IHOP 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

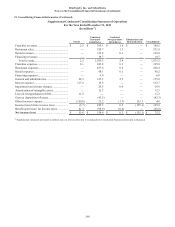

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

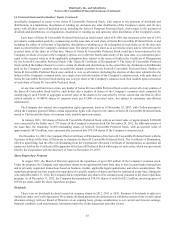

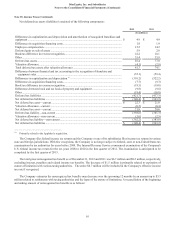

Note 18. Income Taxes (Continued)

94

(In millions)

Unrecognized tax benefit as of December 31, 2010 .............................................................................................. $ 12.8

Change as a result of prior year tax positions ........................................................................................................ (3.3)

Decreases relating to settlements with taxing authorities ...................................................................................... (0.8)

Decreases as a result of a lapse of the statute of limitations .................................................................................. (0.5)

Unrecognized tax benefit as of December 31, 2011............................................................................................... 8.2

Change as a result of prior year tax positions ........................................................................................................ 0.8

Change as a result of current year tax positions..................................................................................................... 0.2

Decreases relating to settlements with taxing authorities ...................................................................................... (0.9)

Decreases as a result of a lapse of the statute of limitations .................................................................................. (1.6)

Unrecognized tax benefit as of December 31, 2012 .............................................................................................. $ 6.7

As of December 31, 2012, the accrued interest and penalties were $1.4 million and $0.2 million, respectively, excluding any

related income tax benefits. As of December 31, 2011, the accrued interest and penalties were $3.0 million and $0.3 million,

respectively, excluding any related income tax benefits. The decrease of $1.6 million of accrued interest is primarily related to the

decrease of unrecognized tax benefits due to settlements with taxing authorities, partially offset by the accrual of interest during

the twelve months ended December 31, 2012. The Company recognizes interest accrued related to unrecognized tax benefits and

penalties as a component of income tax expense which is recognized in the Consolidated Statements of Operations.

The Company has various state net operating loss carryovers representing $5.0 million of state taxes. The net operating loss

carryovers will expire, if unused, during the period from 2013 through 2031.

For the years ended December 31, 2012 and 2011, the Company had a total valuation allowance in the amounts of $4.1 million

and $2.9 million, respectively. The entire $4.1 million in 2012 is related to various state net operating loss carryovers for DineEquity,

Inc. and International House of Pancakes, LLC and Subsidiaries.

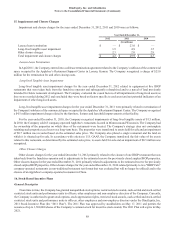

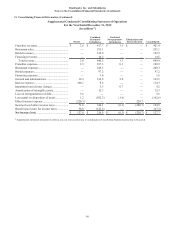

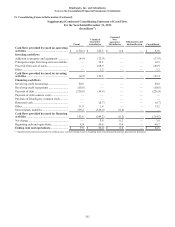

19. Net Income (Loss) Per Share

The computation of the Company's basic and diluted net income (loss) per share is as follows:

Year Ended December 31,

2012 2011 2010

(In thousands, except per share data)

Numerator for basic and diluted income (loss) per common share:

Net income (loss) $ 127,674 $ 75,192 $ (2,788)

Less: Series A preferred stock dividends — — (25,927)

Less: Accretion of Series B preferred stock (2,498) (2,573) (2,432)

Less: Net (income) loss allocated to unvested participating restricted

stock (2,718)(1,886) 1,173

Net income (loss) available to common stockholders - basic 122,458 70,733 (29,974)

Effect of unvested participating restricted stock 127 34 —

Effect of dilutive securities:

Convertible Series B preferred stock 2,498 — —

Numerator - net income available to common shareholders - diluted $ 125,083 $ 70,767 $ (29,974)

Denominator:

Weighted average outstanding shares of common stock - basic 17,992 17,846 17,240

Effect of dilutive securities:

Stock options 264 339 —

Convertible Series B preferred stock 621 — —

Weighted average outstanding shares of common stock - diluted 18,877 18,185 17,240

Net income (loss) per common share:

Basic $ 6.81 $ 3.96 $ (1.74)

Diluted $ 6.63 $ 3.89 $ (1.74)

For the years ended December 31, 2011 and 2010, diluted loss per common share is computed using the basic weighted

average number of common shares outstanding during the period, as the 643,000 and 992,600 shares, respectively, from common

stock equivalents would have been antidilutive.