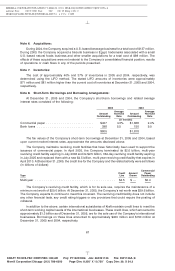

Weighted

Risk-Free Average Expected Expected Fair Value

Interest Rate Expected Life Volatility Dividend Yield at Grant Date

2005 Altria Group, Inc. ......... 3.87% 4 years 32.90% 4.43% $14.08

2004 Altria Group, Inc. ......... 2.99 4 36.63 5.39 10.30

2003 Altria Group, Inc. ......... 2.68 4 37.61 6.04 8.76

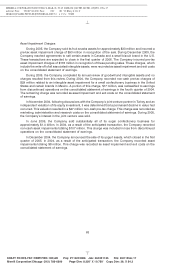

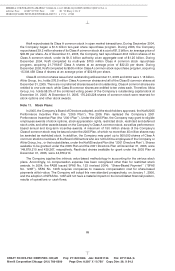

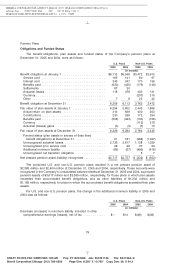

The Company may grant shares of restricted stock and rights to receive shares of stock to eligible

employees, giving them in most instances all of the rights of stockholders, except that they may not sell,

assign, pledge or otherwise encumber such shares and rights. Such shares and rights are subject to

forfeiture if certain employment conditions are not met. During 2005, 2004 and 2003, the Company

granted approximately 4.2 million, 4.1 million and 3.7 million restricted Class A shares, respectively, to

eligible U.S.-based employees, and during 2005, 2004 and 2003, also issued to eligible non-U.S.

employees rights to receive approximately 1.8 million, 1.9 million and 1.6 million Class A equivalent

shares, respectively. The market value per restricted share or right was $33.32, $32.23 and $36.56 on the

dates of the 2005, 2004 and 2003 grants, respectively. At December 31, 2005, restrictions on these

shares and rights, net of forfeitures, lapse as follows: 2006—4,140,552 shares; 2007—5,079,097 shares;

2008—5,596,297 shares; 2009—100,000 shares; 2010—69,170 shares; and 2012—100,000 shares.

The fair value of the shares of restricted stock and rights to receive shares of stock at the date of

grant is amortized to expense ratably over the restriction period. The Company recorded compensation

expense related to the restricted stock and rights of $148 million, $106 million and $57 million for the

years ended December 31, 2005, 2004 and 2003, respectively. The unamortized portion, which is

reported on the consolidated balance sheets as a reduction of shareholders’ equity, was $202 million

and $190 million at December 31, 2005 and 2004, respectively.

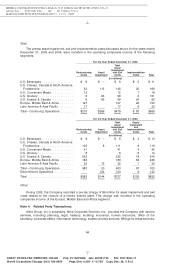

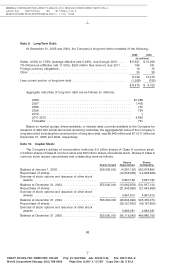

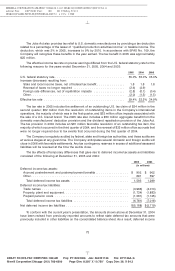

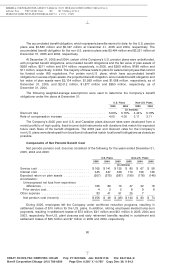

Note 12. Earnings Per Share:

Basic and diluted EPS from continuing and discontinued operations were calculated using the

following:

For the Years Ended

December 31,

2005 2004 2003

(in millions)

Earnings from continuing operations .......................... $2,904 $2,669 $3,379

(Loss) earnings from discontinued operations .................... (272) (4) 97

Net earnings ........................................... $2,632 $2,665 $3,476

Weighted average shares for basic EPS ........................ 1,684 1,709 1,727

Plus incremental shares from assumed conversions of stock options,

restricted stock and stock rights ............................ 9 5 1

Weighted average shares for diluted EPS ....................... 1,693 1,714 1,728

Incremental shares from assumed conversions are calculated as the number of shares that would

be issued, net of the number of shares that could be purchased in the marketplace with the cash

71

6 C Cs: 40776