IHOP 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

Capital Allocation Strategy

On February 26, 2013, our Board of Directors approved a capital allocation strategy that contemplates the return of a significant

portion of our free cash flow to our stockholders. The Board of Directors approved the payment of a cash dividend of $0.75 per

share of our common stock, payable at the close of business on March 29, 2013 to the stockholders of record as of the close of

business on March 15, 2013. The Board of Directors also approved a stock repurchase authorization of up to $100 million of our

common stock, replacing the previously announced $45 million authorization, pursuant to which $21.2 million of common stock

was repurchased.

Debt Modification and Retirements

On February 4, 2013, we entered into an amendment to our Credit Agreement. The amendment lowers the interest rate floor

on our term loan borrowings under the Credit Agreement by 0.50%, eliminates the interest rate floor on our revolving loans under

the Credit Agreement, reduces the amount of required debt repayments from our excess cash flow and modifies the calculation

of the permitted amount of restricted payments (see "Liquidity and Capital Resources of the Company - February 2013

Amendment"). We will recognize costs of approximately $1.2 million in our 2013 Consolidated Statements of Operations related

to this debt modification.

During the year ended December 31, 2012, we repaid $210.5 million of outstanding borrowings under the Credit Agreement

and we repurchased $5.0 million of our 9.5% Senior Notes. Including the write-off of the discount and deferred financing costs

related to the debt retired and a $0.5 million premium paid on the Senior Notes, we recognized a loss on the retirement of debt of

$5.6 million. Additionally, as the result of refranchising 154 Applebee’s company-operated restaurants, we were released from

financing obligations of $111.5 million related to 66 of the properties refranchised.

Financial Statement Effect of Refranchising Company-Operated Restaurants

As noted under “2012 Highlights” above, we have reached our goal of transitioning Applebee's to a 99% franchised system.

Compared to amounts that have been reported historically since the Applebee's acquisition, the amounts reported in future periods

for company-operated restaurant revenues and expenses will be considerably smaller, while franchise royalty revenues and expenses

should increase. Our segment profit margin percentage will increase but total segment profit will likely be smaller because royalties

from franchised restaurants are a smaller percentage of restaurant revenues than the historic restaurant operating profit margin

percentage of company-operated restaurants. However, changes in same-restaurant sales will create less of an impact on operating

income now that the Applebee's system is 99% franchised.

Additionally, our interest expense will be lower because the after-tax proceeds from the sale of restaurant assets were used

to retire debt. The completed refranchising of the Applebee’s company-operated restaurants also will result in a reduction of both

general and administrative expenses and required capital investment in restaurant assets as compared to amounts reported prior

to the completion of our refranchising strategy.

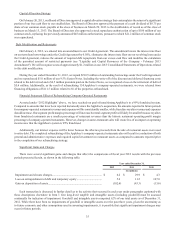

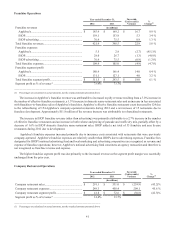

Significant Gains and Charges

There were several significant gains and charges that affect the comparisons of fiscal year 2012 results with the previous

periods presented herein, as shown in the following table:

Year ended December 31,

2012 2011 2010

(In millions)

Impairment and closure charges...................................................................... $ 4.2 $ 29.9 $ 4.3

Loss on extinguishment of debt and temporary equity................................... 5.6 11.2 107.0

Gain on disposition of assets........................................................................... (102.6)(43.3)(13.6)

Each transaction is discussed in further detail as to the activity that occurred in each year under paragraphs captioned with

these descriptions elsewhere in Item 7. Our long-lived tangible and intangible assets (including goodwill) must be assessed

continually for indicators of impairment. Goodwill and intangible assets comprised 62% of our total assets as of December 31,

2012. While there have been no impairments of goodwill or intangible assets over the past three years, given the uncertainty as

to future economic and other assumptions used in assessing impairments, it is possible that significant impairment charges may

occur in future periods.