IHOP 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

13. Commitments and Contingencies (Continued)

86

Litigation, Claims and Disputes

The Company is subject to various lawsuits, governmental inspections, administrative proceedings, audits, and claims arising

in the ordinary course of business. Some of these lawsuits purport to be class actions and/or seek substantial damages. The Company

is required to record an accrual for litigation loss contingencies that are both probable and reasonably estimable. Legal fees and

expenses associated with the defense of all of the Company's litigation are expensed as such fees and expenses are incurred. In

the opinion of management, these matters are adequately covered by insurance or, if not so covered, are without merit or are of

such a nature or involve amounts that would not have a material adverse impact on the Company's business or consolidated financial

statements. Management regularly assesses the Company's insurance deductibles, analyzes litigation information with the

Company's attorneys and evaluates its loss experience in connection with pending legal proceedings. While the Company does

not presently believe that any of the legal proceedings to which the Company is currently a party will ultimately have a material

adverse impact on the Company, there can be no assurance that the Company will prevail in all the proceedings the Company is

party to, or that the Company will not incur material losses from them.

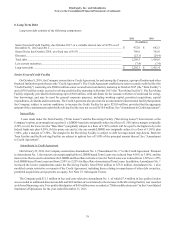

As previously disclosed, the Company defended a collective action, Gerald Fast v. Applebee's International, Inc., in the United

States District Court for the Western District of Missouri, Central Division that commenced in July 2006. In this case, the plaintiffs

claimed that tipped servers and bartenders in Applebee's company-operated restaurants spent more than 20% of their time

performing general preparation and maintenance duties, or “non-tipped work,” for which they should be compensated at the

minimum wage. Under this action, plaintiffs sought unpaid wages and other relief of up to $17 million plus plaintiffs' attorneys'

fees and expenses. The Company entered into a settlement agreement on September 25, 2012 to settle the collective action for

$9.1 million, and the court granted final approval of the settlement and dismissed the action on November 1, 2012. The Company

funded the settlement on December 6, 2012.

Letters of Credit

The Company provides letters of credit, primarily to various insurance carriers to collateralize obligations for outstanding

claims. As of December 31, 2012, the Company had approximately $12.1 million of unused letters of credit outstanding. These

letters expire on various dates in 2012 and are automatically renewed for an additional year if no cancellation notice is submitted.

14. Preferred Stock and Stockholders' Equity

Preferred Stock

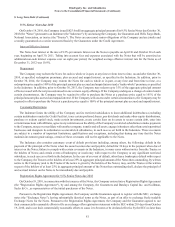

As part of the financing for the Applebee's acquisition, on November 29, 2007, the Company completed two separate private

placements of preferred stock.

Series A Perpetual Preferred Stock

On November 29, 2007, the Company issued and sold 190,000 shares of Series A Perpetual Preferred Stock (the "Series A

Perpetual Preferred Stock") for an aggregate purchase price of $190.0 million in cash. Total issuance costs were approximately

$3.0 million. All of the shares were sold to MSD SBI, L.P., an affiliate of MSD Capital, L.P., pursuant to a purchase agreement

dated as of July 15, 2007, as amended as of November 29, 2007.

In the fourth quarter of 2010, the Company redeemed all 190,000 shares of the Series A Perpetual Preferred Stock for $199.0

million, including a redemption premium of $7.6 million and $1.4 million of dividends accrued through the date of redemption.

In accordance with U.S. GAAP, the redemption premium was included as part of dividends paid on Series A Perpetual Preferred

Stock for the year ended December 31, 2010.

On December 14, 2012, the Company filed a Certificate of Elimination of the Series A Preferred Stock with the Secretary of

State of the State of Delaware to eliminate its Series A Preferred Stock. The Certificate of Elimination, effective upon filing, had

the effect of eliminating from the Corporation’s Restated Certificate of Incorporation, as amended, all matters set forth in the

Certificate of Designations of the Series A Preferred Stock with respect to such series, which was previously filed by the Corporation

with the Secretary of State on November 29, 2007.

Series B Convertible Preferred Stock

On November 29, 2007, the Company issued and sold 35,000 shares of Series B Convertible Preferred Stock for an aggregate

purchase price of $35.0 million in cash. Total issuance costs were approximately $0.8 million. All of the shares were sold to

affiliates of Chilton Investment Company, LLC (collectively, "Chilton") pursuant to a purchase agreement dated as of July 15,

2007. The shares of Series B Convertible Preferred Stock ranked (i) senior to the common stock, and any series of preferred stock