IHOP 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

75

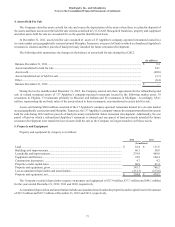

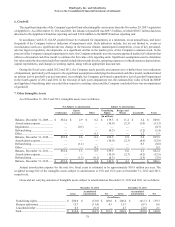

Reclassifications

Amounts previously reported as inventories at December 31, 2011 have been restated to conform to current classifications.

Food and beverage inventories at company restaurants are now included in "other current assets" and inventories of unactivated

gift cards are now included in "prepaid gift cards."

As Originally

Reported As Currently

Reported

(In thousands)

Inventories.......................................................................... $ 12,031 $ —

Prepaid gift cards ............................................................... $ 36,643 $ 45,412

Other current assets............................................................ $ 8,051 $ 11,313

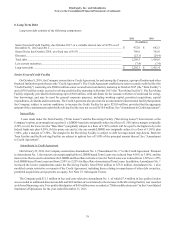

Recently Adopted Accounting Standards

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)

No. 2011-04, Fair Value Measurement - Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements

in U.S. GAAP and IFRSs (“ASU 2011-04”). The amendments in ASU 2011-04 result in common fair value measurement and

disclosure requirements in U.S. GAAP and international financial reporting standards (“IFRS”). ASU 2011-04 also provides for

certain changes in current GAAP disclosure requirements. The adoption of ASU 2011-04 did not have a material impact on the

Company's consolidated financial statements.

In May 2011, the FASB issued ASU No. 2011-05, Comprehensive Income - Presentation of Comprehensive Income (“ASU

2011-05”). ASU 2011-05 requires the presentation of the total of comprehensive income, the components of net income, and the

components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate

but consecutive statements. The amendments in this update did not change the items that must be reported in other comprehensive

income. The adoption of ASU 2011-05 did not have a material impact on the Company's consolidated financial statements.

In September 2011, the FASB issued ASU No. 2011-08, Intangibles-Goodwill and Other - Testing Goodwill for Impairment

("ASU 2011-08"). The amendments in ASU No. 2011-08 are intended to simplify goodwill impairment testing by adding a

qualitative review step to assess whether the required quantitative impairment analysis that exists today is necessary. Under these

amendments, an entity would not be required to calculate the fair value of a reporting unit unless the entity determines, based on

the qualitative assessment, that it is more likely than not that its fair value is less than its carrying amount. The Company adopted

ASU 2011-08 as of January 1, 2012, but did not elect to utilize the option of qualitative assessment of goodwill impairment. The

adoption of ASU 2011-08 did not have a material impact on the Company's consolidated financial statements.

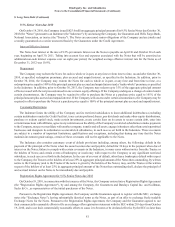

New Accounting Pronouncements

In July 2012, the FASB issued ASU No. 2012-02, Intangibles - Testing Indefinite Lived Intangibles for Impairment (“ASU

2012-02”). ASU 2012-02 allows an entity the option to first assess qualitative factors to determine whether it is necessary to

perform a quantitative impairment test on indefinite-lived intangibles. An entity electing to perform a qualitative assessment is no

longer required to calculate the fair value of an indefinite-lived intangible asset unless the entity determines, based on the qualitative

assessment, that it is more likely than not that the asset is impaired. The guidance is effective for impairment tests for the Company's

fiscal 2013, however, earlier adoption is allowed. As the guidance does not change the underlying principle that the carrying

amount of an indefinite-lived intangible asset should not exceed its fair value, the adoption of ASU 2012-02 is not anticipated to

have a material impact on the Company's consolidated financial statements.

The Company reviewed all other newly issued accounting pronouncements and concluded that they either are not applicable

to the Company's operations or that no material effect is expected on the Company's financial statements as a result of future

adoption.