HSBC 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

– International trade and receivables finance: we

provide the services and finance our clients need

throughout the trade cycle including; letters of

credit, collections, guarantees; receivables finance;

supply chain solutions; and risk distribution. HSBC

is supporting the development of renminbi as a trade

currency, with renminbi capabilities for exporters,

importers, and companies looking to invest in China.

– Payments and Cash Management: we are a leading

provider of domestic and cross-border payments,

collections, liquidity management and account

services offering local, regional and global solutions

delivered via e-enabled platforms designed to

address the current and future needs of our clients.

– Global Banking and Markets: our Commercial Banking

franchise represents a key client base for Global

Banking and Markets products and services, including

foreign exchange and interest rate products, together

with capital raising on debt and equity markets.

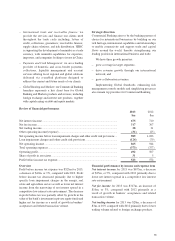

Strategic direction

Commercial Banking aims to be the banking partner of

choice for international businesses by building on our

rich heritage, international capabilities and relationships

to enable connectivity and support trade and capital

flows around the world, thereby strengthening our

leading position in international business and trade.

We have three growth priorities:

– grow coverage in target segments;

– drive revenue growth through our international

network; and

– grow collaboration revenues.

Implementing Global Standards, enhancing risk

management controls models and simplifying processes

also remain top priorities for Commercial Banking.

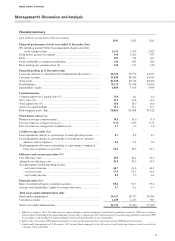

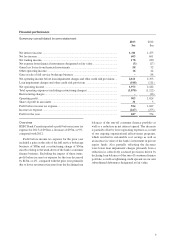

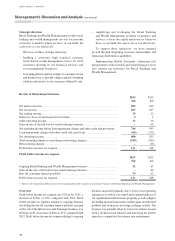

Review of financial performance

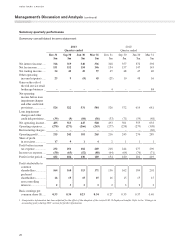

2013

$m

2012

$m

Net interest income ........................................................................................................ 675 710

Net fee income ............................................................................................................... 317 307

Net trading income ......................................................................................................... 28 31

Other operating income/(expense) ................................................................................. (31) (25)

Net operating income before loan impairment charges and other credit risk provisions ... 989 1,023

Loan impairment charges and other credit risk provisions ............................................ (124) (79)

Net operating income ..................................................................................................... 865 944

Total operating expenses ................................................................................................ (373) (377)

Operating profit .............................................................................................................. 492 567

Share of profit in associates ........................................................................................... 31 5

Profit before income tax expense ................................................................................... 523 572

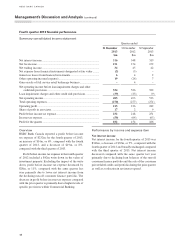

Overview

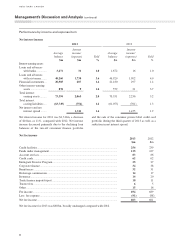

Profit before income tax expense was $523m for 2013,

a decrease of $49m, or 9%, compared with 2012. Profit

before income tax decreased primarily due to higher

specific loan impairment charges in the energy, real

estate and agriculture sectors as well as lower net interest

income from the narrowing of net interest spread in a

competitive low interest rate environment. The decrease

in profit before tax was partially offset by growth in the

value of the bank’s investment in private equity funds and

higher net fee income as a result of growth in bankers’

acceptances and related transaction volume.

Financial performance by income and expense item

Net interest income for 2013 was $675m, a decrease

of $35m, or 5%, compared with 2012 primarily due to

lower net interest spread in a competitive low interest

rate environment.

Net fee income for 2013 was $317m, an increase of

$10m, or 3%, compared with 2012 primarily as a

result of growth in bankers’ acceptances and related

transaction volume.

Net trading income for 2013 was $28m, a decrease of

$3m, or 10% compared with 2012 primarily due to lower

trading volume related to foreign exchange products.