IHOP 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

105

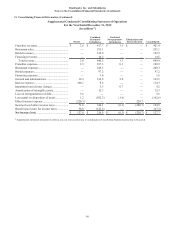

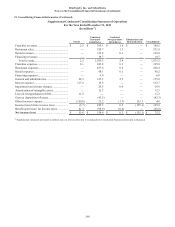

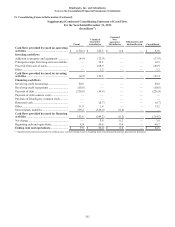

22. Selected Quarterly Financial Data (Unaudited)

Revenues(a) Operating

Margin Net Income

(Loss) (b)

Net Income

(Loss)

Per Share—

Basic(c)

Net Income

(Loss)

Per Share—

Diluted(c)

(In thousands, except per share amounts)

2012

1st Quarter................................................ $ 245,582 $ 108,575 $ 31,344 $ 1.69 $ 1.64

2nd Quarter............................................... 229,391 98,254 16,938 0.89 0.88

3rd Quarter................................................ 216,318 96,377 60,573 3.26 3.14

4th Quarter................................................ 158,637 88,738 18,819 0.98 0.97

2011

1st Quarter................................................ $ 300,200 $ 110,769 $ 29,699 $ 1.59 $ 1.53

2nd Quarter(d) ............................................ 268,338 100,285 348 (0.02)(0.02)

3rd Quarter................................................ 264,481 100,553 16,525 0.86 0.85

4th Quarter................................................ 242,179 96,022 28,620 1.55 1.51

________________________________

(a) Revenues have been impacted by the refranchising of 286 Applebee's company-operated restaurants over the past two years

as follows: 17 in the first quarter of 2012, 98 in the third quarter of 2012, 39 in the fourth quarter of 2012, 65 in the first

quarter of 2011, one in the third quarter of 2011 and 66 in the fourth quarter of 2011.

(b) Net income (loss) was impacted by gains on disposition of assets (primarily the refranchising and sale of related restaurant

assets of Applebee's company-operated restaurants) of $16.7 million in the first quarter of 2012, $73.6 million in the third

quarter of 2012, $13.0 million in the fourth quarter of 2012, $23.8 million in the first quarter of 2011 and $22.0 million in the

fourth quarter of 2011.

(c) The quarterly amounts may not add to the full year amount as each quarterly calculation is discrete from the full-year calculation.

(d) The net income and net loss per share were significantly impacted by approximately $21 million of charges related to the

termination of the sublease for the Applebee's Restaurant Support Center in Lenexa, Kansas in the 2nd quarter of 2011.

23. Subsequent Events

On February 4, 2013, the Company entered into Amendment No. 2 ("Amendment No. 2") to the Credit Agreement. Pursuant

to Amendment No. 2, the interest rate margin applicable to LIBOR-based Term Loans was reduced from 3.00% to 2.75%, and the

interest rate floors used to determine the LIBOR and Base Rate reference rates for Term Loans was reduced from 1.25% to 1.00%

for LIBOR-based Term Loans and from 2.25% to 2.00% for Base Rate-denominated Term Loans. The interest rate margin for

Revolving Loans was reduced from 3.50% to 1.75% for Base Rate loans and from 4.50% to 2.75% LIBOR Rate loans. The

commitment fee for the unused portion of the Revolving Facility was reduced from 0.75% to 0.50% and, if the consolidated

leverage ratio is reduced below 4.75:1, from 0.50% to 0.375%.

In addition, Amendment No. 2 establishes the following consolidated leverage ratio thresholds for excess cash flow

prepayments: 50% if the consolidated leverage ratio is 5.75:1 or greater; 25% if the consolidated leverage ratio is less than 5.75:1

and greater than or equal to 5.25:1; and 0% if the consolidated leverage ratio is less than 5.25:1. Pursuant to Amendment No. 2,

the Corporation’s mandatory repayment of 1% per year is now based on the outstanding principal balance of $472 million as of

December 31, 2012, as compared to the previous outstanding balance of $742 million.

Amendment No. 2 revised the definition of excess cash flow to eliminate the deduction for any extraordinary receipts or

disposition proceeds. Finally, Amendment No. 2 revised the definition of certain permitted payments so that the calculation of

allowable restricted payments is performed on a quarterly basis instead of an annual basis that was required prior to Amendment

No. 2. All other material provisions, including maturity and covenants under the Credit Agreement, remain unchanged.

On February 26, 2013, the Company's Board of Directors approved the payment of a cash dividend of $0.75 per share on the

Company's common stock, payable at the close of business on March 29, 2013 to the stockholders of record as of the close of

business on March 15, 2013. The Board of Directors also approved a stock repurchase authorization of up to $100 million of

DineEquity, Inc. common stock, replacing the previously announced $45 million authorization.