HSBC 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

IFRS 12 ‘Disclosure of Interests in Other Entities

(‘IFRS 12’)

IFRS 12 is a comprehensive standard on disclosure

requirements for all forms of interests in other entities,

including for unconsolidated structured entities. New

disclosures are provided in notes 16 and 27.

IFRS 13 ‘Fair Value Measurement’ (‘IFRS 13’)

IFRS 13 establishes a single framework for measuring

fair value and introduces new requirements for

disclosure of fair value measurements. The adoption of

IFRS 13 did not have a material impact on the bank’s

consolidated financial statements. Disclosures are

provided in note 24.

Future accounting developments

In addition to the projects to complete financial

instrument accounting, discussed below, the International

Accounting and Standards Board (‘IASB’) is continuing

to work on its project on revenue recognition and lease

accounting which could represent significant changes to

accounting requirements in the future.

Offsetting

In December 2011, the IASB issued amendments to IAS

32 ‘Offsetting Financial Assets and Financial Liabilities’

which clarified the requirements for offsetting financial

instruments and addressed inconsistencies in current

practice when applying the offsetting criteria in IAS 32

‘Financial Instruments: Presentation’. The amendments

are effective for annual periods beginning on or

after 1 January 2014 and are required to be applied

retrospectively. Based on our assessment performed

to date, we do not expect the amendments to IAS 32

to have a material effect on the bank’s consolidated

financial statements.

Financial instruments

The IASB issued IFRS 9 ‘Financial Instruments’ which

introduced new requirements for the classification and

measurement of financial assets in November 2009

and financial liabilities in October 2010, with a further

proposed amendments in November 2012. Together,

these changes represent the first phase in the IASB’s

planned replacement of IAS 39 ‘Financial Instruments:

Recognition and Measurement’. IFRS 9 classification

and measurement requirements are to be applied

retrospectively but prior periods need not be restated.

Since the final requirements for classification and

measurement are uncertain, it remains impracticable to

quantify the effect of the existing IFRS 9 as at the date of

the publication of these consolidated financial statements.

The second phase in the IASB’s project to replace

IAS 39 will address the impairment of financial assets.

In November 2013, the IASB completed the third

phase of its project to replace IAS 39 and issued general

hedge accounting requirements. The revised hedge

accounting requirements are applied prospectively and

the bank is currently in the process of assessing the

impact on its consolidated financial statements. Macro

hedging is not included in the IFRS 9 project and will be

addressed separately.

In November 2013, the IASB issued amendments

to IFRS 9 in respect of transition requirements and the

effective date. As a result of these amendments, it is

confirmed that all phases of IFRS 9 (except for changes

to the presentation of gains and losses for certain

liabilities measured at fair value) must be applied from

the same effective date. The IASB plans to determine

the effective date when the entire IFRS 9 project is

closer to completion.

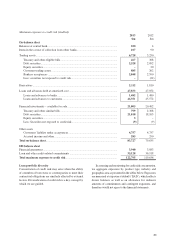

Off-balance sheet arrangements

As part of our banking operations, we enter into a

number of off-balance sheet financial transactions that

have a financial impact, but may not be recognized in

our financial statements. These types of arrangements

are contingent and may not necessarily, but in certain

circumstances could, involve us incurring a liability

in excess of amounts recorded in our consolidated

statement of financial position. These arrangements

include: guarantees, letters of credit, and derivatives.