Kraft 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MERRILL CORPORATION SPAPPON// 8-MAR-06 11:23 DISK126:[06CHI5.06CHI1135]BA1135A.;23

mrll.fmt Free: 1270DM/0D Foot: 0D/ 0D VJ J1:1Seq: 1 Clr: 0

DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51

KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: BA1135A.;23

Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250 X 10.750Copy Dim: 40. X 60.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2005

COMMISSION FILE NUMBER 1-16483

KRAFT FOODS INC.

(Exact name of registrant as specified in its charter)

Virginia 52-2284372

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

Three Lakes Drive,

Northfield, Illinois 60093

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 847-646-2000

Securities registered pursuant to Section 12(b) of the Act:

Name of each exchange

Title of each class on which registered

Class A Common Stock, no par value New York Stock Exchange

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes No

Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange

Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated

filer. See definition of ‘‘accelerated filer and large accelerated filer’’ in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer Accelerated filer Non-accelerated filer

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

The aggregate market value of the shares of Class A Common Stock held by non-affiliates of the registrant,

computed by reference to the closing price of such stock on June 30, 2005, was approximately $8 billion. At February 28,

2006, there were 488,625,533 shares of the registrant’s Class A Common Stock outstanding, and 1,180,000,000 shares of

the registrant’s Class B Common Stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for use in connection with its annual meeting of shareholders to

be held on April 25, 2006, filed with the Securities and Exchange Commission (the ‘‘SEC’’) on March 10, 2006, are

incorporated in Part III hereof and made a part hereof.

6 C Cs: 40747

Table of contents

-

Page 1

... (Address of principal executive offices) 60093 (Zip Code) Registrant's telephone number, including area code: 847-646-2000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Common Stock, no par value New York Stock... -

Page 2

... States, Canada, Europe, Latin America, Asia Pacific, the Middle East and Africa. Prior to June 13, 2001, Kraft was a wholly owned subsidiary of Altria Group, Inc. On June 13, 2001, Kraft completed an initial public offering (''IPO'') of 280,000,000 shares of its Class A common stock at a price... -

Page 3

... of beverages, cheese, snacks, convenient meals and various packaged grocery products. The Company manages and reports operating results through two units: Kraft North America Commercial and Kraft International Commercial. Kraft North America Commercial operates in the United States and Canada, and... -

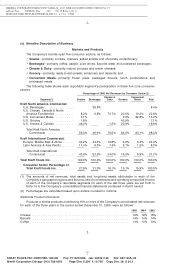

Page 4

...beverages; • Cheese & Dairy-primarily natural, process and cream cheeses; • Grocery-primarily ready-to-eat cereals, enhancers and desserts; and • Convenient Meals-primarily frozen pizza, packaged dinners, lunch combinations and processed meats. The following table shows each reportable segment... -

Page 5

... cheeses; Kraft grated cheeses; Cheez Whiz process cheese sauce; Polly-O cheese; Deluxe process cheese slices; and Knudsen and Breakstone's cottage cheese and sour cream. Kraft peanut butter in Canada; Miracle Whip spoonable dressing in Canada; Post cereal in Canada; and Jell-O products in Canada... -

Page 6

... ready-to-eat cereals; Kraft spoonable and pourable salad dressings; Kraft and ETA peanut butters; and Vegemite yeast spread. Kraft macaroni & cheese dinners; and Oscar Mayer lunch meat, bacon and hot dogs. Beverages: Cheese & Dairy: Grocery: Convenient Meals: Latin America & Asia Pacific Snacks... -

Page 7

... retail food outlets. In general, the retail trade for food products is consolidating. Food products are distributed through distribution centers, satellite warehouses, company-operated and public cold-storage facilities, depots and other facilities. Most distribution in North America is in the form... -

Page 8

...sale of dairy products and imposing their own labeling requirements on food products. Many of the food commodities on which Kraft North America Commercial's United States businesses rely are subject to governmental agricultural programs. These programs have substantial effects on prices and supplies... -

Page 9

... Company's business units are subject to a number of laws and regulations relating to their relationships with their employees. These laws and regulations are specific to the location of each enterprise. In addition, in accordance with European Union requirements, Kraft International Commercial has... -

Page 10

... host countries in which the Company does business. The Company has specific programs across its international business units designed to meet applicable environmental compliance requirements. 9 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DE1135A.;25 Merrill Corporation... -

Page 11

... in Note 14 to the Company's consolidated financial statements contained in Part II hereof. Kraft's subsidiaries export coffee products, refreshment beverages products, grocery products, cheese, biscuits, and processed meats. In 2005, exports from the United States by these subsidiaries amounted to... -

Page 12

... information on the Company's website is not, and shall not be deemed to be, a part of this Report or incorporated into any other filings the Company makes with the SEC. 11 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DE1135A.;25 Merrill Corporation/Chicago (312) 786-6300... -

Page 13

... price increases, and demanding lower pricing, increased promotional programs and specifically tailored products. These customers also may use shelf space currently used for the 12 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DE1135A.;25 Merrill Corporation/Chicago... -

Page 14

...'s subsidiaries conduct their businesses in local currency and, for purposes of financial reporting, their results are translated into U.S. dollars based on average exchange rates 13 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DE1135A.;25 Merrill Corporation/Chicago (312... -

Page 15

...or fully pursued, the negative publicity surrounding such assertions regarding the Company's products or processes could adversely affect its reputation and brand image. 14 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DE1135A.;25 Merrill Corporation/Chicago (312) 786-6300... -

Page 16

... benefit plans and the related net periodic benefit cost. A significant increase in the Company's funding requirements could have a negative impact on its results of operations. 15 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DE1135A.;25 Merrill Corporation/Chicago (312... -

Page 17

... there are 98 facilities located in 44 countries. These manufacturing and processing facilities are located throughout the following territories: Number of Facilities Territory United States ...Canada ...European Union ...Eastern Europe, Middle East and Africa . Latin America ...Asia Pacific... -

Page 18

... 3, 2005. The settlement amount is not material to the Company. Item 4. Submission of Matters to a Vote of Security Holders. None. 17 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DG1135A.;12 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250⯠X 10.750⯠Copy... -

Page 19

... Company's Class A common stock is listed is the New York Stock Exchange. At January 31, 2006, there were approximately 2,900 holders of record of the Company's Class A common stock. 18 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DG1135A.;12 Merrill Corporation/Chicago... -

Page 20

...]UNIVERSAL.BST;51 6 C Cs: 45273 Item 6. Selected Financial Data. KRAFT FOODS INC. Selected Financial Data-Five Year Review (in millions of dollars, except per share data) 2005 2004 2003 2002 2001 Summary of Operations: Net revenues ...Cost of sales ...Operating income ...Interest and other debt... -

Page 21

... capital stock. Kraft North America Commercial's segments are U.S. Beverages; U.S. Cheese, Canada & North America Foodservice; U.S. Convenient Meals; U.S. Grocery; and U.S. Snacks & Cereals. Kraft International Commercial's segments are Europe, Middle East & Africa; and Latin America & Asia Pacific... -

Page 22

... as marketing, administration and research costs on the consolidated statement of earnings. During 2005, the Company's interest in the joint venture was sold. 21 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10 Merrill Corporation/Chicago (312) 786-6300 Page... -

Page 23

... ultimately different from previous estimates, the revisions are included in the Company's consolidated results of operations for 22 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250⯠X 10.750⯠Copy Dim... -

Page 24

...FSP 106-2''). FSP 106-2 requires companies to account for the effect of the subsidy on benefits attributable to past service as an actuarial experience gain and as 23 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10 Merrill Corporation/Chicago (312) 786-6300 Page... -

Page 25

... United States and certain brands in Mexico. A portion of this charge, $17 million, was reclassified to earnings from discontinued operations on the consolidated statement of earnings in the fourth quarter of 2004. 24 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A... -

Page 26

...the consolidated financial statements, Altria Group, Inc.'s subsidiary, Altria Corporate Services, Inc., provides the Company with various services, including planning, legal, treasury, auditing, insurance, human resources, office of the secretary, corporate affairs, information technology, aviation... -

Page 27

... the audits close. Consolidation. The consolidated financial statements include Kraft Foods Inc., as well as its wholly-owned and majority-owned subsidiaries. Investments in which Kraft Foods Inc. exercises significant influence (20%-50% ownership interest), are accounted for under the equity method... -

Page 28

...of discount retailers, primarily in Europe, with an emphasis on own-label products; • changing consumer preferences, including diet trends; • competitors with different profit objectives and less susceptibility to currency exchange rates; and • concerns and/or regulations regarding food safety... -

Page 29

... a material impact on the Company's consolidated financial position, results of operations or cash flows, and future sales of businesses could in some cases result in losses on sale. As previously discussed, the Company sold substantially all of its sugar confectionery business in June 2005 for pre... -

Page 30

... confectionery business, in the aggregate, were not material to the Company's consolidated financial position, results of operations or cash flows in any of the periods presented. 29 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DI1135A.;10 Merrill Corporation/Chicago (312... -

Page 31

..., Canada & North America Foodservice U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Total Kraft North America Commercial ...Europe, Middle East & Africa ...Latin America & Asia Pacific ...Total Kraft International Commercial Net revenues ... Operating income: Operating companies... -

Page 32

... Costs Costs (in millions) Total U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice ...U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Europe, Middle East & Africa ...Latin America & Asia Pacific ...Total-Continuing Operations ... $ 9 33 12 6 6 127 17 $ - 113 93... -

Page 33

... Foodservice . U.S. Grocery ...Europe, Middle East & Africa ...Latin America & Asia Pacific ... ... ... ... ... ... ... ... ... ... ... ... ... ... $ (1) 2 (113) 4 $- (5) 8 $3 $ - (31) $(31) (Gains) losses on sales of businesses ... $(108) As discussed in Note 14 to the consolidated financial... -

Page 34

... net revenues by $838 million and operating income by $98 million. These increases were due primarily to the weakness of the U.S. dollar against the euro and the Canadian dollar. 33 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DK1135A.;21 Merrill Corporation/Chicago... -

Page 35

... Operating Results by Reportable Segment Kraft North America Commercial For the Years Ended December 31, 2005 2004 2003 (in millions) Volume (in pounds): U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Net revenues... -

Page 36

...spending and lower volume. Cheese net revenues also increased, reflecting commodity-driven pricing from 2004, partially offset by increased promotional spending and 35 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DK1135A.;21 Merrill Corporation/Chicago (312) 786-6300 Page... -

Page 37

... points of growth), as gains in biscuits and cereals were partially offset by a decline in salted snacks. In biscuits, volume increased due primarily to new product introductions in 36 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DK1135A.;21 Merrill Corporation/Chicago... -

Page 38

... the benefit of the 53rd week) and higher pricing, net of increased promotional spending ($39 million, reflecting commodity-driven pricing in snack nuts and cereals). Biscuits net revenues increased, driven by new product introductions and improved mix. Cereals net revenues also increased, due... -

Page 39

... spoonable salad dressings. Desserts net revenues increased due primarily to lower promotional spending for new product introductions and favorable mix from sugar-free desserts. 38 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DK1135A.;21 Merrill Corporation/Chicago (312... -

Page 40

... program ($18 million), partially offset by lower fixed manufacturing costs ($40 million). Kraft International Commercial For the Years Ended December 31, 2005 2004 2003 (in millions) Volume (in pounds): Europe, Middle East & Africa ...Latin America & Asia Pacific ...Volume (in pounds) ...Net... -

Page 41

...also declined, impacted by increased biscuit competition in China and resizing of biscuit products in Latin America, partially offset by higher shipments in Venezuela. In 40 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DK1135A.;21 Merrill Corporation/Chicago (312) 786-6300... -

Page 42

... compares Kraft International Commercial's operating results for 2004 with 2003. Volume decreased 1.1%, due primarily to the impact of the divestiture of a rice business and a branded fresh cheese business in Europe in 2003, as well as price competition and trade inventory reductions in several... -

Page 43

... The following discusses operating results within each of Kraft International Commercial's reportable segments. Europe, Middle East & Africa. Volume decreased 1.3%, due primarily to the divestiture of a rice business and a branded fresh cheese business in Europe in 2003, price competition in France... -

Page 44

... in 2004 was due primarily to an increase in the Company's Class A share repurchases and dividend payments. In November 2004, the Company issued 43 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DM1135A.;12 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250⯠X 10... -

Page 45

..., any credit rating triggers or any provisions that could require the posting of collateral. The Company expects to refinance long-term and short-term debt from time to time. The 44 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DM1135A.;12 Merrill Corporation/Chicago (312... -

Page 46

...Purchase obligations for inventory and production costs (such as raw materials, indirect materials and supplies, packaging, co-manufacturing arrangements, storage and distribution) are 45 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DM1135A.;12 Merrill Corporation/Chicago... -

Page 47

...have a material impact on its consolidated financial position, results of operations or cash flows. At December 31, 2005, the number of shares to be issued upon 46 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DM1135A.;12 Merrill Corporation/Chicago (312) 786-6300 Page Dim... -

Page 48

... losses on commodity futures and option contracts is deferred as a component of accumulated other comprehensive earnings (losses) and is recognized as a component of cost of sales in the Company's consolidated statement of earnings when the related inventory is sold. 47 KRAFT FOODS-FSC CERTIFIED... -

Page 49

... derivative financial instruments. The VAR computation includes the Company's debt; short-term investments; foreign currency forwards, swaps and options; and commodity futures, forwards and options. Anticipated transactions, foreign currency trade payables and receivables, and net investments in... -

Page 50

... management's assessment of the effectiveness of the Company's internal control over financial reporting as of December 31, 2005. February 7, 2006 49 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DP1135A.;7 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250⯠X 10... -

Page 51

... consolidated balance sheets and the related consolidated statements of earnings, shareholders' equity, and cash flows, present fairly, in all material respects, the financial position of Kraft Foods Inc. and its subsidiaries at December 31, 2005 and 2004, and the results of their operations... -

Page 52

... of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. /s/ PRICEWATERHOUSECOOPERS LLP Chicago, Illinois February 7, 2006 51 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DP1135A.;7 Merrill Corporation/Chicago (312... -

Page 53

... AND SHAREHOLDERS' EQUITY ... 23,835 9,453 (1,663) 31,625 (2,032) 29,593 $57,628 23,762 8,304 (1,205) 30,861 (950) 29,911 $59,928 See notes to consolidated financial statements. 52 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DQ1135A.;7 Merrill Corporation/Chicago (312... -

Page 54

... ...Net earnings ... $ $ $ $ 1.72 $ (0.16) 1.56 $ 1.56 1.56 1.55 1.55 $ $ $ $ 1.95 0.06 2.01 1.95 0.06 2.01 1.72 $ (0.17) 1.55 $ See notes to consolidated financial statements. 53 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DR1135A.;7 Merrill Corporation/Chicago... -

Page 55

... . Change in fair value of derivatives accounted for as hedges ...Total other comprehensive earnings ...Total comprehensive earnings ...Exercise of stock options and issuance of other stock awards ...Cash dividends declared ($0.66 per share) . . Class A common stock repurchased ...Balances, December... -

Page 56

...-term debt repaid ...Repayment of notes payable to Altria Group, Inc. and affiliates ...Increase (decrease) in amounts due to Altria Group, Inc. and affiliates Repurchase of Class A common stock ...Dividends paid ...Other ...Net cash used in financing activities ...Effect of exchange rate changes on... -

Page 57

..., Canada, Europe, Latin America, Asia Pacific and Middle East and Africa. Prior to June 13, 2001, the Company was a wholly-owned subsidiary of Altria Group, Inc. On June 13, 2001, the Company completed an initial public offering (''IPO'') of 280,000,000 shares of its Class A common stock at a price... -

Page 58

...At December 31, 2005 and 2004, goodwill by reportable segment was as follows (in millions): 2005 2004 U.S. Beverages ...U.S. Cheese, Canada & North U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Europe, Middle East & Africa . Latin America & Asia Pacific . ...America Foodservice... -

Page 59

...period, whereas balance sheet accounts are translated using exchange rates at the end of each period. Currency translation adjustments are recorded as a component of shareholders' 58 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17 Merrill Corporation/Chicago (312... -

Page 60

... facts and circumstances. The consolidated tax provision includes the impact of changes to accruals that are considered appropriate. Upon the closure of current 59 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17 Merrill Corporation/Chicago (312) 786-6300 Page... -

Page 61

.... No compensation expense for employee stock options is reflected in net earnings, as all stock options granted under those plans had an exercise price equal to the market value of the common stock on the date of grant. Net 60 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File... -

Page 62

..., except per share data): 2005 2004 2003 Net earnings, as reported ...Deduct: Total stock-based employee compensation expense determined under fair value method for all stock option awards, net of related tax effects Pro forma net earnings ...Earnings per share: Basic-as reported ...Basic-pro... -

Page 63

... sales ...Marketing, administration and research costs ...Total-continuing operations ...Discontinued operations ...Total implementation costs ... $ 2 56 29 87 $87 $ 7 30 13 50 8 $58 62 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17 Merrill Corporation/Chicago... -

Page 64

... transaction, the Company recorded asset impairments totaling $8 million. This charge was recorded as asset impairment and exit costs on the consolidated statement of earnings. 63 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DU1135A.;17 Merrill Corporation/Chicago (312... -

Page 65

... Costs Costs (in millions) Total U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice ...U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Europe, Middle East & Africa ...Latin America & Asia Pacific ...Total-Continuing Operations ... $ 9 33 12 6 6 127 17 $ - 113 93... -

Page 66

... certain foreign earnings as part of Altria Group, Inc.'s dividend repatriation plan under provisions of the American Jobs Creation Act. Increased taxes for this repatriation of $21 million, were reimbursed by Altria Group, Inc. The reimbursement was reported in the Company's financial statements as... -

Page 67

...in the aggregate, were not material to the Company's consolidated financial position, results of operations or cash flows in any of the periods presented. 66 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DW1135A.;8 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250... -

Page 68

... acquired a biscuits business in Egypt, trademarks associated with a small U.S.-based natural foods business and other smaller acquisitions for a total cost of $98 million. The effects of these acquisitions were not material to the Company's consolidated financial position, results of operations... -

Page 69

...million shares of preferred stock. Shares of Class A common stock issued, repurchased and outstanding were as follows: Shares Issued Shares Repurchased Shares Outstanding Balance at January 1, 2003 ...Repurchase of shares ...Exercise of stock options and issuance of other stock awards ...Balance at... -

Page 70

... of SFAS No. 123R will not have a material impact on its consolidated financial position, results of operations or cash flows. 69 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DY1135A.;6 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250⯠X 10.750⯠Copy Dim: 38... -

Page 71

... did not result in compensation cost for stock options. The Company's employees held options to purchase the following number of shares of Altria Group, Inc. stock at December 31, 2005: Options Outstanding Average Weighted Remaining Average Number Contractual Exercise Outstanding Life Price Options... -

Page 72

...: 3 Clr: 0 DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51 6 C Cs: 40776 Had compensation cost for stock option awards under the Kraft plans and Altria Group, Inc. plans been determined by using the fair value at the grant date, the Company's net earnings and basic and diluted EPS would have been $2,625... -

Page 73

... the earnings and resulted in a net tax reduction of $28 million in the consolidated income tax provision during 2005, the majority of which was recorded during the second quarter. 72 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DY1135A.;6 Merrill Corporation/Chicago (312... -

Page 74

...previously reported amounts to reflect state deferred tax amounts that were previously included in other liabilities on the consolidated balance sheet. As a result, deferred income 73 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: DY1135A.;6 Merrill Corporation/Chicago (312... -

Page 75

...; U.S. Convenient Meals; U.S. Grocery; and U.S. Snacks & Cereals. Kraft International Commercial's operations are organized and managed by geographic location. Kraft International Commercial's segments are Europe, Middle East & Africa; and Latin America & Asia Pacific. In October 2005, the Company... -

Page 76

... interest: Operating companies income: U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice ...U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Europe, Middle East & Africa ...Latin America & Asia Pacific ...Amortization of intangibles ...General corporate expenses... -

Page 77

... yogurt assets, a small business in Colombia, a minor trademark in Mexico and a small equity investment in Turkey for aggregate pre-tax gains of $108 million. During 76 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8 Merrill Corporation/Chicago (312) 786-6300 Page... -

Page 78

... expense from continuing operations: U.S. Beverages ...U.S. Cheese, Canada & North America Foodservice U.S. Convenient Meals ...U.S. Grocery ...U.S. Snacks & Cereals ...Europe, Middle East & Africa ...Latin America & Asia Pacific ... ... ... ... ... ... ... ... ... ... ... ... ... ... $ 60 166 98... -

Page 79

..., through separate plans, many of which are governed by local statutory requirements. In addition, the Company's U.S. and Canadian subsidiaries provide health care and other benefits to substantially all retired employees. Health care benefits for retirees outside the United States and Canada are... -

Page 80

... Plans Non-U.S. Plans 2005 2004 2005 2004 (in millions) Decrease (increase) in minimum liability included in other comprehensive earnings (losses), net of tax ... $- $14 $(48) $(36) 79 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8 Merrill Corporation/Chicago... -

Page 81

...respectively. Non-U.S. plant closures and early retirement benefits resulted in curtailment and settlement losses of $25 million and $7 million in 2005 and 2004, respectively. 80 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8 Merrill Corporation/Chicago (312) 786... -

Page 82

... and other benefit laws, as well as asset performance significantly above or below the assumed long-term rate of return on pension assets, or significant changes in interest rates. 81 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8 Merrill Corporation/Chicago (312... -

Page 83

... obligation for the subsidy related to benefits attributed to past service by $315 million and decreased its unrecognized actuarial losses by the same amount. 82 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8 Merrill Corporation/Chicago (312) 786-6300 Page Dim... -

Page 84

...-Percentage-Point Increase One-Percentage-Point Decrease Effect on total of service and interest cost ...Effect on postretirement benefit obligation ... 14.7% 10.6 (11.9)% (8.8) 83 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8 Merrill Corporation/Chicago (312... -

Page 85

... costs arising from actions that offer employees benefits in excess of those specified in the respective plans are charged to expense when incurred. 84 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EA1135A.;8 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250... -

Page 86

... all of the Company's derivative financial instruments are effective as hedges. The primary currencies to which the Company is exposed, based on the size and location of its 85 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EC1135A.;7 Merrill Corporation/Chicago (312) 786... -

Page 87

... losses on commodity futures and option contracts is deferred as a component of accumulated other comprehensive earnings (losses) and is recognized as a component of cost of sales in the Company's consolidated statement of earnings when the related inventory is sold. Ineffectiveness related to cash... -

Page 88

... on its consolidated balance sheet at December 31, 2005, relating to these guarantees. Note 19. Quarterly Financial Data (Unaudited): 2005 Quarters First Second Third Fourth (in millions, except per share data) Net revenues ...Gross profit ...Earnings from continuing operations ...Earnings (loss... -

Page 89

... Fourth Asset impairment and exit costs ...Losses (gains) on sales of businesses ... $291 $291 $129 $129 $44 8 $52 $139 (5) $134 88 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EE1135A.;14 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250⯠X 10.750⯠Copy... -

Page 90

..., the Company's internal control over financial reporting. See also ''Report of Management on Internal Control over Financial Reporting'' in Item 8. Item 9B. Other Information. None. 89 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EE1135A.;14 Merrill Corporation/Chicago... -

Page 91

..., Kraft Canada Senior Vice President, Business Process Simplification, and Corporate Controller Group Vice President and President, Eastern Europe, Middle East and Africa Region Executive Vice President and Chief Financial Officer Senior Vice President, Sales, North America Commercial Group Vice... -

Page 92

...43 53 55 Executive Vice President, Global Technology and Quality Group Vice President and President, U.S. Grocery Sector Senior Vice President, Sales, International Commercial Executive Vice President, Global Supply Chain All of the above-named officers have been employed by the Company in various... -

Page 93

... Average Exercise Price of Outstanding Options Equity compensation plans approved by stockholders ...Item 13. 19,924,651 $31.00 150,318,577 Certain Relationships and Related Transactions. See Item 11. Item 14. Principal Accounting Fees and Services. See Item 11. 92 KRAFT FOODS-FSC CERTIFIED... -

Page 94

... First Amendment adding Supplement A)(6) 10.9 Kraft Foods Inc. Supplemental Benefits Plan II(6) 10.10 Form of Employee Grantor Trust Enrollment Agreement(8)(12) 93 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EN1135A.;13 Merrill Corporation/Chicago (312) 786-6300 Page Dim... -

Page 95

... Performance Incentive Plan(11)(12) 2001 Kraft Foods Inc. Compensation Plan for Non-Employee Directors (Deferred Compensation)(13) Description of Agreement with Roger K. Deromedi(14) Pre-Owned Aircraft Purchase and Sales Agreements, between Altria Corporate Services, Inc. and Kraft Foods Aviation... -

Page 96

... by reference to the Registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on December 19, 2005 (SEC File No. 1-16483). 95 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: EN1135A.;13 Merrill Corporation/Chicago (312) 786-6300 Page Dim... -

Page 97

...the undersigned, thereunto duly authorized. KRAFT FOODS INC. By: /s/ JAMES P. DOLLIVE (James P . Dollive, Executive Vice President and Chief Financial Officer) Date: March 10, 2006 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 98

....fmt Free: 4130DM/0D Foot: 0D/ 0D VJ RSeq: 1 Clr: 0 DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51 6 C Cs: 41116 REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON FINANCIAL STATEMENT SCHEDULE To the Board of Directors and Shareholders of Kraft Foods Inc.: Our audits of the consolidated financial... -

Page 99

... to divestitures, acquisitions and currency translation. (b) Represents charges for which allowances were created. S-2 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: JK1135A.;3 Merrill Corporation/Chicago (312) 786-6300 Page Dim: 8.250⯠X 10.750⯠Copy Dim: 38. X 54... -

Page 100

....06CHI1135]JM1135A.;5 mrll.fmt Free: 5570DM/0D Foot: 0D/ 0D VJ J1:1Seq: 1 Clr: 0 DISK024:[PAGER.PSTYLES]UNIVERSAL.BST;51 6 C Cs: 29596 Cert no. SW-COC-1798 9MAR200611070927 KRAFT FOODS-FSC CERTIFIED-10K/AR Proj: P1102CHI06 Job: 06CHI1135 File: JM1135A.;5 Merrill Corporation/Chicago (312) 786-6300...