IHOP 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

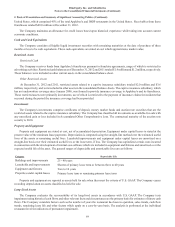

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

74

available to common stockholders for the period by the weighted average number of common shares and potential shares of

common stock outstanding during the period if their effect is dilutive. The Company uses the treasury stock method to calculate

the weighted average shares used in the diluted earnings per share calculation. Potentially dilutive common shares include the

assumed exercise of stock options, assumed vesting of restricted stock and assumed conversion of Series B Preferred Stock using

the if-converted method.

Other Comprehensive Income (Loss)

For the years ended December 31, 2012 and 2011, the income tax benefit or provision allocated to items of other comprehensive

income was not significant. The amount of income tax benefit allocated to an interest rate swap was $9.5 million for the year

ended December 31, 2010.

Treasury Stock

The Company may from time to time utilize treasury stock when vested stock options are exercised, when restricted stock

awards are granted and restricted stock units settle in stock upon vesting. The cost of treasury stock re-issued is determined on

the first-in, first-out method.

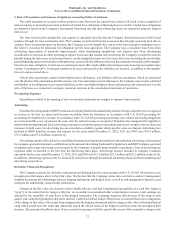

Business Segments

The Company identifies its reporting segments based on the organizational units used by management to monitor performance

and make operating decisions. The Company's reporting segments are as follows: franchise operations, company restaurant

operations, rental operations and financing operations. Within the franchise and company restaurant segments, the Company

operates two different restaurant concepts, Applebee's and IHOP. Applebee's has no material rental or financing operations.

Franchise Segment

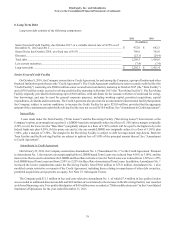

As of December 31, 2012, the franchise operations segment consisted of 2,011 restaurants operated by Applebee's franchisees

in the United States, one United States territory and 15 countries outside of the United States and 1,569 restaurants operated by

IHOP franchisees and area licensees in the United States, two United States territories and five countries outside of the United

States. Franchise operations revenue consists primarily of franchise royalty revenues, sales of proprietary products (primarily

IHOP pancake and waffle dry-mixes) and the portion of the franchise fees allocated to IHOP and Applebee's intellectual property.

Additionally, franchise fees designated for IHOP's national advertising fund and local marketing and advertising cooperatives are

recognized as revenue and expense of franchise operations; however, Applebee's national advertising fund activity constitutes

agency transactions and therefore is not recognized as franchise revenue and expense.

Franchise operations expenses include IHOP advertising expense, the cost of proprietary products, pre-opening training

expenses and other franchise-related costs.

Company Segment

As of December 31, 2012, the company restaurant operations segment consisted of 23 Applebee's company-operated

restaurants, 10 IHOP company-operated restaurants and two restaurants reacquired from franchisees and operated by IHOP on a

temporary basis until refranchised. All company-operated restaurants are located in the United States.

Company restaurant sales are retail sales at company-operated restaurants. Company restaurant expenses are operating

expenses at company-operated restaurants and include food, beverage, labor, benefits, utilities, rent and other operating costs.

Rental Segment

Rental operations revenue includes revenue from operating leases and interest income from direct financing leases. Rental

operations expenses are costs of operating leases and interest expense on capital leases on franchisee-operated restaurants. The

rental operations revenue and expenses are primarily generated by IHOP. Applebee's has an insignificant amount of rental activity

related to properties that are retained after refranchising company-operated restaurants. Rental activity occurs until such time as

the properties can be disposed of by sale.

Financing Segment

Financing operations revenue primarily consists of interest income from the financing of IHOP franchise fees and equipment

leases, as well as sales of equipment associated with refranchised IHOP restaurants and a portion of franchise fees for restaurants

taken back from franchisees not allocated to IHOP intellectual property. Financing expenses are the cost of restaurant equipment.