HSBC 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

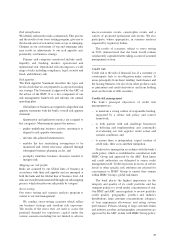

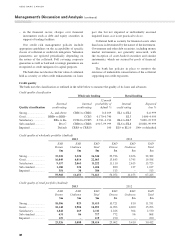

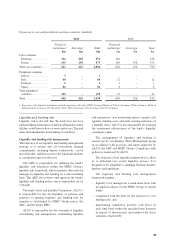

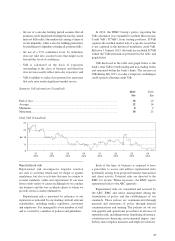

Exposures to core and peripheral eurozone countries (Audited)

2013 2012

Financial

institutions

$m

1Sovereign

$m

Total

$m

Financial

institutions

$m

1Sovereign

$m Total

$m

Core countries

Germany ...................... 326 205 531 326 – 326

France .......................... 215 258 473 316 156 472

Total core countries ........ 541 463 1,004 642 156 798

Peripheral countries

Greece .......................... 3–3 – – –

Italy .............................. 60 – 60 12 – 12

Portugal ....................... 6 – 6 1 – 1

Spain ............................ 86 – 86 8–8

Total peripheral

countries ...................... 155 – 155 21 – 21

Total ............................... 696 463 1,159 663 156 819

1 Exposures with financial institutions include exposures with other HSBC Group affiliates of $3m in Germany, $29m in France, $64m in

Spain and $3m in Greece (31 December 2012: $3m in Germany, $8m in France and $7m in Spain).

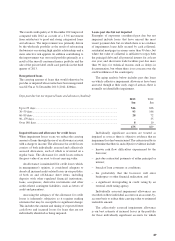

Liquidity and funding risk

Liquidity risk is the risk that the bank does not have

sufficient financial resources to meet its obligations as they

fall due, or will have to do so at an excessive cost. This risk

arises from mismatches in the timing of cash flows.

Liquidity and funding risk management

The objective of our liquidity and funding management

strategy is to ensure that all foreseeable funding

commitments, including deposit withdrawals, can be

met when due, and that access to the wholesale markets

is coordinated and cost-effective.

The ARC is responsible for defining the bank’s

liquidity risk tolerances within the HSBC Group’s

liquidity risk framework, which mandates that each site

manages its liquidity and funding on a self-sustaining

basis. The ARC also reviews and approves the bank’s

liquidity and funding policy and is responsible for its

oversight.

The bank’s Asset and Liability Committee (‘ALCO’)

is responsible for the development of policies and

practices to manage liquidity and funding risk. Its

mandate is established by HSBC Group policy, the

ARC, and the bank’s RMC.

ALCO is responsible for the oversight of liquidity

and funding risk management, establishing liquidity

risk parameters, and monitoring metrics against risk

appetite, funding costs, and early warning indicators of

a liquidity stress. ALCO is also responsible for ensuring

the operational effectiveness of the bank’s liquidity

contingency plan.

The management of liquidity and funding is

carried out by our Balance Sheet Management group

in accordance with practices and limits approved by

ALCO, the ARC and HSBC Group. Compliance with

policies is monitored by ALCO.

The objective of our liquidity framework is to allow

us to withstand very severe liquidity stresses. It is

designed to be adaptable to changing business models,

markets and regulations.

Our liquidity and funding risk management

framework requires:

– liquidity to be managed on a stand-alone basis with

no implicit reliance on the HSBC Group or central

banks;

– compliance with the limit for the advances to core

funding ratio; and

– maintaining cumulative positive cash flows in

each time band within the specified time horizons

in respect of idiosyncratic and market-wide stress

scenarios, respectively.

41