HSBC 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

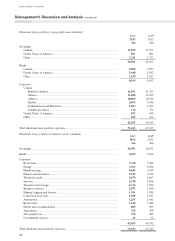

37

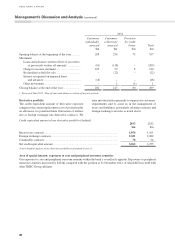

The overall credit quality at 31 December 2013 improved

compared with 2012 as a result of a 3.3% movement

from satisfactory to good and strong categorized loans

and advances. The improvement was primarily driven

by the wholesale portfolio as the result of refocussing

the business on existing high quality relationships and a

more selective risk appetite. In addition contributing to

the improvement was our retail portfolio primarily as a

result of the run-off consumer finance portfolio and the

sale of the private label credit card portfolio in the third

quarter of 2013.

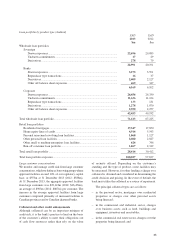

Renegotiated loans

The carrying amount of loans that would otherwise be

past due or impaired whose terms have been renegotiated

was $237m at 31 December 2013 (2012: $266m).

Loans past due but not impaired

Examples of exposures considered past due but not

impaired include loans that have missed the most

recent payment date but on which there is no evidence

of impairment; loans fully secured by cash collateral;

residential mortgages in arrears more than 90 days, but

where the value of collateral is sufficient to repay both

the principal debt and all potential interest for at least

one year; and short-term trade facilities past due more

than 90 days for technical reasons such as delays in

documentation, but where there is no concern over the

creditworthiness of the counterparty.

The aging analysis below includes past due loans

on which collective impairment allowances have been

assessed, though at their early stage of arrears, there is

normally no identifiable impairment.

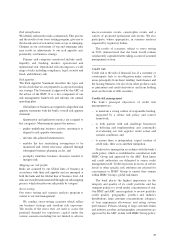

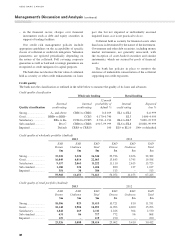

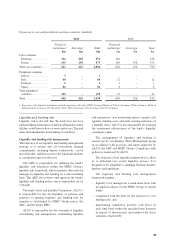

Days past due but not impaired loans and advances (Audited)

2013

$m

2012

$m

Up to 29 days ................................................................................................................. 546 626

30–59 days ..................................................................................................................... 93 146

60–89 days ..................................................................................................................... 28 72

90–179 days ................................................................................................................... –35

Over 180 days ................................................................................................................ 810

675 889

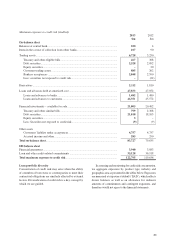

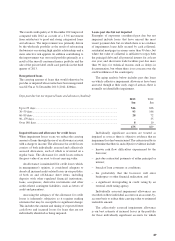

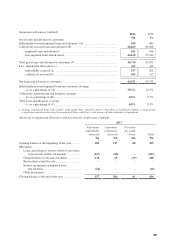

Impaired loans and allowance for credit losses

When impairment losses occur, we reduce the carrying

amount of loans through the use of an allowance account

with a charge to income. The allowance for credit losses

consists of both individually assessed and collectively

assessed allowances, each of which is reviewed on a

regular basis. The allowance for credit losses reduces

the gross value of an asset to its net carrying value.

An allowance is maintained for credit losses which,

in management’s opinion, is considered adequate to

absorb all incurred credit-related losses in our portfolio,

of both on and off-balance sheet items, including

deposits with other regulated financial institutions,

loans, acceptances, derivative instruments and other

credit-related contingent liabilities, such as letters of

credit and guarantees.

Assessing the adequacy of the allowance for credit

losses is inherently subjective as it requires making

estimates that may be susceptible to significant change.

This includes the amount and timing of expected future

cash flows and incurred losses for loans that are not

individually identified as being impaired.

Individually significant accounts are treated as

impaired as soon as there is objective evidence that an

impairment loss has been incurred. The criteria used by us

to determine that there is such objective evidence include:

– known cash flow difficulties experienced by the

borrower;

– past-due contractual payments of either principal or

interest;

– breach of loan covenants or conditions;

– the probability that the borrower will enter

bankruptcy or other financial realization; and

– a significant downgrading in credit rating by an

external credit rating agency.

Individually assessed impairment allowances are

recorded on these individual accounts on an account-by-

account basis to reduce their carrying value to estimated

realizable amount.

The collectively assessed impairment allowance

is our best estimate of incurred losses in the portfolio

for those individually significant accounts for which

37