IHOP 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

16. Stock-Based Incentive Plans (Continued)

90

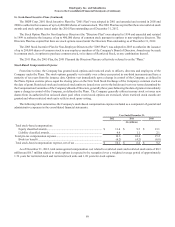

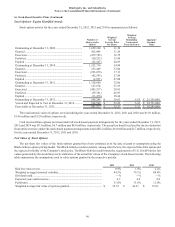

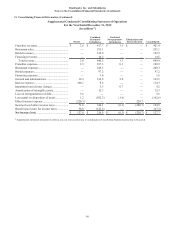

Stock Options - Equity Classified Awards

Stock option activity for the years ended December 31, 2012, 2011 and 2010 is summarized as follows:

Number of

Shares under

Option

Weighted

Average

Exercise Price

Per Share

Weighted

Average

Remaining

Contractual

Term (in Years)

Aggregate

Intrinsic

Value

Outstanding at December 31, 2009 ..................................... 1,659,100 $ 21.30

Granted ................................................................................ 415,804 31.26

Exercised ............................................................................. (475,705) 16.75

Forfeited .............................................................................. (50,222) 25.84

Expired ................................................................................ (25,267) 44.93

Outstanding at December 31, 2010 ..................................... 1,523,710 24.90

Granted ................................................................................ 233,449 53.04

Exercised ............................................................................. (393,075) 17.11

Forfeited .............................................................................. (42,593) 27.89

Expired ................................................................................ (2,851) 47.08

Outstanding at December 31, 2011 ..................................... 1,318,640 32.06

Granted ................................................................................ 147,674 51.63

Exercised ............................................................................. (455,217) 20.91

Forfeited .............................................................................. (39,381) 46.97

Expired ................................................................................ (13,470) 38.64

Outstanding at December 31, 2012 ..................................... 958,246 $ 39.67 6.55 $ 25,355,000

Vested and Expected to Vest at December 31, 2012............ 924,500 $ 39.29 6.47 $ 24,791,000

Exercisable at December 31, 2012...................................... 601,522 $ 35.57 5.52 $ 18,383,000

The total intrinsic value of options exercised during the years ended December 31, 2012, 2011 and 2010 was $15.0 million,

$14.6 million and $12.0 million, respectively.

Cash received from options exercised under all stock-based payment arrangements for the years ended December 31, 2012,

2011 and 2010 was $9.3 million, $6.7 million and $8.0 million, respectively. The actual tax benefit realized for the tax deduction

from option exercises under the stock-based payment arrangements totaled $6.2 million, $6.0 million and $2.7 million, respectively,

for the years ended December 31, 2012, 2011 and 2010.

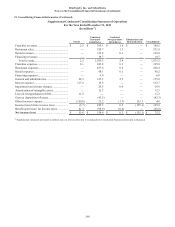

Fair Value of Stock Options

The per share fair values of the stock options granted have been estimated as of the date of grant or assumption using the

Black-Scholes option pricing model. The Black-Scholes model considers, among other factors, the expected life of the option and

the expected volatility of the Company's stock price. The Black-Scholes model meets the requirements of U.S. GAAP but the fair

values generated by the model may not be indicative of the actual fair values of the Company's stock-based awards. The following

table summarizes the assumptions used to value options granted in the respective periods:

2012 2011 2010

Risk free interest rate ...................................................................................... 0.9% 1.8% 2.2%

Weighted average historical volatility............................................................. 84.5% 79.1% 80.4%

Dividend yield................................................................................................. —% —% —%

Expected years until exercise.......................................................................... 4.7 4.6 4.8

Forfeitures....................................................................................................... 11.0% 11.0% 11.0%

Weighted average fair value of options granted.............................................. $ 33.53 $ 34.31 $ 19.93