IHOP 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

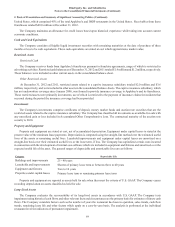

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

73

fair value of the swap over the cumulative change in the fair value of the plain vanilla swap lock, as defined in the accounting

literature. Once a swap is settled, the effective portion is amortized over the estimated life of the hedged item.

The Company has, in the past, utilized derivative financial instruments to manage its exposure to interest rate risks, but is not

currently a party to any derivative financial instruments. The Company does not enter into derivative financial instruments for

trading purposes.

Fair Value Measurements

The Company determines the fair market values of its financial assets and liabilities, as well as non-financial assets and

liabilities that are recognized or disclosed at fair value on a recurring basis, based on the fair value hierarchy established in

U.S. GAAP. The Company measures its financial assets and liabilities using inputs from the following three levels of the fair value

hierarchy:

• Level 1 inputs are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the

ability to access at the measurement date.

• Level 2 inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or

similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset

or liability (i.e., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable

market data by correlation or other means (market corroborated inputs).

• Level 3 includes unobservable inputs that reflect our assumptions about the assumptions that market participants would

use in pricing the asset or liability. The Company develops these inputs based on the best information available, including

our own data.

For more information on the financial instruments the Company measures at fair value, see Note 11, Fair Value Measurements.

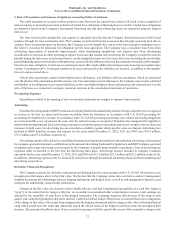

Income Taxes

The Company utilizes the liability method of accounting for income taxes. Under the liability method, deferred taxes are

determined based on the temporary differences between the financial statement and tax bases of assets and liabilities using enacted

tax rates. A valuation allowance is recorded when it is more likely than not that some of the deferred tax assets will not be realized.

The Company also determines its tax contingencies in accordance with U.S. GAAP governing the accounting for contingencies.

The Company records estimated tax liabilities to the extent the contingencies are probable and can be reasonably estimated.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax position

will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized

in the financial statements from such a position are measured based on the largest benefit that has a greater than fifty percent

likelihood of being realized upon ultimate resolution.

Stock-Based Compensation

Members of the Board of Directors and certain employees are eligible to receive stock options, restricted stock, restricted

stock units and performance units pursuant to the DineEquity, Inc. 2011 Stock Incentive Plan. The Company accounts for all stock-

based payments to employees and non-employee directors, including grants of stock options, restricted stock and restricted stock

units to be recognized in the financial statements, based on their respective grant date fair values. The value of the portion of the

award that is ultimately expected to vest is recognized as expense ratably over the requisite service periods. The Company reports

the benefits of tax deductions in excess of recognized compensation cost as a financing cash flow.

The grant date fair value of restricted stock and stock-settled restricted stock units is determined based on the Company's

stock price on the grant date. The Company estimates the grant date fair value of stock option awards using the Black-Scholes

option pricing model, which considers, among other factors, a risk-free interest rate, the expected life of the award and the historical

volatility of the Company's stock price. The amount of certain cash-settled awards is determined based on factors, including the

Company's stock price, that are ultimately determined at the date of payment. These awards are classified as liabilities and

compensation expense related to cash-settled awards is adjusted to fair value at each balance sheet date.

Net Income (Loss) Per Share

Earnings per share is calculated using the two-step method prescribed in U.S. GAAP. Basic net income (loss) per share is

computed by dividing the net income (loss) available to common stockholders for the period by the weighted average number of

common shares outstanding during the period. Diluted net income (loss) per share is computed by dividing the net income (loss)