IHOP 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

standards. Specific training is offered to franchisees to assist them in remediating any areas of opportunity identified in the Operations

Evaluation. In addition, IHOP modified its service procedures in 2012 to improve speed of service and improve guest satisfaction.

While results from both programs have been positive, we recognize that operations excellence is a continuous process without end.

Optimize Franchise Development and Franchise System Health

Under the Current Business Model, IHOP seeks to optimize franchise development by recruiting franchise developers within

and outside the current system and working with these franchise developers in the site selection and building process. This strategy

has proved successful as our franchisees have developed approximately 516 restaurants since the inception of the Current Business

Model and our franchisees have a pipeline of 285 additional new restaurants committed, optioned or pending. In 2012, an IHOP

franchisee opened the first IHOP restaurants in the Middle East demonstrating the interest in the IHOP brand outside of North

America. In 2013, a new international franchisee opened the first IHOP restaurant in the Philippines. We continue to explore

opportunities in new international markets. The existing franchisee base accounts for most of these future development obligations.

In addition, we may take steps to consolidate and rehabilitate existing markets if we believe that doing so is advisable in order

to fully realize development potential. We consistently monitor individual franchisee health and compliance with franchise

agreements and we may also take steps to exercise our contractual rights within the franchise agreement in the event of

noncompliance.

In a challenging economic environment and a highly competitive family dining category, there can be no assurance that the

strategies described above, when implemented, will achieve the intended results within the time frame anticipated.

Significant Known Events, Trends or Uncertainties Impacting or Expected to Impact Comparisons of Reported or

Future Results

Current Economic Conditions

The consumer continues to receive a mixture of positive and negative economic information. Gross Domestic Product ("GDP")

grew at a modest pace for the full year of 2012, but preliminary estimates for the fourth quarter of 2012 showed a slight decline.

The unemployment rate declined from December 2011 to December 2012, but the unemployment rate rose in January 2013. We

believe uncertainty over the degree and duration of the economic recovery, the impact of the expiration of the 2% payroll tax cut

that had been in place for the last two years and possible deficit reduction measures may continue to temper consumer discretionary

spending. A decline or lack of growth in disposable income for discretionary spending could cause our customers to change

purchasing behavior and choose lower-cost dining options or alternatives to dining out. These factors could have an adverse effect

on our business, results of operations and financial condition.

Sales Trends

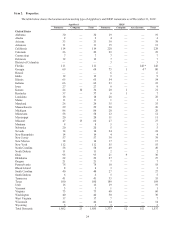

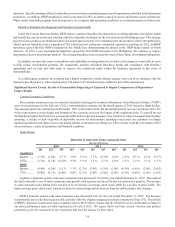

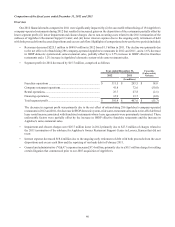

Domestic System-wide Same-restaurant Sales

Increase (Decrease)

2010 2011 2012

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Applebee’s

Quarter....... (2.7)% (1.6)% 3.3 % 2.9% 3.9 % 3.1 % (0.3)% 1.0 % 1.2 % 0.7 % 2.0 % 0.9 %

YTD........... (2.7)% (2.2)% (0.5)% 0.3% 3.9 % 3.5 % 2.3 % 2.0 % 1.2 % 1.0 % 1.3 % 1.2 %

IHOP

Quarter....... (0.4)% (1.0)% 0.1 % 1.1% (2.7)% (2.9)% (1.5)% (1.0)% (0.5)% (1.4)% (2.0)% (2.6)%

YTD........... (0.4)% (0.7)% (0.4)% 0.0% (2.7)% (2.8)% (2.4)% (2.0)% (0.5)% (0.9)% (1.3)% (1.6)%

Applebee’s domestic system-wide same-restaurant sales increased 1.2% for the year ended December 31, 2012. This marked

the third consecutive year of same-restaurant sales growth, with increases in nine of the last ten consecutive quarters. The increase

in same-restaurant sales during 2012 was driven by an increase in average guest check offset by a decline in guest traffic. The

higher average guest check came from an increase in menu pricing and an increase from favorable product mix changes.

IHOP’s domestic system-wide same-restaurant sales decreased 1.6% for the year ended December 31, 2012. The decrease

was primarily due to a decline in guest traffic, partially offset by a higher average guest check compared to fiscal 2011. The decline

in IHOP's domestic system-wide same-restaurant sales in 2012 reflects, in part, that the initiatives we are undertaking to improve

our sales performance were not fully implemented for all of 2012. We expect that it will take several visitation and product

promotion cycles for consumers to see, experience and taste the actions we have taken.