IHOP 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

Item 3. Legal Proceedings.

We are subject to various lawsuits, administrative proceedings, audits, and claims arising in the ordinary course of business.

Some of these lawsuits purport to be class actions and/or seek substantial damages. We are required to record an accrual for

litigation loss contingencies that are both probable and reasonably estimable. Legal fees and expenses associated with the defense

of all of our litigation are expensed as such fees and expenses are incurred. Management regularly assesses our insurance deductibles,

analyzes litigation information with our attorneys and evaluates our loss experience in connection with pending legal proceedings.

While we do not presently believe that any of the legal proceedings to which we are currently a party will ultimately have a material

adverse impact on us, there can be no assurance that we will prevail in all the proceedings we are party to, or that we will not incur

material losses from them.

As previously disclosed, we defended a collective action, Gerald Fast v. Applebee's International, Inc., in the United States

District Court for the Western District of Missouri, Central Division that commenced in July 2006. In this case, the plaintiffs

claimed that tipped servers and bartenders in Applebee's company-operated restaurants spent more than 20% of their time

performing general preparation and maintenance duties, or “non-tipped work,” for which they should be compensated at the

minimum wage. Under this action, plaintiffs sought unpaid wages and other relief of up to $17 million plus plaintiffs' attorneys'

fees and expenses. We entered into a settlement agreement on September 25, 2012 to settle the action for $9.1 million, and the

court granted final approval of the settlement and dismissed the action on November 1, 2012. We funded the settlement on

December 6, 2012.

Item 4. Mine Safety Disclosure.

Not Applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

Market Information

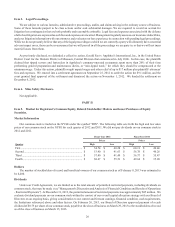

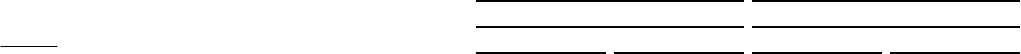

Our common stock is traded on the NYSE under the symbol "DIN". The following table sets forth the high and low sales

prices of our common stock on the NYSE for each quarter of 2012 and 2011. We did not pay dividends on our common stock in

2012 and 2011.

Fiscal Year 2012 Fiscal Year 2011

Prices Prices

Quarter High Low High Low

First...................................................................................... $ 54.74 $ 40.28 $ 60.11 $ 49.46

Second ................................................................................. $ 53.90 $ 41.63 $ 56.78 $ 46.26

Third .................................................................................... $ 57.40 $ 41.49 $ 56.37 $ 35.47

Fourth .................................................................................. $ 68.47 $ 55.51 $ 49.64 $ 35.20

Holders

The number of stockholders of record and beneficial owners of our common stock as of February 8, 2013 was estimated to

be 6,200.

Dividends

Under our Credit Agreement, we are limited as to the total amount of permitted restricted payments, including dividends on

common stock, that may be made (see "Management's Discussion and Analysis of Financial Condition and Results of Operations

- Restricted Payments"). At December 31, 2012, the permitted amount of restricted payments was approximately $85 million. We

evaluate dividend payments on our common stock within the context of our overall capital allocation strategy with our Board of

Directors on an ongoing basis, giving consideration to our current and forecast earnings, financial condition, cash requirements,

the limitations referenced above and other factors. On February 26, 2013, our Board of Directors approved payment of a cash

dividend of $0.75 per share of our common stock, payable at the close of business on March 29, 2013 to the stockholders of record

as of the close of business on March 15, 2013.