IHOP 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

77

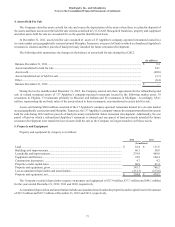

4. Assets Held For Sale

The Company classifies assets as held for sale and ceases the depreciation of the assets when there is a plan for disposal of

the assets and those assets meet the held for sale criteria as defined in U.S. GAAP. Reacquired franchises, property and equipment

and other assets held for sale are accounted for on the specific identification basis.

At December 31, 2011, assets held for sale consisted of assets of 17 Applebee's company-operated restaurants located in a

six-state market area geographically centered around Memphis, Tennessee, one parcel of land on which a refranchised Applebee's

restaurant is situated and three parcels of land previously intended for future restaurant development.

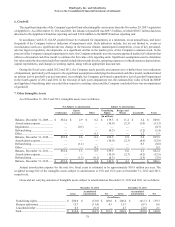

The following table summarizes the changes in the balance of assets held for sale during fiscal 2012:

(In millions)

Balance December 31, 2011................................................................................................................................... $ 9.4

Assets transferred to held for sale .......................................................................................................................... 54.1

Assets sold.............................................................................................................................................................. (60.0)

Assets transferred out of held for sale.................................................................................................................... (3.1)

Other....................................................................................................................................................................... (0.4)

Balance December 31, 2012................................................................................................................................... $ —

During the twelve months ended December 31, 2012, the Company entered into three agreements for the refranchising and

sale of related restaurant assets of 137 Applebee's company-operated restaurants located in the following market areas: 39

restaurants in Virginia, 33 restaurants primarily in Missouri and Indiana and 65 restaurants in Michigan. Accordingly, $54.1

million, representing the net book value of the assets related to these restaurants, was transferred to assets held for sale.

Assets sold totaling $60.0 million consisted of the 17 Applebee's company-operated restaurants located in a six-state market

area geographically centered around Memphis, Tennessee, the 137 Applebee's company-operated restaurants transferred into assets

held for sale during 2012 and two parcels of land previously intended for future restaurant development. Additionally, the one

parcel of land on which a refranchised Applebee's restaurant is situated and one parcel of land previously intended for future

restaurant development were transferred out of assets held for sale as the Company no longer intends to sell those assets.

5. Property and Equipment

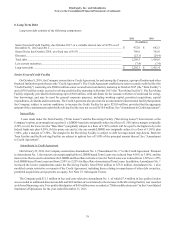

Property and equipment by category is as follows:

2012 2011

(In millions)

Land............................................................................................................................................ $ 65.4 $ 111.6

Buildings and improvements...................................................................................................... 60.1 58.8

Leaseholds and improvements.................................................................................................... 279.8 409.8

Equipment and fixtures............................................................................................................... 74.9 100.4

Construction in progress............................................................................................................. 4.7 4.2

Properties under capital lease ..................................................................................................... 60.8 61.4

Property and equipment, gross ................................................................................................... 545.7 746.2

Less accumulated depreciation and amortization....................................................................... (251.3) (272.0)

Property and equipment, net....................................................................................................... $ 294.4 $ 474.2

The Company recorded depreciation expense on property and equipment of $27.9 million, $37.7 million and $48.1 million

for the years ended December 31, 2012, 2011 and 2010, respectively.

Accumulated depreciation and amortization includes accumulated amortization for properties under capital lease in the amount

of $32.5 million and $29.7 million at December 31, 2012 and 2011, respectively.