HSBC 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

106

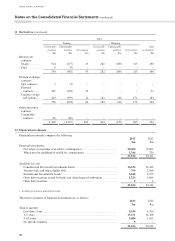

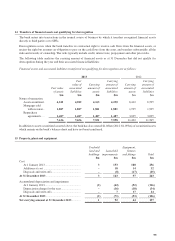

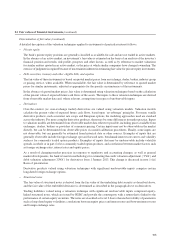

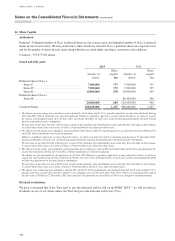

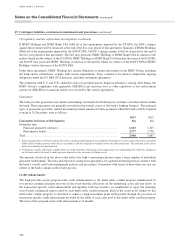

24 Fair values of financial instruments (continued)

Bases of valuing financial assets and liabilities measured at fair value

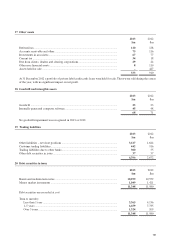

The table below provides an analysis of the various bases described above which have been deployed for valuing

financial assets and financial liabilities measured at fair value in the consolidated financial statements.

Valuation techniques

Level 1

Quoted

market price

$m

Level 2

using

observable

inputs

$m

Level 3 with

significant

unobservable

inputs

$m

Total

$m

At 31 December 2013

Assets

Trading assets .............................................................. 2,754 3,974 – 6,728

Derivatives .................................................................. – 2,078 34 2,112

Financial investments: available-for-sale.................... 19,143 2,671 – 21,814

Liabilities

Trading liabilities ........................................................ 3,470 917 9 4,396

Financial liabilities at fair value .................................. – 428 – 428

Derivatives .................................................................. – 1,712 34 1,746

At 31 December 2012

Assets

Trading assets .............................................................. 2,292 2,980 – 5,272

Derivatives .................................................................. – 1,805 5 1,810

Financial investments: available-for-sale.................... 17,705 2,697 9 20,411

Liabilities

Trading liabilities ........................................................ 2,119 504 49 2,672

Financial liabilities at fair value .................................. – 436 – 436

Derivatives .................................................................. – 1,408 7 1,415

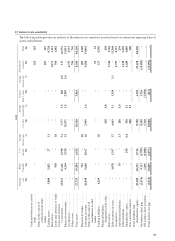

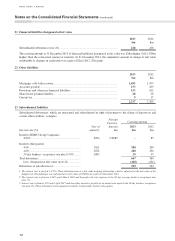

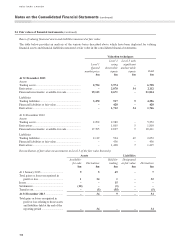

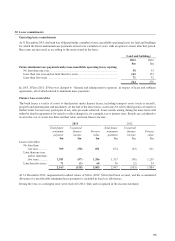

Reconciliation of fair value measurements in Level 3 of the fair value hierarchy

Assets Liabilities

Available-

for-sale

$m

Derivatives

$m

Held for

trading

$m

Designated

at fair value

$m

Derivatives

$m

At 1 January 2013 ............................... 9 5 49 – 7

Total gains or losses recognized in

profit or loss .................................. 1 34 1 – 32

Issues ................................................... – – 15 – –

Settlements .......................................... (10) – (1) – –

Transfer out ......................................... – (5) (55) – (5)

At 31 December 2013 ......................... – 34 9 – 34

Total gains or losses recognized in

profit or loss relating to those assets

and liabilities held at the end of the

reporting period ................................ – 34 – – 34

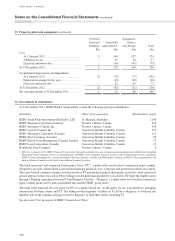

Notes on the Consolidated Financial Statements (continued)