IHOP 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

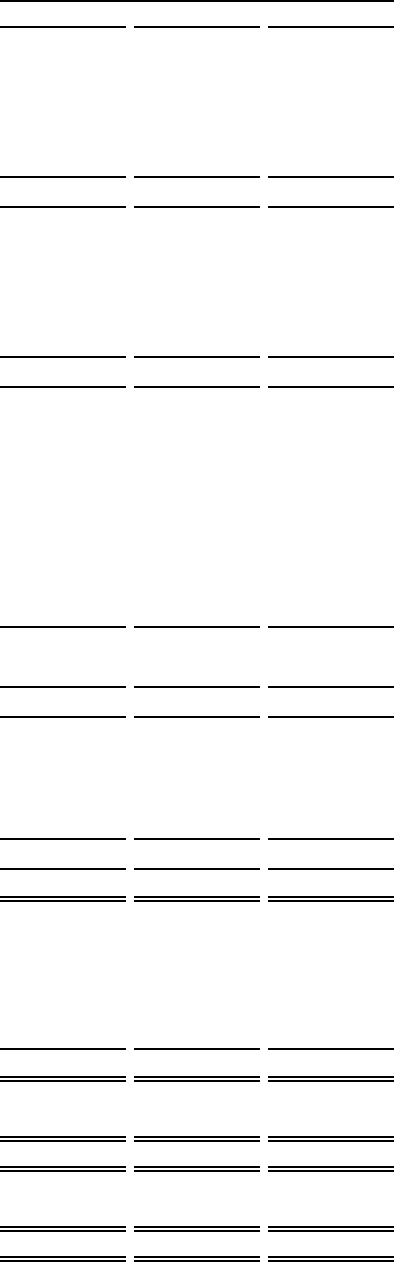

65

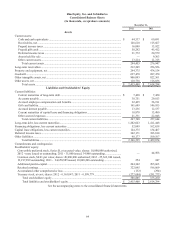

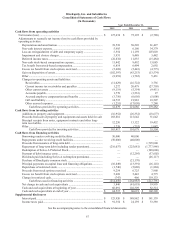

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income

(In thousands, except per share amounts)

Year Ended December 31,

2012 2011 2010

Segment Revenues:

Franchise revenues....................................................................................... $ 421,459 $ 398,539 $ 377,137

Company restaurant sales............................................................................. 291,121 530,984 815,572

Rental revenues ............................................................................................ 122,859 125,960 124,508

Financing revenues....................................................................................... 14,489 19,715 16,424

Total segment revenues..................................................................................... 849,928 1,075,198 1,333,641

Segment Expenses:

Franchise expenses....................................................................................... 109,900 105,006 103,505

Company restaurant expenses...................................................................... 249,296 458,443 699,336

Rental expenses............................................................................................ 97,165 98,147 99,030

Financing expenses ...................................................................................... 1,623 5,973 1,969

Total segment expenses..................................................................................... 457,984 667,569 903,840

Gross segment profit....................................................................................... 391,944 407,629 429,801

General and administrative expenses................................................................ 163,215 155,822 160,330

Interest expense................................................................................................. 114,338 132,707 171,537

Impairment and closure charges........................................................................ 4,218 29,865 4,285

Amortization of intangible assets...................................................................... 12,293 12,300 12,300

Loss on extinguishment of debt and temporary equity..................................... 5,554 11,159 107,003

Debt modification costs .................................................................................... — 4,031 —

Gain on disposition of assets............................................................................. (102,597)(43,253)(13,574)

Income (loss) before income taxes.................................................................... 194,923 104,998 (12,080)

Income tax (provision) benefit.......................................................................... (67,249)(29,806) 9,292

Net income (loss).............................................................................................. 127,674 75,192 (2,788)

Other comprehensive income (loss), net of tax:

Adjustment to unrealized loss on available-for-sale investments ................. 140 — —

Foreign currency translation adjustment ....................................................... 2(12) —

Interest rate swap........................................................................................... — — 20,529

Total other comprehensive income (loss).................................................. 142 (12) 20,529

Total comprehensive income.......................................................................... $ 127,816 $ 75,180 $ 17,741

Net income (loss) available to common stockholders:

Net income (loss) .............................................................................................. $ 127,674 $ 75,192 $ (2,788)

Less: Series A preferred stock dividends.......................................................... — — (25,927)

Less: Accretion of Series B preferred stock...................................................... (2,498)(2,573)(2,432)

Less: Net (income) loss allocated to unvested participating restricted stock.... (2,718)(1,886) 1,173

Net income (loss) available to common stockholders ...................................... $ 122,458 $ 70,733 $ (29,974)

Net income (loss) available to common stockholders per share:

Basic .............................................................................................................. $ 6.81 $ 3.96 $ (1.74)

Diluted........................................................................................................... $ 6.63 $ 3.89 $ (1.74)

Weighted average shares outstanding:

Basic .............................................................................................................. 17,992 17,846 17,240

Diluted........................................................................................................... 18,877 18,185 17,240

See the accompanying notes to the consolidated financial statements.