HSBC 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

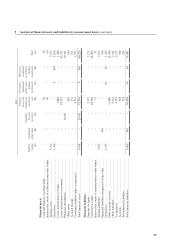

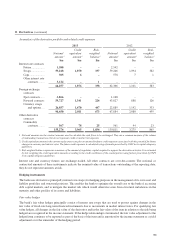

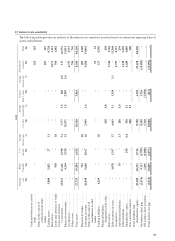

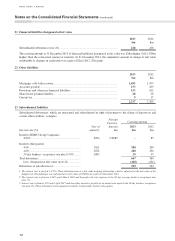

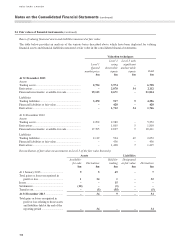

13 Interest rate sensitivity

The following table provides an analysis of the interest rate sensitivity position based on contractual repricing dates of

assets and liabilities.

2013

Floating

rate

$m

Within

3 months

$m

3–12

months

$m

Average

interest rate

%

1–5 years

$m

Average

interest rate

%

Greater

than 5 years

$m

Average

interest rate

%

Non-interest

sensitive

$m

Total

$m

Cash and balances at central

bank ................................. – – – – – 165 165

Items in the course of

collection from other

banks ............................... – – – – – 107 107

Trading assets ........................ 3,880 2,821 27 1.1 – – – 6,728

Derivatives ............................ – – – – – 2,112 2,112

Loans and advances to banks – 938 – 1.0 – – 544 1,482

Loans and advances

to customers .................... 23,913 11,461 2,978 3.1 7,777 3.5 105 4.5 117 46,351

Financial investments ............ – 4,364 3,920 1.5 10,571 1.5 2,959 2.6 – 21,814

Acceptances .......................... – – – – – 4,757 4,757

Other assets ........................... – – – – – 744 744

Total assets ............................ 27,793 19,584 6,925 18,348 3,064 8,546 84,260

Deposits by banks ................. – 722 – 1.0 – – 483 1,205

Customer accounts ................ 26,040 5,640 8,167 1.0 2,969 2.6 – 9,028 51,844

Items in the course of

transmission to other

banks ............................... – – – – – 53 53

Trading liabilities .................. 4,269 – – 1.0 – – 127 4,396

Financial liabilities

designated at fair value ... – – – 428 4.8 – – 428

Derivatives ............................ – – – – – 1,746 1,746

Debt securities in issue .......... – 4,070 1,297 1.7 4,643 3.1 1,338 3.1 – 11,348

Acceptances .......................... – – – – – 4,757 4,757

Subordinated liabilities ......... – 39 – 1.7 200 5.0 – – 239

Other liabilities ...................... – – – – – 3,159 3,159

Shareholders’ equity .............. – – 250 6.6 350 5.1 – 4,285 4,885

Non controlling interest ........ – – – 200 5.2 – – 200

Total liabilities and

shareholders’ equity ........ 30,309 10,471 9,714 8,790 1,338 23,638 84,260

On-balance sheet gap ............ (2,516) 9,113 (2,789) 9,558 1,726 (15,092) –

Off-balance sheet positions ... – 1,696 (1,088) 1,330 (1,938) – –

Total interest rate gap ............ (2,516) 10,809 (3,877) 10,888 (212) (15,092) –