IHOP 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 Net positive financial impact is comprised of net savings and cost avoidances. Net savings represent cost reductions year-over-year. Cost avoidances represent cost

increases that were avoided because of an action taken by CSCS.

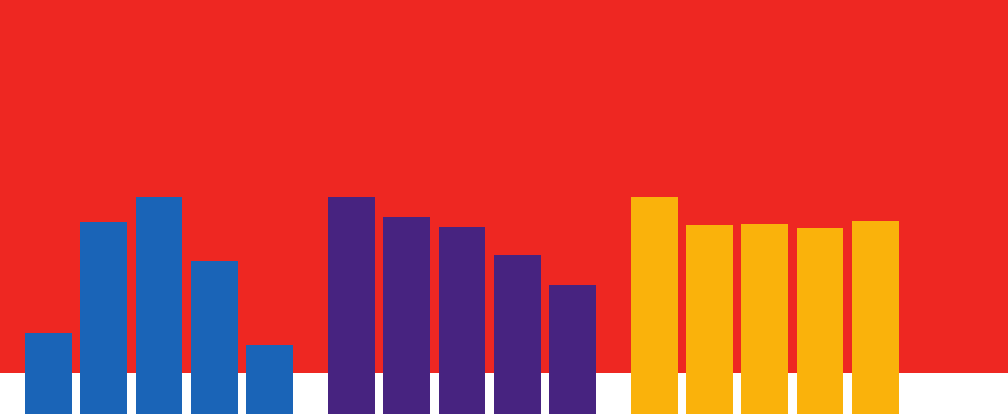

2 The decline in free cash flow in fiscal 2012 was primarily due to the increase in cash taxes paid on refranchising proceeds and, as expected, lower segment profit due

to refranchising.

3 General and administrative ("G&A") expenses increased $7.4 million, primarily due to a $9.1 million charge for settling certain litigation that commenced prior to our 2007

acquisition of Applebee's.

Free

cash flow2

(in millions)

Total

debt

(in billions)

Consolidated general &

administrative expense3

(in millions)

2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012

$135

$153

$108

$48

$57

$2.36

$2.14 $2.03

$1.73

$1.40

$182.2

$158.5 $159.6 $155.8 $163.2

“ As DineEquity moves forward with a more

franchise-centric structure, collaborative

input from key franchise partners is more

and more important. This unique opportunity

to leverage experience from the field

increases the value the parent franchisor

can return to the entire system.”

Roy Raeburn, President, Apple-Metro

Leveraging resources to build value

Having met our refranchising goals, we announced

a capital allocation strategy in February 2013 that will

create additional value for our shareholders. We

re-priced our senior secured credit facility, lowering

the effective interest rate from 4.25% to 3.75% in

keeping with our objective to lower interest expense

on borrowings. At the same time, we modified debt

covenants to reduce limitations on DineEquity’s capital

allocation options, providing the Company with added

flexibility. As of December 31, 2012, the outstanding

principal balance of the Company’s senior secured

credit facility was reduced from $844 million as of

December 31, 2010 to $472 million.

Achieving new levels of synergy and efficiency

In 2012, we continued to move forward with the

implementation of more efficient internal processes.

We are working to ensure that we have the right type

of resources and organizational structure to effectively

support our two brands; deliver industry-leading

support to franchisees, and realize economies of scale

whenever possible.

The independent purchasing cooperative, CSCS,

which DineEquity participates in, has established itself

as a point of competitive differentiation by enabling

procurement of commodity items at lower costs and

reduced distribution expenses, which are then passed

on in the form of savings to our franchisees and

ultimately to our guests. In 2012 alone, CSCS calculated

that it has generated a Net Positive Financial Impact of

$21.2 million for Applebee’s franchisees and $15.4 million

for IHOP franchisees.1

We’ve also continued to evolve our DineEquity Shared

Services model, in order to leverage expertise across

the organization. Today, Shared Services includes the

2