IHOP 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

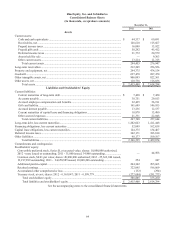

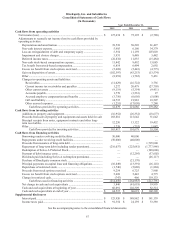

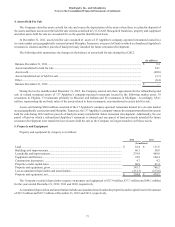

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

Year Ended December 31,

2012 2011 2010

Cash flows from operating activities

Net income (loss) ........................................................................................ $ 127,674 $ 75,192 $ (2,788)

Adjustments to reconcile net income (loss) to cash flows provided by

operating activities:

Depreciation and amortization ............................................................... 39,538 50,220 61,427

Non-cash interest expense...................................................................... 5,985 6,160 34,379

Loss on extinguishment of debt and temporary equity .......................... 5,554 11,159 107,003

Impairment and closure charges............................................................. 3,931 8,448 3,482

Deferred income taxes............................................................................ (22,832) 11,835 (15,484)

Non-cash stock-based compensation expense........................................ 11,442 9,492 13,085

Tax benefit from stock-based compensation.......................................... 6,814 6,494 2,692

Excess tax benefit from stock options exercised.................................... (5,669) (5,443) (4,775)

Gain on disposition of assets.................................................................. (102,597) (43,253) (13,574)

Other....................................................................................................... (8,991) (1,765) 5,431

Changes in operating assets and liabilities:

Receivables........................................................................................ (11,629) (16,722) 3,736

Current income tax receivables and payables ................................... 1,272 20,479 (27,703)

Other current assets ........................................................................... (9,119) (5,354) (9,411)

Accounts payable............................................................................... 1,778 (3,533) 27

Accrued employee compensation and benefits ................................. (3,756) (6,656) (5,000)

Gift card liability ............................................................................... 14,735 21,983 19,507

Other accrued expenses..................................................................... (1,251) (17,050) 7,248

Cash flows provided by operating activities................................. 52,879 121,686 179,282

Cash flows from investing activities

Additions to property and equipment..................................................... (16,952) (26,332) (18,677)

Proceeds from sale of property and equipment and assets held for sale 168,881 115,642 51,642

Principal receipts from notes, equipment contracts and other long-

term receivables...................................................................................... 12,250 13,122 19,452

Other....................................................................................................... 1,238 (753) 1,087

Cash flows provided by investing activities................................. 165,417 101,679 53,504

Cash flows from financing activities

Borrowings under revolving credit facilities.......................................... 50,000 40,000 —

Repayments under revolving credit facilities......................................... (50,000) (40,000) —

Proceeds from issuance of long-term debt............................................. — — 1,725,000

Repayment of long-term debt (including tender premiums).................. (216,037) (225,681) (1,777,946)

Redemption of Series A Preferred Stock................................................ — — (190,000)

Payment of debt issuance costs.............................................................. — (12,295) (57,602)

Dividends paid (including Series A redemption premiums).................. — — (26,117)

Purchase of DineEquity common stock ................................................. — (21,170) —

Principal payments on capital lease and financing obligations.............. (10,849) (13,391) (16,118)

Repurchase of restricted stock................................................................ (1,740) (5,080) (1,884)

Proceeds from stock options exercised .................................................. 9,254 6,725 7,968

Excess tax benefit from stock options exercised.................................... 5,669 5,443 4,775

Change in restricted cash........................................................................ (747) 466 119,133

Cash flows used in financing activities ........................................ (214,450) (264,983) (212,791)

Net change in cash and cash equivalents ............................................... 3,846 (41,618) 19,995

Cash and cash equivalents at beginning of year..................................... 60,691 102,309 82,314

Cash and cash equivalents at end of year............................................... $ 64,537 $ 60,691 $ 102,309

Supplemental disclosures

Interest paid............................................................................................ $ 123,926 $ 148,982 $ 141,139

Income taxes paid................................................................................... $ 91,354 $ 24,139 $ 33,389

See the accompanying notes to the consolidated financial statements.