IHOP 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

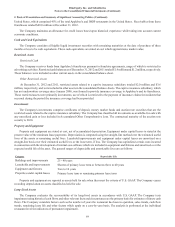

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

72

The rental payments or receipts on those property leases that meet the capital lease criteria will result in the recognition of

interest expense or interest income and a reduction of capital lease obligation or financing lease receivable. Capital lease obligations

are amortized based on the Company's incremental borrowing rate and direct financing leases are amortized using the implicit

interest rate.

The lease term used for straight-line rent expense is calculated from the date the Company obtains possession of the leased

premises through the lease termination date. The Company records rent from the possession date through restaurant open date as

expense. Once a restaurant opens for business, the Company records straight-line rent over the lease term plus contingent rent to

the extent it exceeded the minimum rent obligation per the lease agreement. The Company uses a consistent lease term when

calculating depreciation of leasehold improvements, when determining straight-line rent expense and when determining

classification of its leases as either operating or capital. For leases that contain rent escalations, the Company records the total rent

payable during the lease term, as determined above, on the straight-line basis over the term of the lease (including the rent holiday

period beginning upon our possession of the premises), and records the difference between the minimum rents paid and the straight-

line rent as a lease obligation. Certain leases contain provisions that require additional rental payments based upon restaurant sales

volume ("contingent rent"). Contingent rentals are accrued each period as the liabilities are incurred, in addition to the straight-

line rent expense noted above.

Certain lease agreements contain tenant improvement allowances, rent holidays and lease premiums, which are amortized

over the shorter of the estimated useful life or lease term. For tenant improvement allowances, the Company also records a deferred

rent liability or an obligation in non-current liabilities on the consolidated balance sheets and amortizes the deferred rent over the

term of the lease as a reduction to company restaurant expenses in the consolidated statements of operations.

Pre-opening Expenses

Expenditures related to the opening of new or relocated restaurants are charged to expense when incurred.

Advertising

Franchise fees designated for IHOP's national advertising fund and local marketing and advertising cooperatives are recognized

as revenue as the fees are earned and become receivables from the franchisee in accordance with U.S. GAAP governing the

accounting for franchise fee revenue. In accordance with U.S. GAAP governing advertising costs, related advertising obligations

are accrued and the costs expensed at the same time the related revenue is recognized. Franchise fees designated for Applebee's

national advertising fund and local advertising cooperatives constitute agency transactions and are not recognized as revenues and

expenses. In both cases, the advertising fees are recorded as a liability against which specific costs are charged. Advertising fees

included in IHOP franchise revenue and expense for the years ended December 31, 2012, 2011 and 2010 were $76.4 million,

$75.5 million and $74.4 million, respectively.

Advertising expense reflected in the consolidated statements of operations includes local marketing advertising costs incurred

by company-operated restaurants, contributions to the national advertising fund made by Applebee's and IHOP company-operated

restaurants and certain advertising costs incurred by the Company to benefit future franchise operations. Costs of advertising are

expensed either as incurred or the first time the advertising takes place. Advertising expense included in company restaurant

operations for the years ended December 31, 2012, 2011 and 2010 was $13.1 million, $23.3 million and $32.2 million, respectively.

In addition, advertising expenses may be incurred by franchisees through the national advertising funds and local marketing and

advertising cooperatives.

Derivative Financial Instruments

The Company accounts for derivative instruments and hedging activities in accordance with U.S. GAAP. All derivatives are

recognized on the balance sheet at their fair value. On the date that the Company enters into a derivative contract, management

formally documents all relationships between hedging instruments and hedged items, as well as risk management objectives and

strategies for undertaking various hedge transactions.

Changes in the fair value of a derivative that is highly effective and that is designated and qualifies as a cash flow hedge (a

"swap"), to the extent that the hedge is effective, are recorded in accumulated other comprehensive income, until earnings are

affected by the variability of cash flows of the hedged transaction. The Company measures effectiveness of the swap at each

quarter end, using the hypothetical derivative method. Under this method, hedge effectiveness is measured based on a comparison

of the change in fair value of the actual swap designated as the hedging instrument and the change in fair value of the hypothetical

swap which would have the terms that identically match the critical terms of the hedged cash flows from the anticipated debt

issuance. The amount of ineffectiveness, if any, recorded in earnings would be equal to the excess of the cumulative change in the