IHOP 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

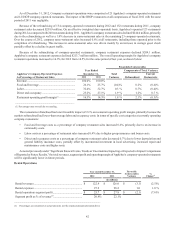

The increase in Applebee’s franchise revenue was primarily attributable to increased royalty revenue resulting from a 9.2%

increase in the number of effective franchise restaurants and a 2.0% increase in domestic same-restaurant sales. Applebee's effective

franchise restaurant count increased by 149 due to the refranchising of 132 Applebee’s company-operated restaurants during 2011

and net franchise restaurant development. Approximately $11.4 million of the revenue increase was attributable to refranchised

restaurants.

The increase in IHOP franchise revenue (other than advertising) was primarily attributable to an increase of 3.6% in the

number of effective franchise restaurants and an increase in both volume and pricing of pancake and waffle dry mix, partially

offset by a decrease of 2.0% in IHOP domestic franchise same-restaurant sales.

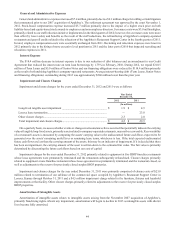

The decrease in IHOP franchise expenses was due to lower bad debt expense of $2.3 million partially offset by higher cost

of sales associated with the increased revenues from pancake and waffle dry mix sales. In 2010, bad debt expense included a

reserve of approximately $2.0 million related to a former franchise operator of 40 IHOP franchise restaurants that defaulted on

its obligations in the fourth quarter of 2010.

IHOP advertising revenues and expenses increased due to the increase in IHOP franchise restaurants partially offset by the

decrease in IHOP domestic franchise same-restaurant sales. Applebee's franchise expenses are relatively smaller than IHOP's due

to advertising expenses. Franchise fees designated for IHOP's national advertising fund and local marketing and advertising

cooperatives are recognized as revenue and expense of franchise operations; however, Applebee's national advertising fund

constitutes an agency transaction and therefore is not recognized as franchise revenue and expense.

Company Restaurant Operations

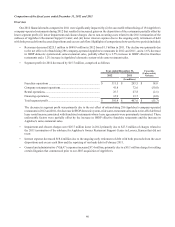

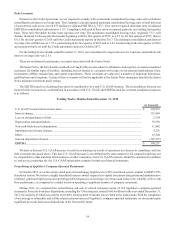

Year ended December 31, Favorable

(Unfavorable)

Variance

%

Change(1)

2011 2010

(In millions)

Company restaurant sales.................................................... $ 531.0 $ 815.6 $ (284.6) (34.9)%

Company restaurant expenses ............................................. 458.4 699.3 240.9 34.4 %

Company restaurant segment profit..................................... $ 72.6 $ 116.3 $ (43.7) (37.6)%

Segment profit as % of revenue(1)........................................ 13.7% 14.3%

____________________________________________________________

(1) Percentages are calculated on actual amounts, not the rounded amounts presented above

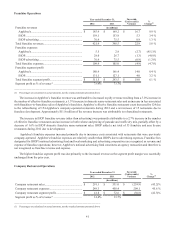

As of December 31, 2011, Company restaurant operations were comprised of 177 Applebee's company-operated restaurants

and 15 IHOP company-operated restaurants. The impact of the IHOP restaurants on all comparisons of fiscal 2011 with the same

period of 2010 was negligible.

Company restaurant sales decreased $284.6 million. In the past 15 months Applebee's refranchised 215 company-operated

restaurants (132 during 2011 and 83 in the fourth quarter of 2010) and closed seven company-operated restaurants during 2010.

As a result, Applebee's company restaurant sales declined $292.7 million, partially offset by a $6.9 million increase in revenue

from currently operating restaurants, which represents a 1.8% increase in company same-restaurant sales. The increase in same-

restaurant sales was driven mainly by an increase in average guest check that resulted from an increase of approximately 1.4% in

menu pricing and an increase from favorable product mix changes. Traffic was flat compared to the prior year.

Company restaurant expenses declined $240.9 million. Applebee's company restaurant expenses declined $253.3 million

because of the refranchising of company-operated restaurants and closures noted above, partially offset by an increase of $11.1

million in costs at currently operating restaurants. The overall operating margin for Applebee's company restaurant operations

declined to 14.5% for 2011 from 14.8% for the same period of last year, as shown below: