IHOP 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Debt Covenants

Pursuant to the Credit Agreement, we are required to comply with a maximum consolidated leverage ratio and a minimum

consolidated cash interest coverage ratio. The Company's current required maximum consolidated leverage ratio of total debt (net

of unrestricted cash not to exceed $75 million) to adjusted EBITDA is 7.25:1. Our current required minimum ratio of adjusted

EBITDA to consolidated cash interest is 1.5:1. Compliance with each of these ratios is required quarterly, on a trailing four-quarter

basis. These ratio thresholds become more rigorous over time. The maximum consolidated leverage ratio, originally 7.5:1, will

decline, in annual 25-basis-point decrements beginning with the first quarter of 2012, to 6.5:1 by the first quarter of 2015, then to

6.0:1 for the first quarter of 2016 until the Credit Agreement expires in October 2017. The minimum consolidated cash interest

coverage ratio will increase to 1.75:1 commencing in the first quarter of 2013 and to 2.0:1 commencing in the first quarter of 2016

and remain at that level until the Credit agreement expires in October 2017.

For the trailing twelve months ended December 31, 2012, our consolidated leverage ratio was 4.6:1 and our consolidated cash

interest coverage ratio was 2.5:1.

There are no financial maintenance covenants associated with the Senior Notes.

The Senior Notes, the Term Facility and the Revolving Facility are also subject to affirmative and negative covenants considered

customary for similar types of facilities, including, but not limited to, covenants with respect to incremental indebtedness, liens,

investments, affiliate transactions, and capital expenditures. These covenants are subject to a number of important limitations,

qualifications and exceptions. Certain of these covenants will not be applicable to the Senior Notes during any time that the Senior

Notes maintain investment grade ratings.

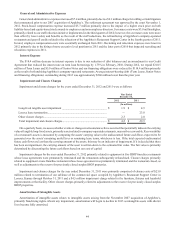

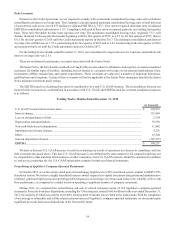

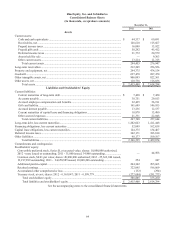

The EBITDA used in calculating these ratios is considered to be a non-U.S. GAAP measure. The reconciliation between our

income before income taxes, as determined in accordance with U.S. GAAP, and EBITDA used for covenant compliance purposes

is as follows:

Trailing Twelve Months Ended December 31, 2012

(in thousands)

U.S. GAAP income before income taxes............................................................................................................... $ 194,923

Interest charges....................................................................................................................................................... 131,869

Loss on extinguishment of debt ............................................................................................................................. 5,554

Depreciation and amortization ............................................................................................................................... 39,538

Non-cash stock-based compensation ..................................................................................................................... 11,442

Impairment and closure charges............................................................................................................................. 4,218

Other....................................................................................................................................................................... 15,304

Gain on disposition of assets.................................................................................................................................. (102,597)

EBITDA................................................................................................................................................................. $ 300,251

We believe this non-U.S. GAAP measure is useful in evaluating our results of operations in reference to compliance with the

debt covenants discussed above. This non-U.S. GAAP measure is not defined in the same manner by all companies and may not

be comparable to other similarly titled measures of other companies. Non-U.S. GAAP measures should be considered in addition

to, and not as a substitute for, the U.S. GAAP information contained within our financial statements.

Franchising of Applebee's Company-Operated Restaurants

In October 2012, we achieved our stated goal of transitioning Applebee's to a 99% franchised system, similar to IHOP's 99%

franchised system. We believe a highly franchised business model requires less capital investment and general and administrative

overhead, generates higher gross and operating profit margins (as a percentage of revenue) and reduces the volatility of free cash

flow performance, as compared to a model based on operating a significant number of company restaurants.

During 2012, we completed the refranchising and sale of related restaurant assets of 154 Applebee's company-operated

restaurants. Proceeds from asset dispositions, including the 154 restaurants, totaled $168.9 million for the year ended December 31,

2012, the majority of which was used to retire debt, after payment of income taxes related to the transactions. With the completion

of our strategy to refranchise and sell the related restaurant assets of Applebee's company-operated restaurants, we do not anticipate

significant proceeds from asset dispositions in the foreseeable future.