IHOP 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

88

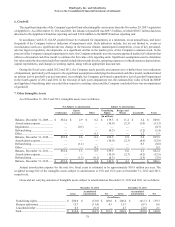

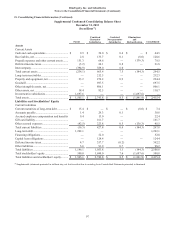

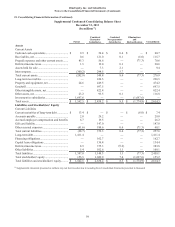

15. Impairment and Closure Charges

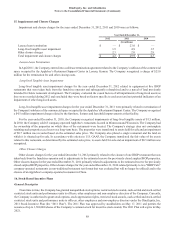

Impairment and closure charges for the years ended December 31, 2012, 2011 and 2010 were as follows:

Year Ended December 31,

2012 2011 2010

(In millions)

Lenexa lease termination $ — $ 23.0 $ —

Long-lived tangible asset impairment 1.9 4.9 1.5

Other closure charges 2.3 2.0 2.8

Total impairment and closure charges $ 4.2 $ 29.9 $ 4.3

Lenexa Lease Termination

In April 2011, the Company entered into a sublease termination agreement related to the Company’s sublease of the commercial

space occupied by the Applebee’s Restaurant Support Center in Lenexa, Kansas. The Company recognized a charge of $23.0

million for the termination fee and other closing costs.

Long-lived Tangible Asset Impairment

Long-lived tangible asset impairment charges for the year ended December 31, 2012 related to equipment at five IHOP

restaurants that were taken back from the franchisee operator and subsequently refranchised and to a parcel of land previously

intended for future restaurant development. The Company evaluated the causal factors of all impairments of long-lived assets as

they were recorded during 2012 and concluded they were based on factors specific to each asset and not potential indicators of an

impairment of other long-lived assets.

Long-lived tangible asset impairment charges for the year ended December 31, 2011 were primarily related to termination of

the Company's sublease of the commercial space occupied by the Applebee’s Restaurant Support Center. The Company recognized

a $4.5 million impairment charge related to the furniture, fixtures and leasehold improvements at that facility.

For the year ended December 31, 2010, the Company recognized impairments of long-lived tangible assets of $1.5 million.

In 2010, the Company sold 63 company-operated Applebee's restaurants located in Minnesota and Wisconsin. The Company had

fee ownership of the properties on which three of the restaurants were located. The Company's strategy does not contemplate

retaining such properties as a lessor on a long-term basis. The properties were transferred to assets held for sale and an impairment

of $0.7 million was recorded based on the estimated sales price. The Company also placed a single restaurant and the land on

which it is situated up for sale. In accordance with criteria in U.S. GAAP, the Company transferred the fair value of the assets

related to this restaurant, as determined by the estimated sales price, to assets held for sale and an impairment of $0.5 million was

recognized.

Other Closure Charges

Other closure charges for the year ended December 31, 2012 primarily related to the closure of one IHOP restaurant that was

taken back from the franchisee operator and to adjustments to the estimated reserve for previously closed surplus IHOP properties.

Other closure charges for the year ended December 31, 2011 primarily related to adjustments to the estimated reserve for previously

closed surplus IHOP properties. Other closure charges for the year ended December 31, 2010 related primarily to two "IHOP Cafe"

company-operated restaurants (a non-traditional restaurant test format that was evaluated but will no longer be utilized) and to the

closure of an Applebee's company-operated restaurant in China.

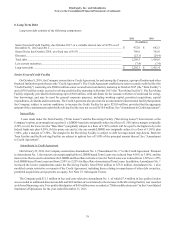

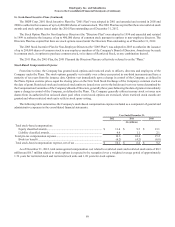

16. Stock-Based Incentive Plans

General Description

From time to time, the Company has granted nonqualified stock options, restricted stock awards, cash-settled and stock-settled

restricted stock units and performance units to officers, other employees and non-employee directors of the Company. Currently,

the Company is authorized to grant stock options, stock appreciation rights, restricted stock awards, cash-settled and stock-settled

restricted stock units and performance units to officers, other employees and non-employee directors under the DineEquity, Inc.

2011 Stock Incentive Plan (the “2011 Plan”). The 2011 Plan was approved by stockholders on May 17, 2011 and permits the

issuance of up to 1,500,000 shares of the Company’s common stock for incentive stock awards. The 2011 Plan will expire in May

2021.