IHOP 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

78

6. Goodwill

The significant majority of the Company's goodwill and other intangible assets arose from the November 29, 2007 acquisition

of Applebee's. As of December 31, 2012 and 2011, the balance of goodwill was $697.5 million, of which $686.7 million has been

allocated to the Applebee's franchise reporting unit and $10.8 million to the IHOP franchise reporting unit.

In accordance with U.S. GAAP, goodwill must be evaluated for impairment, at a minimum, on an annual basis, and more

frequently if the Company believes indicators of impairment exist. Such indicators include, but are not limited to, events or

circumstances such as a significant adverse change in the business climate, unanticipated competition, a loss of key personnel,

adverse legal or regulatory developments, or a significant decline in the market price of the Company's common stock. In the

process of the Company's annual impairment review, the Company primarily uses the income approach method of valuation that

utilizes a discounted cash flow model to estimate the fair value of its reporting units. Significant assumptions used to determine

fair value under the discounted cash flows model include future trends in sales, operating expenses, overhead expenses, depreciation,

capital expenditures, and changes in working capital, along with an appropriate discount rate.

During the fiscal years ended 2012 and 2011, the Company made periodic assessments as to whether there were indicators

of impairment, particularly with respect to the significant assumptions underlying the discounted cash flow model, and determined

an interim test of goodwill was not warranted. Accordingly, the Company performed a quantitative test of goodwill impairment

in the fourth quarter of 2012 and 2011. In the first step of each year's impairment test, the estimated fair value of both the IHOP

and Applebee's franchising units exceeded their respective carrying values and the Company concluded there was no impairment

of goodwill.

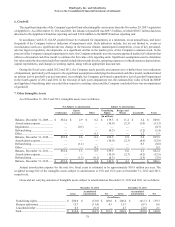

7. Other Intangible Assets

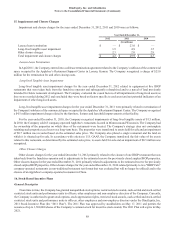

As of December 31, 2012 and 2011, intangible assets were as follows:

Not Subject to Amortization Subject to Amortization

Tradename Liquor

Licenses Other Franchising

Rights Recipes and

Menus Leaseholds Total

(In millions)

Balance, December 31, 2009...... $ 652.4 $ 2.9 $ 0.2 $ 179.5 $ 11.2 $ 3.4 $ 849.6

Amortization expense................. — — — (10.0) (2.3) (1.0) (13.3)

Impairment.................................. — (0.3) — — — — (0.3)

Refranchising.............................. — — — (0.2) — (1.2) (1.4)

Other ........................................... — — 0.1 — — 1.2 1.3

Balance, December 31, 2010...... 652.4 2.6 0.3 169.3 8.9 2.4 835.9

Amortization expense................. — — — (10.0) (2.3) (0.6) (12.9)

Refranchising.............................. — (1.1) — — — 0.3 (0.8)

Other ........................................... — — 0.2 — — — 0.2

Balance, December 31, 2011...... 652.4 1.5 0.5 159.3 6.6 2.1 822.4

Amortization expense................. — — — (10.0) (2.3) (0.2) (12.5)

Refranchising.............................. — (1.5) (0.1) (0.3) — (1.9) (3.8)

Balance, December 31, 2012...... $ 652.4 $ — $ 0.4 $ 149.0 $ 4.3 $ — $ 806.1

Annual amortization expense for the next five fiscal years is estimated to be approximately $10.9 million per year. The

weighted average life of the intangible assets subject to amortization is 19.0 and 18.8 years at December 31, 2012 and 2011,

respectively.

Gross and net carrying amounts of intangible assets subject to amortization at December 31, 2012 and 2011 are as follows:

December 31, 2012 December 31, 2011

Gross Accumulated

Amortization Net Gross Accumulated

Amortization Net

(In millions)

Franchising rights........................................ $ 200.0 $ (51.0) $ 149.0 $ 200.4 $ (41.1) $ 159.3

Recipes and menus...................................... 15.7 (11.4) 4.3 15.7 (9.1) 6.6

Leaseholds/other ......................................... 0.3 (0.3) — 4.7 (2.6) 2.1

Total.............................................................. $ 216.0 $ (62.7) $ 153.3 $ 220.8 $ (52.8) $ 168.0